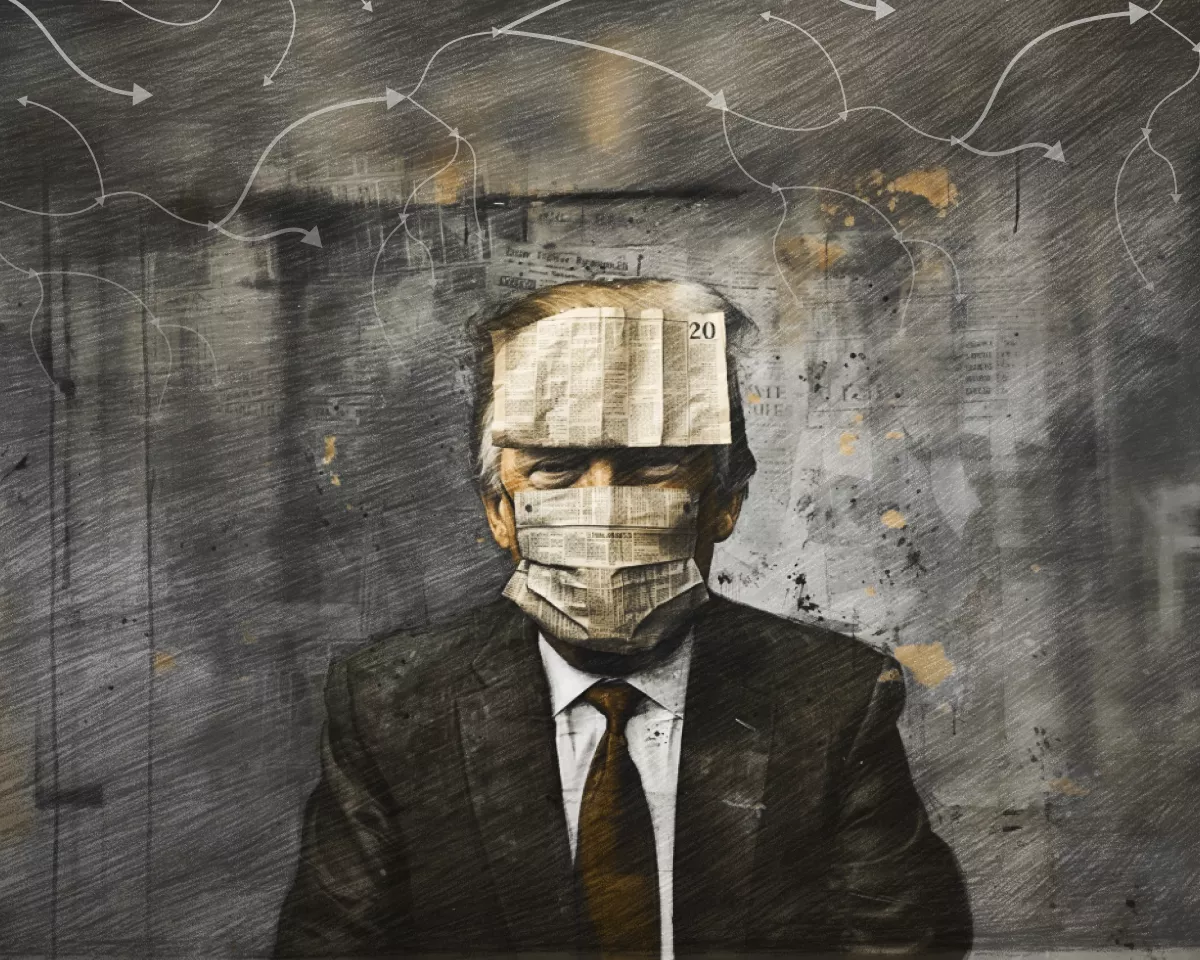

While Donald Trump’s team has been crafting the image of a “future crypto president”, a very different game has been playing out—one most voters and crypto users scarcely notice. Oleg Cash Coin explains for ForkLog a subtle link between America’s electoral cycle and digital-asset markets.

Follow the money

Prediction markets have heated up in recent months, with Polymarket especially popular. They have revealed not only who crypto supporters expect in the White House, but also several common misconceptions about market trends and election expectations.

Divergences between odds on the traditional forecasting venue Kalshi and the crypto-native Polymarket suggest that the “crypto president” may not be who many think.

Why do markets reprice the probability of one candidate’s victory—and how do financial markets handle these risks? Charts alone do not reveal causes, but they do point to clear, logical correlations that sit well beyond the noise around Democrat Kamala Harris and Republican Donald Trump. Markets care about only one thing: money.

When Kamala rose

Large flows into prediction venues became especially visible in July—after Joe Biden left the race and Democrats switched to Harris.

After that, the stance of the Fed on the policy rate shifted markedly: in September it cut the rate to a 4.75–5% range—the first reduction since 2020.

When Trump and Harris were roughly tied, almost every market moved in unison, undergoing pullbacks. At the same time, for the first time since 2022 the US Treasury yield curve normalised (the inversion between 2- and 10-year bonds disappeared). For investors this is a fundamental indicator of an economy on the mend.

Notably, when Harris’s odds improved and neither candidate had a decisive lead, the world’s biggest financial market judged long-term investments more attractive than short-term ones.

That could reflect both the Democrat’s rising popularity and sliding ratings for Trump. But it is not that simple.

Trump’s performance

Delving into Treasury yield charts shows the opposite pattern. Markets began snapping up US Treasuries across the curve in early October—just as the Republican’s odds improved.

In theory, rising yields mean investors are de-risking and moving into havens. They also suggest markets expect the Fed to pause or slow the pace of rate cuts.

Thus, from early October we see Trump’s probability rising and Harris’s falling, alongside mounting investor caution toward risk assets such as bitcoin, the S&P 500 and other non–fixed-income instruments.

It is worth tracking how assets have moved since Trump’s odds rose. Consider physical gold (a haven), the S&P 500 (risk assets) and bitcoin.

During this period, markets cooled expectations of rapid Fed rate cuts. Instead of falling to 3.75% on the lending rate, the probability of a freeze at least through the end of 2024 has increased.

Since early October, bitcoin has behaved like a hedging instrument akin to gold or US Treasuries, as shown by its correlation with those two assets.

The key misconception is that Trump—or anyone else—is “friendly” to cryptocurrencies. Precisely for this reason, the blockchain industry is pricing a positive election scenario by buying bitcoin or other digital assets.

The chart shows the flagship risk asset, the S&P 500, losing appeal in October to gold and bitcoin. Any future president may sway markets, but the first cryptocurrency has already outlived four US presidents without much public help from officials.

Conclusions

Charts and data suggest capital flows “fear” Trump’s return to the Oval Office and that the Fed will slow the rate-cutting cycle this year. And bitcoin—up 12% since early October—has behaved like a hedge against a Trump victory or a Harris defeat, rather than a bet on either candidate’s policies.

Also remember: before elections, candidates court every conceivable voter group. Ignoring the crypto electorate would be a mistake, given its growing ranks in recent years.