HYPE Token Surges Despite Bitcoin Correction

HYPE token rises amid crypto market downturn, seen as a capital preservation tool by experts.

The native token of Hyperliquid (HYPE) has risen amidst a general downturn in the crypto market. Some experts are now viewing the asset as a capital preservation tool, noted CoinDesk analyst Omkar Godbole.

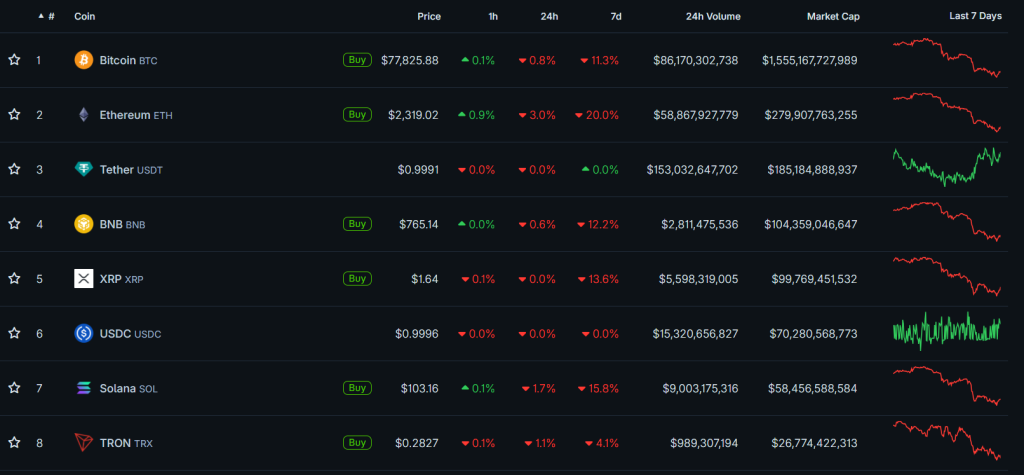

While Bitcoin and Ethereum prices fell, Hyperliquid markets reached record highs. Open interest exceeded $1 billion, and daily trading volume hit $4.8 billion, the publication’s specialist highlighted.

The surge in activity was linked to the HIP-3 initiative. The update allowed for the creation of trading pairs for cryptocurrencies, stocks, and gold, provided 500,000 HYPE is staked.

Over the week, HYPE’s rate increased by 41%. In the same period, the price of the leading cryptocurrency fell by more than 11%, with many altcoins experiencing even deeper declines.

Godbole noted that HYPE is being dubbed a “defensive bet.” The token is compared to utility or pharmaceutical stocks, which are chosen for capital preservation during bearish trends in the stock market.

However, the expert warned of risks. The haven status might be temporary. If the market downturn intensifies, investor confidence could wane, and trading activity across platforms might decline. In this scenario, HYPE’s growth is likely to halt.

At the time of writing, the token is trading at $30.55.

Back in December 2025, an analyst known as Jordi warned of the risks of slashing and losses in the new Hyperliquid markets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!