How to build a cryptocurrency portfolio

Key points

- A cryptocurrency portfolio is a set of digital assets in which an investor holds capital. It can include various assets: bitcoin, Ethereum, stablecoins, NFTs and DeFi financial products.

- In a diversified portfolio, losses in some components can be offset by gains in others, helping to keep the overall position steady over the long run.

- To build a well-balanced portfolio, analyse different coins carefully and weigh multiple factors.

What is a cryptocurrency portfolio?

A cryptocurrency portfolio is a collection of digital assets held by an investor or trader. It may include bitcoin, altcoins, NFTs and various financial products — for example, DeFi indices.

A key difference from a traditional portfolio is where cryptoassets are held: on a non-custodial or an exchange wallet.

Cryptocurrencies and tokens can be bought on centralised venues such as Binance, on P2P marketplaces and OTC platforms. Many wallets, including MetaMask and Exodus, also allow purchases with fiat.

What are asset allocation and diversification?

Before building a portfolio, it helps to understand asset allocation and diversification.

Asset allocation means investing across different classes of financial instruments (cryptocurrencies, equities, bonds, precious metals and so on).

Example portfolio:

- 40% — equities;

- 30% — bonds;

- 20% — cryptoassets;

- 10% — fiat currencies.

Diversification is the distribution of funds across different assets or sectors. In equities, for instance, one might invest across agriculture, technology, energy or healthcare.

Both approaches aim to reduce investment risk and portfolio volatility — the essence of “Don’t put all your eggs in one basket”.

Strictly speaking, digital currencies form a single asset class. Even so, a crypto portfolio can contain coins and tokens serving very different use cases.

Example crypto portfolio:

- 40% — bitcoin;

- 30% — stablecoins;

- 15% — NFTs;

- 15% — altcoins.

Allocation is a key driver of portfolio returns. Different assets behave differently as market and economic conditions change.

Because the returns of different instruments and asset classes do not always move together, diversification lowers overall risk.

When building a crypto portfolio, account for the market’s specifics: many coins show a tight statistical relationship with bitcoin.

At times, some altcoins exhibit low or even negative correlation with bitcoin. Attentive investors can use this when constructing and reviewing portfolios.

What are the main asset-allocation strategies?

Patient investors may opt for strategic allocation. It entails building a set of assets that balances expected risk and return over the long term.

This approach is applied regardless of current market conditions — the allocation is maintained even when regimes shift materially.

Dynamic allocation is similar to strategic allocation: it is long-term and focuses on the risk–return trade-off. However, asset weights can change with market conditions.

With tactical allocation, the investor is more hands-on — for example, concentrating on instruments and sectors with the greatest growth potential. Such strategies involve more frequent trading and rebalancing, and investors may fully enter or exit assets depending on conditions.

In a diversified portfolio, losses in some components can be offset by gains in others, helping to keep the overall position steady over the long run.

The more diversified the portfolio, the better it may track the market as a whole. Sometimes, more concentrated portfolios containing just a few well-chosen assets can perform better.

Managing a diversified portfolio demands more time, effort and research — each component warrants careful analysis of risks and prospects.

If the portfolio’s components are on different blockchains, multiple wallets and/or exchanges may be required.

How to build a well-balanced crypto portfolio

Every market participant has a distinct risk tolerance, their own sense of balance and preferences when choosing assets.

Even so, there are common rules worth considering when investing in different coins:

- classify investment targets by risk. If highly volatile, illiquid assets dominate, the portfolio is unlikely to be balanced. A few coins may outperform in some phases, but the risk of a deep drawdown is significant. Thoughtful diversification is therefore highly desirable.

- include some stablecoins to dampen overall volatility. They are useful for taking profits and for buying oversold assets on dips.

- rebalance periodically by buying what has fallen and trimming what has rallied strongly, restoring original weights.

- avoid letting any one asset or class dominate. If a coin has multiplied several times, you may be tempted to allocate more to it. Do not let FOMO override your strategy.

- do your own research. It is your money; do not blindly rely on others’ advice.

- invest only what you can comfortably afford to lose. High volatility and potential losses should not create serious consequences for you.

Bitcoin is the first and best-known cryptocurrency. Researchers at K33 Research compared returns from the digital gold with those from the top-100 altcoins by market capitalisation.

According to their findings, bitcoins bought for $1009 in January 2015 would have been worth almost $50,000 in June 2023. The same sum invested in altcoins would have been worth about $6650.

Even so, the analysts do not rule out investors picking “winner tokens” that can outperform bitcoin. K33 Research also stressed the importance of timing exits to lock in gains.

When selecting tokens for a portfolio, consider factors such as:

- on-chain activity;

- market capitalisation;

- current price and historical performance;

- circulating supply;

- maximum token supply;

- issuance schedule and mechanics;

- developer activity on GitHub;

- community activity, and so on.

It is also important to study the team’s background and the project’s roadmap.

To reduce portfolio risk, you can increase the share of bitcoin and other relatively safer assets.

What types of cryptoassets are there?

Thousands of cryptoassets exist. The popular tracker CoinMarketCap follows key metrics for roughly 26,000 coins and groups them into 188 segments: meme tokens, gambling, Play-to-Earn, NFT collections and more.

On CoinGecko the spectrum is narrower — 103 categories, sorted by market capitalisation by default.

There is also a more general classification:

- Payment systems. This category includes first-generation cryptoassets, many of which predate Ethereum: bitcoin, XRP, Litecoin, Bitcoin Cash and so on.

- Stablecoins. Coins such as USDT, USDC and DAI do not offer high returns. They stabilise a portfolio during bouts of volatility, reducing drawdowns in market corrections. If you need to exit a project, it is often simplest to convert into stablecoins.

- Utility tokens. Example: BNB. The coin is used to pay for transactions in BNB Chain applications and to save on trading fees on the Binance centralised exchange. Another example is the LINK token from Chainlink. It pays for oracle services and incentivises node operators. LINK is also used to improve data-processing accuracy and support contract stability on the network.

- Governance tokens. Holding these assets grants voting rights on key questions of protocol development and, in some cases, a share of revenue. Examples: CAKE from PancakeSwap, UNI from Uniswap, SUSHI from SushiSwap. As with utility tokens, their value depends on the success of the associated protocol.

- Financial products based on cryptoassets. These instruments can deliver high diversification in a few clicks and, in some cases, higher returns. For example, the decentralised Metaverse Index (MVI) is built from ten popular GameFi tokens. Nested lets you create and copy other users’ crypto portfolios in a couple of clicks, akin to social trading on eToro.

How to track a crypto portfolio’s performance

You can track a portfolio with spreadsheets such as Excel or Google Sheets, but dedicated tools like CoinMarketCap or CoinGecko are more convenient. Such trackers suit both day traders and long-term investors.

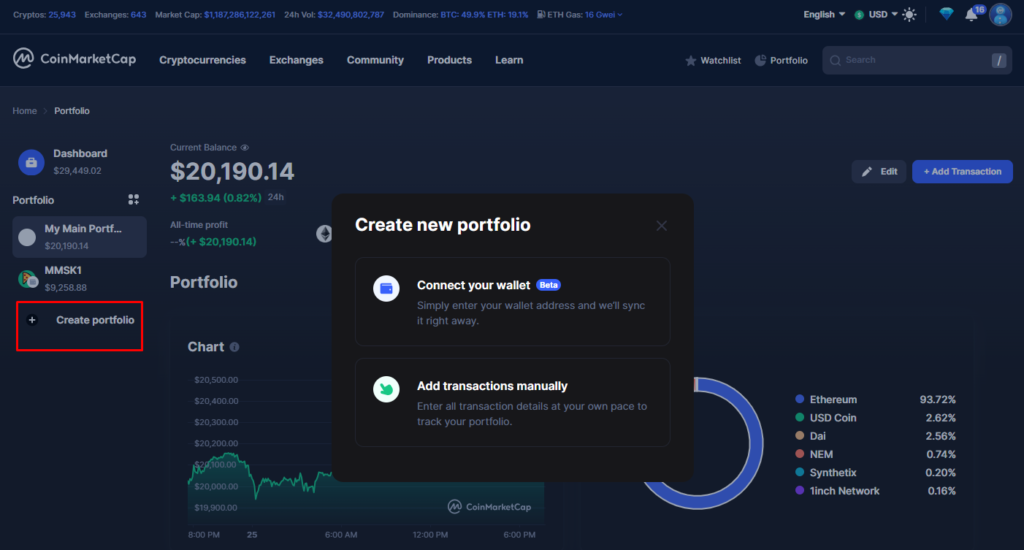

In the Portfolio section on CoinMarketCap, you can set up crypto portfolios for monitoring. Assets can be added manually or in bulk by pasting a Web3 wallet address.

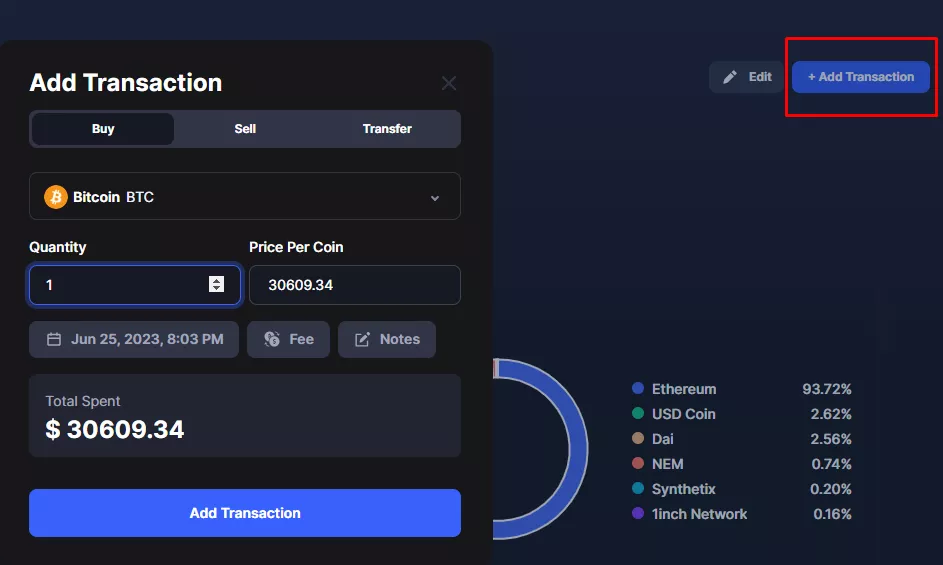

Under Add Transaction you can create or update a portfolio by recording a trade in a chosen coin for the relevant amount. Select Buy, Sell or Transfer.

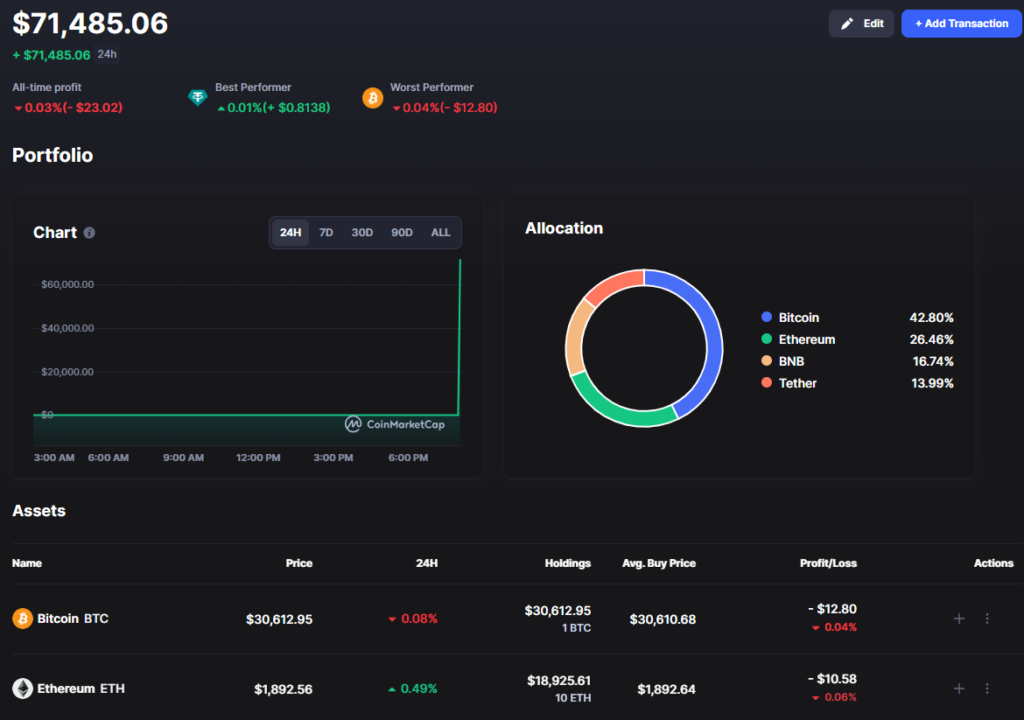

The screenshot below shows a test portfolio, created in minutes, of four assets: bitcoin, Ethereum, BNB and USDT. The assets were added manually in a few clicks.

Similar functionality is available in CoinGecko’s Portfolio.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!