How Artificial Intelligence Predicted Bitcoin’s Price

Artificial intelligence (AI) has long been used to forecast various events. Algorithms, based on historical data, successfully predict Oscar winners, stock quotes and even the spread of a pandemic.

In the last five years, there have been attempts to predict Bitcoin’s price against the dollar. Startups, research groups and enthusiasts have not ceased trying to create an algorithm capable of predicting the behavior of digital gold on the exchange in both the short- and long-term horizons.

Recurrent Neural Networks and Predictive Analytics

Machine-learning algorithm developers employ different approaches in building predictive tools. The most popular among them are recurrent neural networks and the Long Short-Term Memory (LSTM) model.

LSTM model – a type of [simple_tooltip content=’A type of neural networks where the connections between elements form a directed sequence. This enables processing time-series of events or sequential spatial chains.’]recurrent neural network[/simple_tooltip], which can remember long-term dependencies. Just as we draw on past experience to forecast future events, the neural network can remember information over long periods and quickly identify patterns.

Principle of operation of the Long Short-Term Memory (LSTM) model.

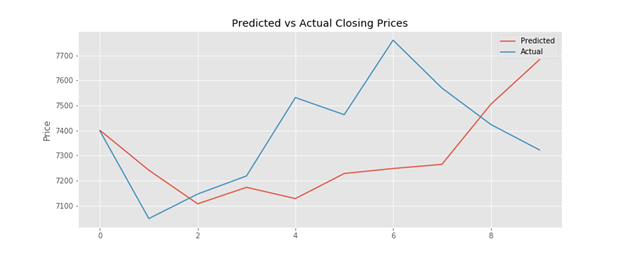

Actual Bitcoin prices over the last 10 days (blue line) and predicted values by the recurrent neural network over the last 10 days (red line).

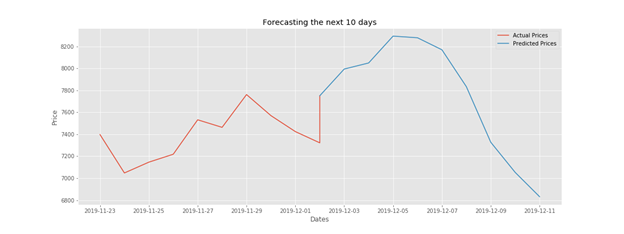

Example of predicting Bitcoin price using an LSTM-based algorithm.

In 2020, Australian developer Derk Zomer [Derk Zomer] developed an algorithm that predicted Bitcoin’s price over the next 20 minutes using a recurrent neural network and an LSTM model. The results showed that neural networks can predict the rate based on simple financial data alone. However, according to the developer himself, from a trader’s perspective such a model is completely useless.

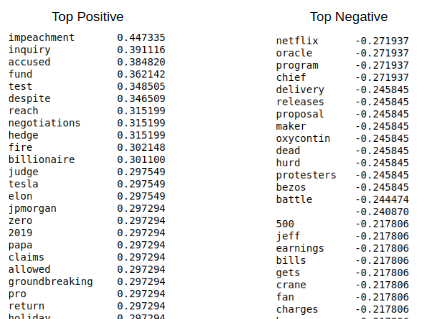

Another noteworthy example is an algorithm by American entrepreneur Federico Riveroll [Federico Riveroll], who attempted to make predictions using AI, using not only historical price data but also news headlines.

For his algorithm, Federico used two [simple_tooltip content=’A dataset is a set of structured data used by developers to train neural networks and machine learning models.’]dataset[/simple_tooltip]: Bitcoin vs USD and Fox Business News, data from which were processed and aligned by date. The neural network identified a number of patterns between keywords in news headlines and the price of the first cryptocurrency.

For example, when the media discussed Trump’s impeachment, Bitcoin’s price rose; when the media wrote about Netflix — it fell. It was these correlational cues that the developed model used for further predictions.

Top positive and negative correlations between news headlines and Bitcoin price.

As a result of testing, the algorithm achieved an accuracy of 64.7%, which is not sufficient for confident forecasting. Nevertheless, the experiment showed that by accounting for more factors that may influence the rate, one can obtain more accurate predictions.

Limitations of AI

Data scarcity

Unlike the stock market, which has data to study for nearly 100 years, the crypto market cannot boast the same.

Moreover, financial data alone is not enough – to create algorithms and forecast the price, other factors must be considered as well.

Human thinking

Currently, all the best engineering developments are still created by people. This means trading tools are subject to biases and limitations of ordinary humans. If we do not fully understand how the market works, how can we create an AI-based algorithm that surpasses our capabilities?

Limited computing power

Complex machine-learning algorithms require enormous computing power. For example, DeepMind needed 1,202 CPUs and 176 GPUs to run the AlphaGo algorithm. This is roughly 25 times more computing units than for a one-computer version. Large companies can easily overcome these barriers, while for early-stage startups or independent researchers such computing power remains out of reach.

Lack of public trust

Although AI has proven its effectiveness in many sectors, it remains unreliable for high-risk investment markets.

Trading firms that adopt it as a forecasting tool will need to work hard to prove to the public a high degree of accuracy for long-term predictions.

Outlook for the future

AI-based tools open new possibilities for development and growth.

Predictive algorithms can recognise patterns in new goods and phenomena. Cryptocurrencies are not the only new and volatile investment asset class. Studying volatility patterns and learning from them may become the quickest path to faster success.

Moreover, sooner or later uncertainty among cryptocurrency users will wane, which will lead to more stable market development. Stabilisation and predictability of digital asset behaviour will enable creating more precise analytics and forecasting tools in the future.

Conclusions

To date, all attempts to create a reliable AI-based forecasting tool have failed.

Indeed, there have been relatively accurate algorithms in practice, but they are still unsuitable for long-term forecasting. High volatility, unpredictability, and data scarcity complicate the task for developers.

Nevertheless, all could change very soon. As practice shows, recurrent neural networks have proven themselves in forecasting tools in other industries. And the more effort researchers devote to data collection and a better understanding of the market, the sooner will come the day when robust tools for cryptocurrency investors appear.

Subscribe to ForkLog news on Telegram: ForkLog Feed — all the news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!