How to maximise passive income from stablecoins: a review of the Coinchange platform

The cryptocurrency market offers a wide range of passive income opportunities: deposits in lending services, liquidity provision, farming, staking, and more.

Together with experts from fintech company Coinchange, we discuss passive investments in DeFi and how much you can earn from them.

What is profit compounding

The DeFi ecosystem DeFi mirrors the model of traditional financial services: decentralized exchanges (DEX) replace platforms with a single center of control, lending services — banks, and governance tokens — voting shares.

The mechanisms of DeFi protocols are embedded in smart contracts, which require only one type of intermediary — liquidity providers. The latter contribute funds for use by traders and investors.

For example, on a DEX providers send tokens to liquidity pools and receive trading fees from each trade — from 0.05% to 1%.

The aim of DeFi projects is to attract and retain liquidity. Decentralized exchanges issue to providers LP tokens. They can be sent to staking and earn additional passive income. Thus DeFi services incentivize investors not to withdraw assets.

Contributing tokens to pools and subsequent staking of LP tokens is an example of a sequence of actions that can be described by the term ‘compounding interest’ — profit compounding.

Maximizing returns in DeFi

Investors often employ complex strategies to boost returns on their investments. For example, HODL can be made more lucrative with a mint-sell-mint loop:

- Issue 2000 DAI backed by 1 ETH.

- Exchange the obtained DAI for 0.77 ETH.

- Issue collateralized 0.77 ETH for 1600 DAI.

- Again exchange DAI for 0.6 ETH.

- Total received 2.37 ETH.

Similar chains can be built for other instruments that issue one token collateralized by another. However, when developing strategies, investors face two problems:

- transaction fees can turn a potentially profitable strategy into a loss. For example, on Ethereum, a contract call fee can reach $700;

- you need to constantly monitor the market and adjust the strategy. Token prices, user preferences of DeFi services, and investment yields can change within hours.

Solutions are offered by companies specializing in DeFi instruments: Coinchange, Celsius, NEXO, BlockFi and others. They analyse the market, create compounding strategies, and invest clients’ funds in popular protocols.

How much can you earn on deposits

Coinchange operates across four blockchains: Ethereum, Avalanche, Polygon and BNB Chain. The platform collects data on service yields and builds investment strategies based on the information gathered.

To minimise the impact of transaction fees on profits, Coinchange uses an off-chain–on-chain scheme. A centralized server processes the information, designs the investment strategy, and issues instructions to proxy contracts. They combine the steps of the strategy into a single transaction, thereby spending less gas.

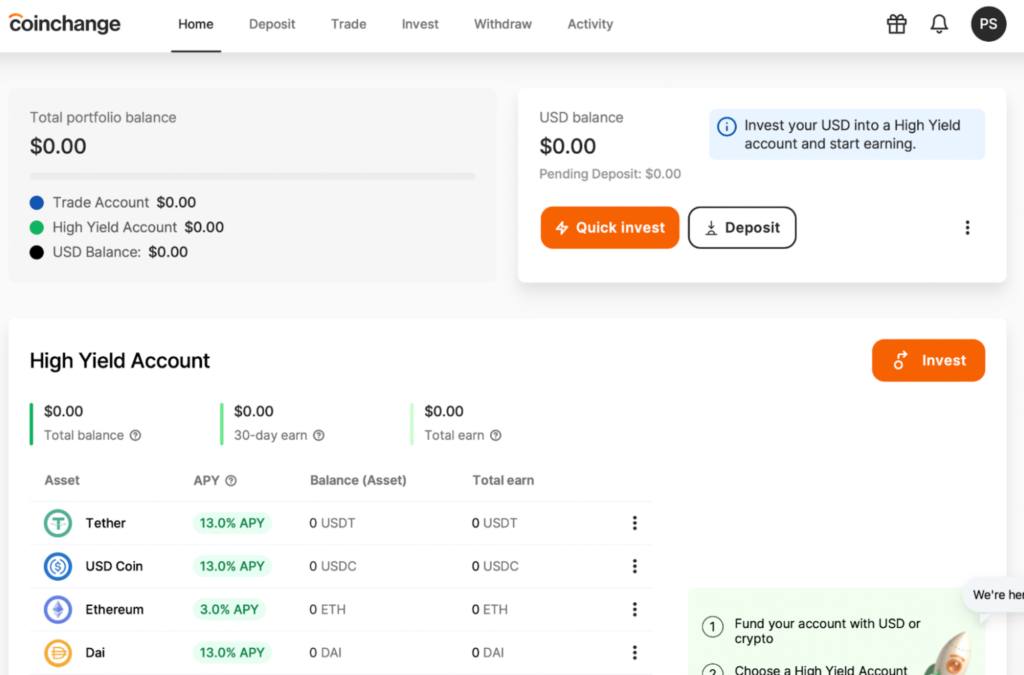

According to Coinchange, the ceiling of passive investment yields in DeFi is 20% per year. At the time of publication, savings accounts yield:

- USDT (ERC-20), USDC and DAI — 13% per year;

- ETH — 3% per year;

- BTC — 0.6% per year.

Unlike DeFi farms and crypto lending services, Coinchange has no withdrawal limits. For example, a user can withdraw funds from a farm for free only after a few weeks from deposit; otherwise a fee of up to 20% applies. Lending services may prohibit withdrawals for one or more months.

Stablecoins are in constant circulation: they are both a trading instrument, a settlement medium, and collateral for exchange operations, hence the returns on such deposits are higher. Ethereum and Bitcoin are of greater interest to long-term investors.

Testing Coinchange

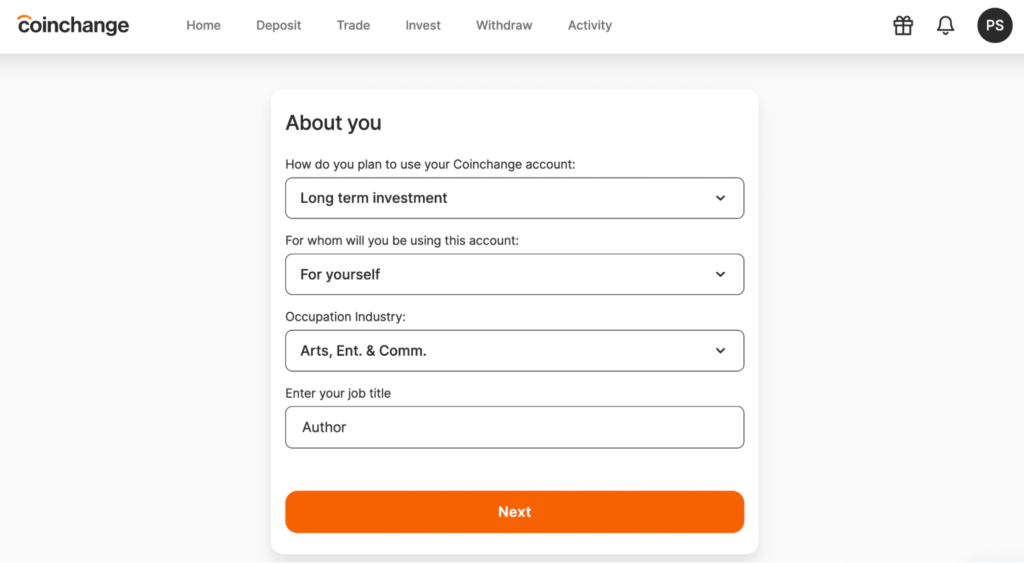

To begin, create an account: provide your email address, first and last name, then choose a password and verify your phone number for two-factor authentication.

After registration you must pass KYC/AML. Although Coinchange works with anonymous DeFi services, it has obtained a Canadian license and complies with the requirements of the U.S. Securities and Exchange Commission for user verification.

The platform does not store user personal data: verification is conducted by Jumio and ChainAnalysis services. A passport is not mandatory: Jumio accepts documents from CIS countries such as Ukrainian ID card or Russian driver’s license.

After verification, we deposit in cryptocurrency or fiat dollars, and then transfer it to a savings account.

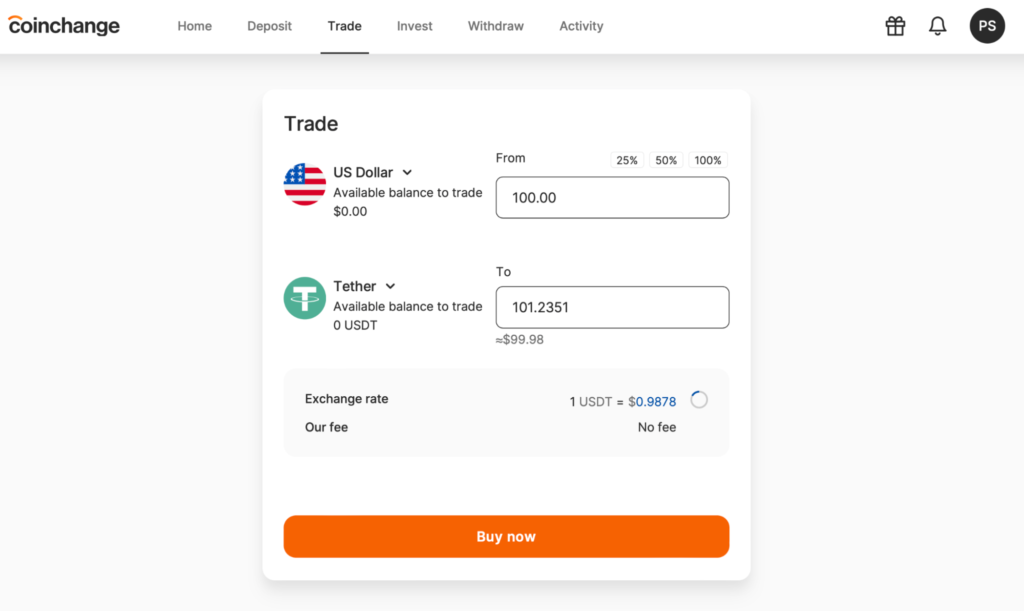

If you deposited dollars, you need to convert them to cryptocurrency in the Trade tab. Coinchange does not charge a conversion fee, and, if you’re lucky, you can even profit from the rate.

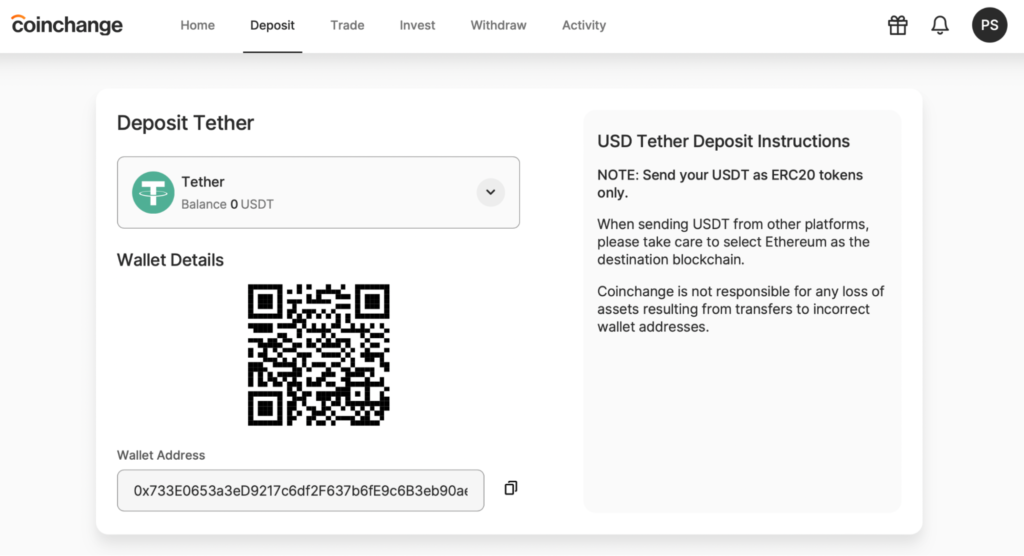

Select the Deposit option from the top menu, specify the currency, and send the tokens to Coinchange’s address. The minimum deposit amount is $50.

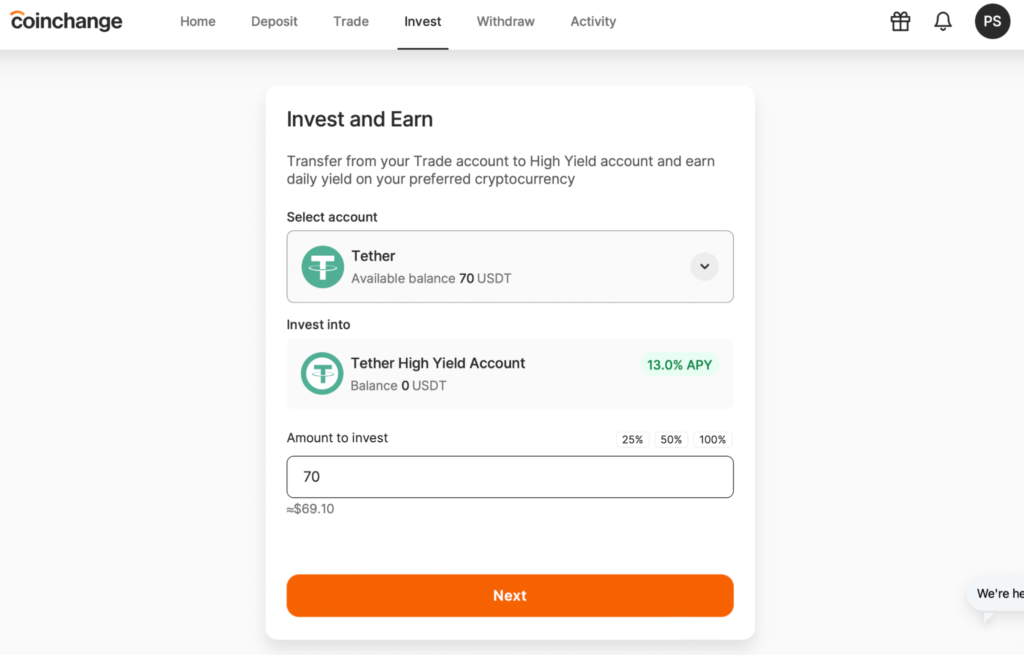

The final step is to invest the tokens. Coinchange will send them to DeFi protocols and start earning profits. To do this, go to the Invest tab, choose a token and specify the amount to invest.

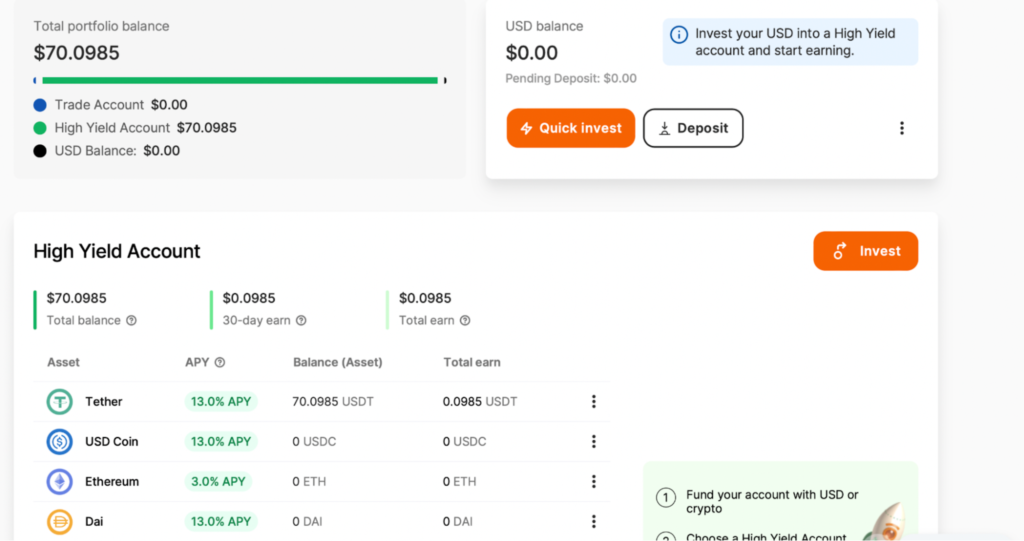

After confirming the transaction, the Coinchange dashboard will start displaying investment statistics. It will take about a day to accrue interest on the deposit — Coinchange processes client orders in batches to save on transaction fees.

We received the first payout on the second day after the deposit. A Coinchange representative explained that this is normal: the service needs time to batch transactions, investments and profit withdrawal.

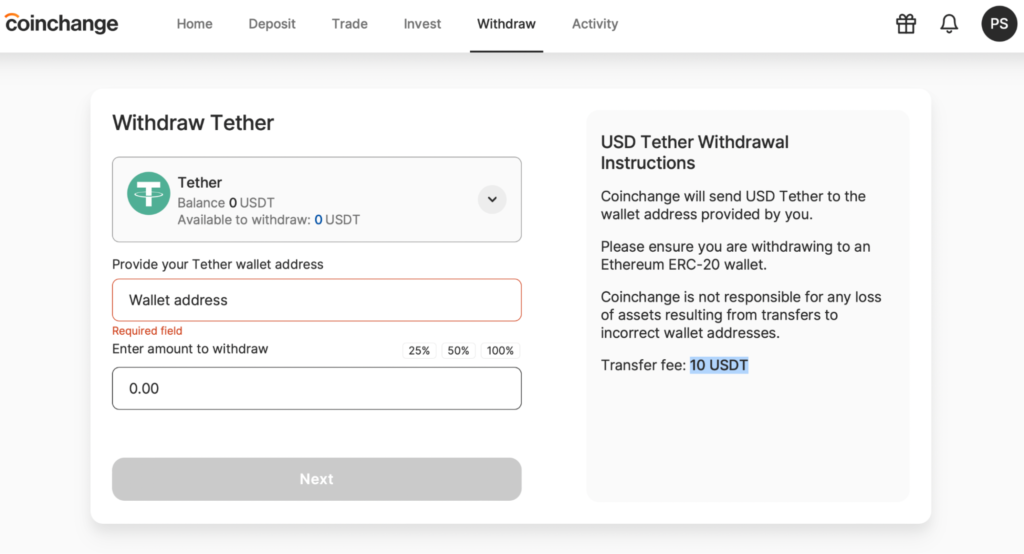

Transferring funds from the investment account to trading takes up to 24 hours. Withdrawals to an external wallet occur within 20 minutes.

Conclusion

On passive investments in DeFi you can earn up to 20% per year, but you would need to operate with millions of dollars and monitor the market around the clock.

The same yields can be achieved by handing your crypto to specialized services. One of them — Coinchange — is suitable for long-term investors who want to earn a stable income with payments in stablecoins.

Currently, the platform pays users 13% per year, but yields vary with market conditions.

Follow ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!