Hopes for a 50 Basis Point Fed Rate Cut Revive Crypto Fund Inflows

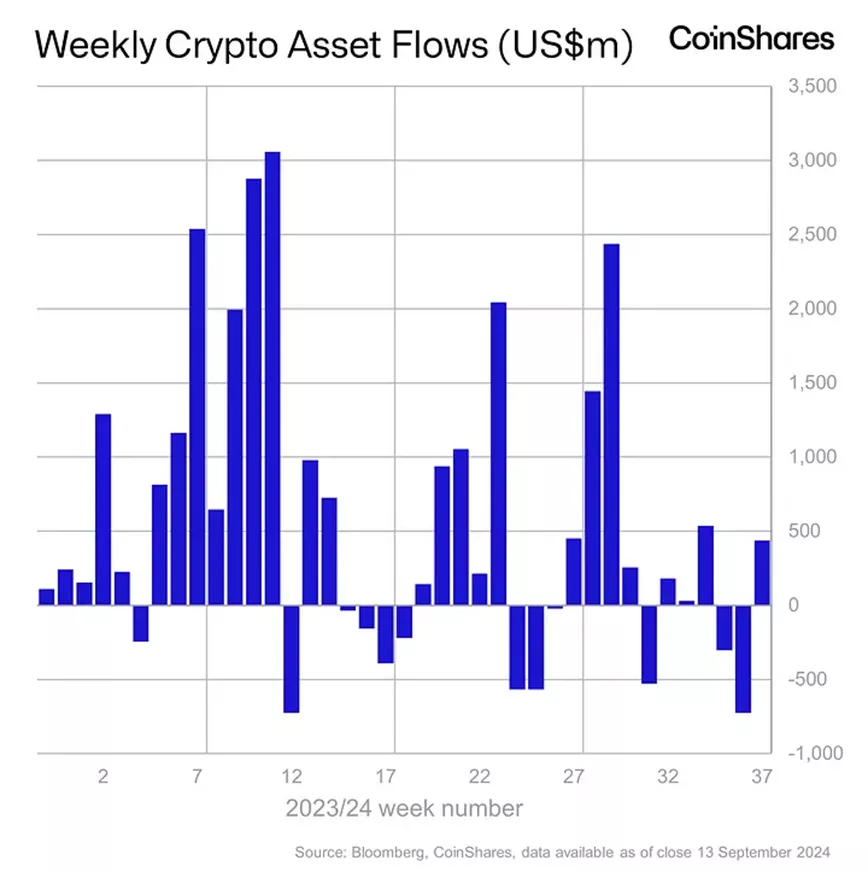

Inflows into cryptocurrency investment funds amounted to $436 million from September 8 to 14, following an outflow of $726 million the previous week, according to CoinShares.

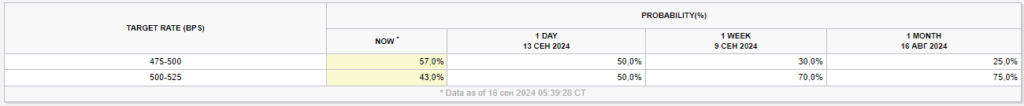

Analysts attributed the reversal in dynamics to a sharp increase in expectations for a 50 basis point cut in the interest rate by the Fed.

The likelihood of more aggressive action on September 17-18 rose to 57%. A week ago, traders assessed these chances at 30%.

The trading volume of ETP remained near $8 billion, compared to this year’s average of $14.2 billion.

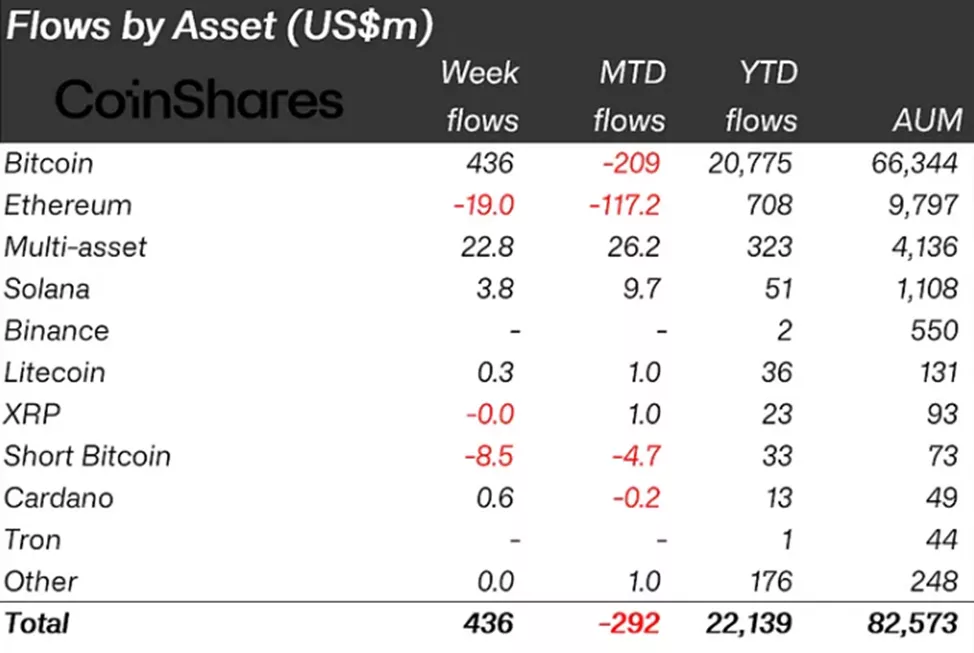

Negative sentiment continued to dominate Ethereum funds, with outflows slowing from $98.1 million to $19 million.

Clients directed $436 million into bitcoin-related instruments after withdrawing $643 million.

Investors withdrew $8.5 million from structures allowing short positions on digital gold (in the previous reporting period, they added $3.9 million).

Solana-based products received $3.8 million (previously — $6.2 million). The positive trend continued for the fourth consecutive week.

Earlier, trader Vladimir Cohen examined the current state of altcoins.

Bitfinex noted that this category of the cryptocurrency market remains relatively strong amid bitcoin’s weakening, while analyst and MN Trading founder Michaël van de Poppe observed a bullish impulse in several tokens.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!