How to Earn from Business Loans: A Look at the DeFi Protocol BondAppétit

In March 2021, Telegram raised $1 billion through a bond issuance. The face value of a single security was $1,000, and the minimum lot was $500,000.

According to the founder of the DeFi protocol BondAppétit Artem Tolkachev, issuing bonds is a fairly labour-intensive process. Document preparation takes a lot of time, and arrangers charge up to 10% in fees.

A solution may lie in uniting the bond market with the digital-asset market, an effort pursued by the BondAppétit team. Here is how to obtain a loan for a business through the protocol and earn from staking BondAppétit tokens.

What is BondAppétit

BondAppétit is a DeFi protocol that issues the stablecoin USDap (BondAppétit USD) and the governance token BAG (BondAppétit Governance). The protocol has been operating since April 5, 2021.

“BondAppétit’s mission is to connect the crypto market with the market for traditional debt instruments and to lower borrowing costs for businesses,” says Artem Tolkachev.

The protocol runs on the Ethereum blockchain. On May 7, the BondAppétit team published a proposal to launch the protocol on Binance Smart Chain (BSC). The project will launch a liquidity pool on the decentralized exchange PancakeSwap. BondAppétit will use the BurgerSwap gateway to integrate with BSC.

The security of BondAppétit’s code was tested by MixBytes, a company that specialises in decentralized software products.

USDap has no centralized issuer. The protocol issues stablecoins only when the necessary collateral—a basket of bonds—is in place. The collateral’s value is regularly updated by oracles. They pull data from Bloomberg and CBonds.

Governance of the Protocol

Holders of BAG can vote on protocol changes and initiate votes with more than 1% of the tokens.

The total supply of governance tokens is 100 million BAG. BondAppétit will distribute them over two years:

- 20 million — to the BondAppétit team with a four-year lock-up;

- 14 million — to the founders of BondAppétit with an 18-month lock-up;

- 1 million — to an investor who invested in the project before launch;

- 65 million — to the project community.

“The community will receive 65% of BAG within two years. At the same time, 5% will be distributed in the next three months for staking on Uniswap and PancakeSwap. Users should own a majority of the tokens: truly decentralised solutions cost the most in crypto markets,” emphasizes Artem Tolkachev.

The BAG governance tokens can be bought on Uniswap at market price. After the project launches on BSC, on PancakeSwap. BAG is also available on the BondAppétit site at $2.50 per token. In addition, the protocol rewards BAG for adding liquidity to BondAppétit’s pools on Uniswap.

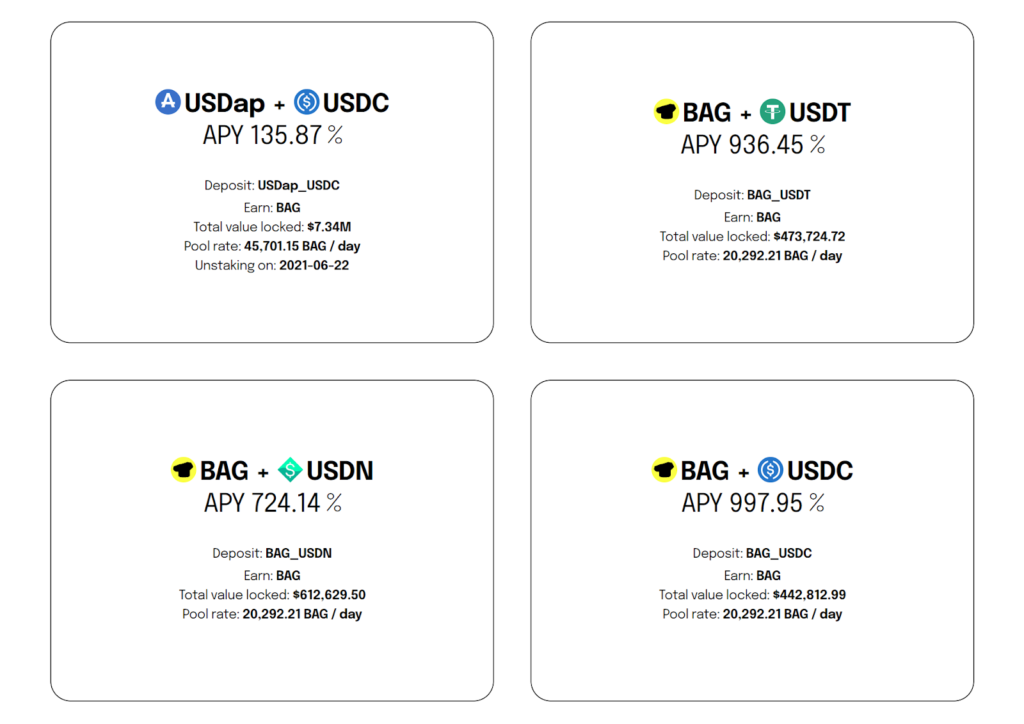

As of publication, more than $8 million was locked in the protocol. The annual percentage yield (APY) of the USDap-USDC pools is 135%, BAG-USDT — 936%, BAG-USDN — 724%, BAG-USDС — 997%.

Team and Plans

BondAppétit was developed by a public team with experience in corporate finance. It includes:

- Artem Tolkachев — Chief Executive Officer of the project. In 2017 he led Deloitte’s blockchain lab; in 2018 he founded the tokenised-securities trading platform Tokenomica;

- Vladislav Komissarov — Chief Technology Officer. From 2013 to 2019 he was Director of Growth for SPARK, a counterparty-check platform. In July 2019 he became CTO of Tokenomica;

- Alexander Ivanov — Project Advisor, founder and CEO of the Waves blockchain platform. Ivanov supported the BondAppétit launch and announced a joint project with Waves Enterprise — East Finance. This protocol will issue synthetic assets on Ethereum and Waves. Collateral will be WEST tokens and the USDap stablecoin.

In May, the project team plans to list BAG on the Waves.Exchange trading platform.

BondAppétit will launch in three stages.

1. Fundraising, from April to July 2021. The main objective is to create USDap liquidity on Uniswap. The protocol locks early investors’ stablecoins for three months, paying rewards in BAG tokens.

At this stage, BondAppétit plans to raise $1.2 million through BAG on the open market.

2. Bond acquisition, from July 2021 to January 2023. The project will purchase bonds and issue USDap stablecoins.

BondAppétit will spend $1 million on bond purchases. The remaining $200,000 will go to support initial liquidity and the operation of the protocol.

3. Direct investing, from January 2023. The BondAppétit team expects the protocol’s market capitalization to reach $100 million. Borrowers will be able to obtain loans in USDap after providing collateral.

The issuance of BAG will cease: BondAppétit governance tokens will become a scarce asset.

Issuing loans through BondAppétit

At present, BondAppétit lends with the participation of the borrower, intermediary and depository.

Intermediaries seek borrowers and handle organisational questions in loan issuance. Depositories store the debt instruments the borrower has sold or pledged.

Intermediaries and depositories are companies approved by the BondAppétit community. An additional condition for intermediaries is owning more than 1% BAG.

The project offers two methods of extending funds: a loan secured by bonds and a bond purchase-and-sale.

BondAppétit issues a loan secured by bonds as follows:

- The company enters into a loan agreement with a regulated broker and provides the bonds as collateral;

- The broker transfers the bonds to the depository;

- The depository transmits collateral information to the protocol via software oracles;

- Based on this data, BondAppétit issues an equivalent amount of USDap;

- The intermediary borrows cryptocurrency from the protocol and converts it into fiat money;

- The intermediary lends the fiat funds to the borrower.

The borrower pays the intermediary the interest on the bonds. The intermediary converts the interest income to cryptocurrency and returns it to the protocol.

A default by the company does not affect the protocol. In that case, the intermediary will take back or sell the collateral.

BondAppétit also provides for bond buy-sell:

- The borrower enters into an agreement with the intermediary and sells bonds to him with deferred payment;

- The intermediary transfers the bonds for safekeeping to the depository, while the papers remain at the intermediary’s disposal;

- The depository transmits collateral information to the protocol via software oracles;

- Based on this data, BondAppétit issues an equivalent amount of USDap;

- The intermediary borrows cryptocurrency from the protocol and converts it into fiat money;

- The intermediary lends the fiat funds to the borrower.

The intermediary becomes the owner of the bonds and earns interest on them. He converts the interest income into cryptocurrency and sends it to the protocol.

The project team plans to remove intermediaries and depositories from loan issuance as soon as regulation allows. BondAppétit will borrow funds directly.

Conclusions

BondAppétit is an ambitious project that could connect the crypto market with traditional debt instruments. In 2020, the International Capital Market Association valued the corporate-bond market at $40.8 trillion.

If business interest in DeFi grows, BondAppétit could become an alternative means of issuing bonds. A partnership with Waves will help accelerate the protocol’s user base.

The team aims to make the protocol genuinely decentralised and actively distributes governance tokens among community members. This minimises developers’ influence on BondAppétit in the long term.

Follow ForkLog’s bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!