Heleket review: crypto payments for business and virtual cards

Heleket brings crypto payments, a multi-currency wallet and virtual cards to online business.

According to Coinlaw, more than 580m people worldwide used cryptocurrencies in July 2025. Annual transfers in stablecoins exceeded $50trn. For large financial firms and online businesses, crypto payments are becoming a way to cut costs and broaden their audience.

One straightforward way to accept digital-asset payments is to use crypto processors such as Heleket. This article explains how the project’s ecosystem works and the problems it addresses for entrepreneurs and investors.

Why add crypto processing

Traditional acquiring costs businesses 1.5–4% per transaction. Crypto processors charge less — Heleket, for instance, takes from 0.4%. Transfers on blockchains range from fractions of a cent to a few dollars and do not depend on the payment amount.

Low fees are only part of the appeal. Holders of digital assets shop worldwide, giving firms that accept them access to a global audience and new customer segments. Integrating modern payment methods also boosts brand recognition and helps companies stand out from competitors.

Another key advantage is speed. Banks can take several days to clear payments, whereas crypto transactions on networks such as Solana and L2 solutions for Ethereum are confirmed in seconds.

Adding crypto payments to a website

Heleket integrates with businesses via an API and ready-made plugins for popular platforms, including WooCommerce, WHMCS, XenForo, PremiumExchanger, Bot-t and Seller.games.

The company says the system calculates the precise processing fee — users and merchants do not lose out to rounding. Each client is assigned a personal manager to assist with integration and payment setup.

“Our service is suitable for online shops, SaaS platforms, gaming projects, freelance exchanges and sellers of digital goods. Working with Heleket does not require registering a legal entity,” — the company said.

To create an account, simply provide and confirm an email address and generate a password. The platform supports Bitcoin, Ethereum, Solana, Tether (ERC-20/TRC-20), USDC, Monero and other cryptocurrencies and tokens.

Multi-currency wallet

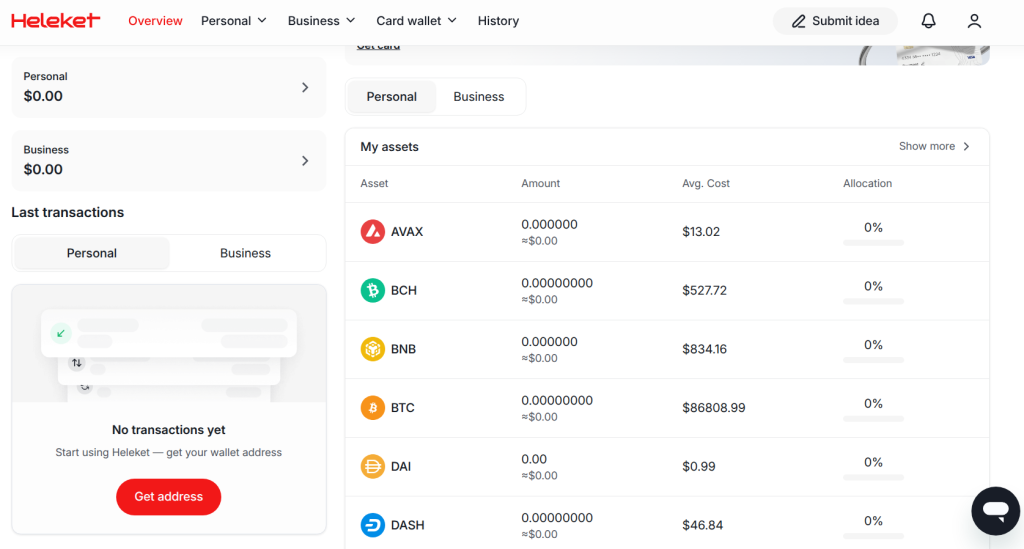

After creating an account on Heleket, the user gets two wallets:

- Personal.

- Business.

You can start using the personal custodial wallet and accept payments immediately — just click “Get address”. The platform will then generate a new address for the chosen token.

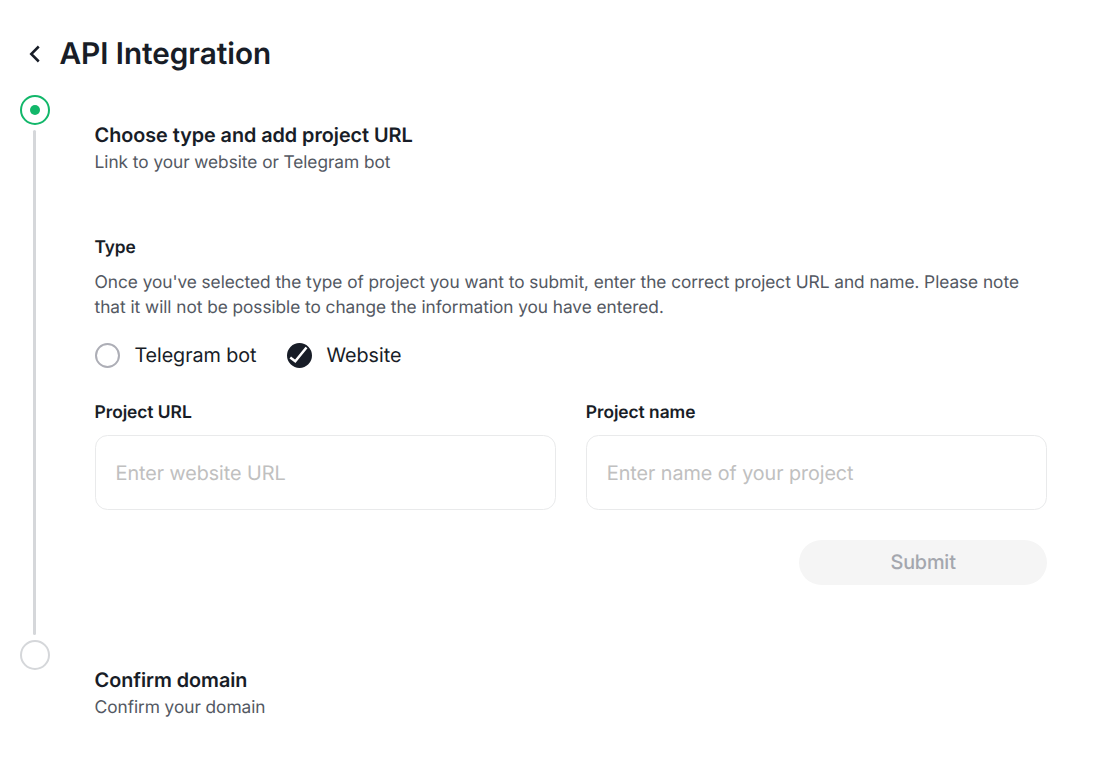

To use the business wallet, you need to create a merchant. Enter its name, after which Heleket will invite you to pass moderation and integrate the API.

To pass moderation, submit an application on the website. After creating the merchant, click “Proceed to installation” and, in the “API integration” menu, click “Submit an application”. Heleket will ask you to choose a type (website or Telegram bot), specify the project name and send it to the crypto processor’s team for review.

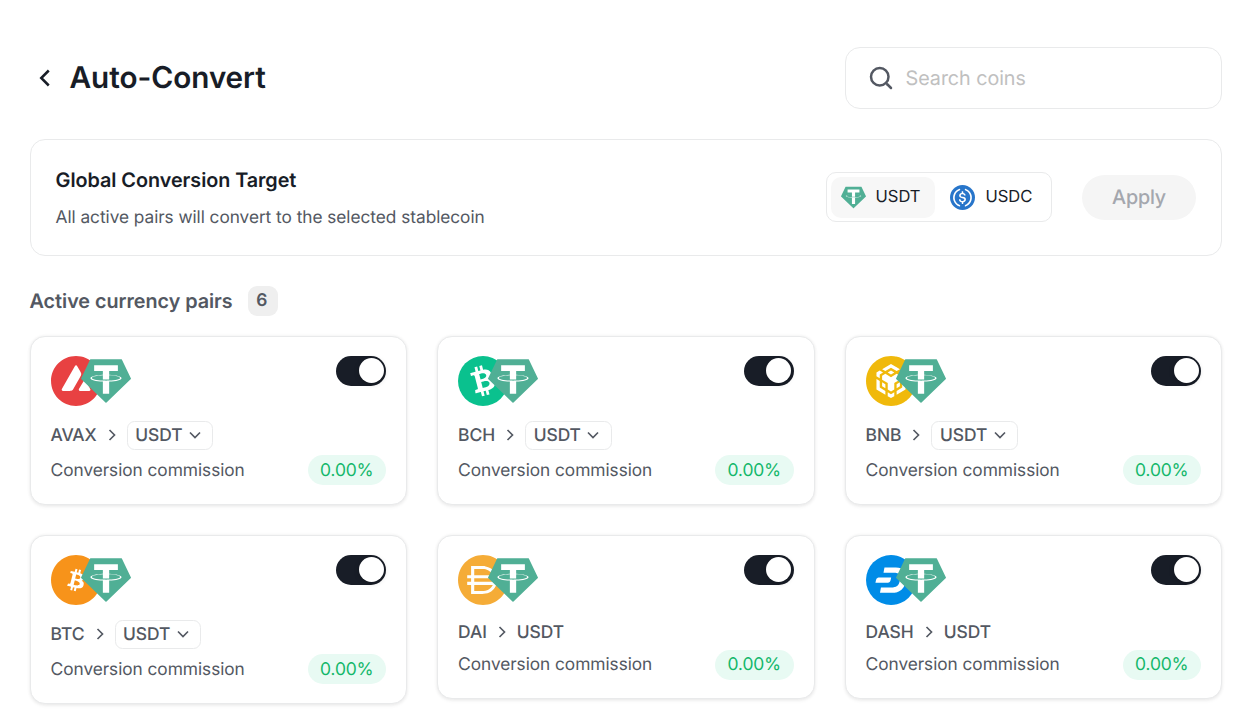

When a crypto payment is received, the seller can convert it automatically into USDT/USDC stablecoins or keep it in the same coin.

Heleket lets you withdraw funds directly in cryptocurrency or to a virtual bank card.

Virtual crypto cards

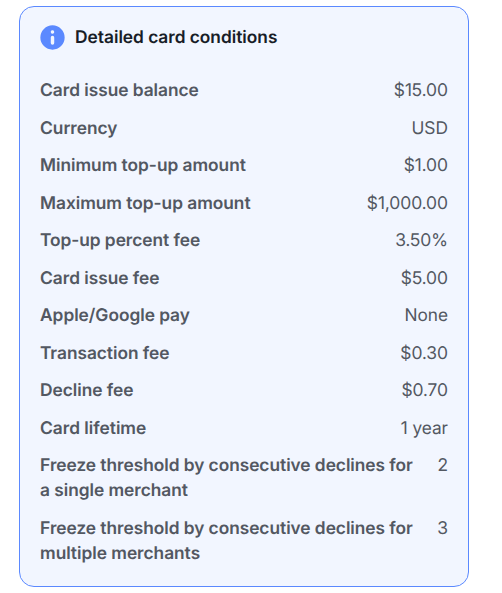

Heleket issues virtual cards by Visa, topped up with USDT and USDC stablecoins. They can be created in the personal account within minutes. To do this you need to:

- top up the personal wallet with at least $20;

- enable two-factor authentication;

- transfer funds to the card balance.

Users can add funds to the personal wallet in any cryptoasset, but to credit the card they must convert them into stablecoins. After transferring 20 USDT/USDC you will receive a card with a $15 balance (ie the effective issuance fee is $5). It cannot be linked to Apple/Google Pay. The validity period is one year.

The card is entirely digital: details (number, CVV, expiry) are available in the account. It can be used to pay for Netflix and Spotify subscriptions, Google and Facebook ad accounts, and games on Steam.

“The function is useful for businesses that accept payments via Heleket. Companies can withdraw funds directly to the card and pay operating expenses without third-party exchangers,” — Heleket notes.

Conclusions

The Heleket ecosystem covers key needs of online businesses and crypto investors: accepting crypto payments with fees from 0.4%, a multi-currency wallet without verification, and virtual cards for online purchases.

To get started, simply confirm your email. The platform has a built-in converter for asset swaps and an auto-converter that automatically turns incoming payments into stablecoins.

Virtual Mastercard cards are issued without KYC. Downsides include the inability to link cards to Apple Pay or Google Pay. Even so, they work smoothly with popular online services.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!