In Argentina, Turkey and beyond, crypto doubles as an inflation hedge

Crypto serves as an inflation hedge and payment rail across several emerging economies.

Amid weakening local currencies, digital assets have become a store of value and a means of payment across several emerging economies, including Bolivia, Venezuela, Argentina, Turkey, Iran and Nigeria, reports Cointelegraph.

Bolivia

In October 2025 Bolivia’s inflation reached 22.23%. The economy is in a prolonged slump: over the past decade its foreign-exchange reserves have fallen from $15bn to $1.98bn—enough for only three months of imports.

Locals are increasingly turning to cryptocurrencies. According to Chainalysis, annual digital-asset transaction volumes in Bolivia exceeded $14.8bn.

By the summer, shops began listing prices in the stablecoin USDT, used as a more predictable unit of account than the boliviano.

In Bolivia, real prices in shops are displayed in USD₮.

A quietly revolutionary shift: digital dollars are powering daily life, commerce, and economic stability. pic.twitter.com/dGP7I2ipxv

— Paolo Ardoino 🤖 (@paoloardoino) June 7, 2025

In November the Bolivian authorities announced plans to integrate stablecoins into the national financial system. Banks will be allowed to offer crypto-custody services.

Venezuela

Venezuela continues to grapple with extremely high inflation: according to Trading Economics, annual price growth exceeded 170% in April. According to an forecast by the IMF, it could reach 270% by end-2025 and 600% by October 2026.

The country ranks fourth in Latin America by crypto-transaction volumes. According to Chainalysis, from July 2024 to June 2025 digital-asset turnover reached $44.6bn.

The New York Times reckons that President Nicolás Maduro has effectively “moved Venezuela’s economy onto stablecoins”. Many residents colloquially refer to such tokens as “Binance dollars”.

Argentina

In April 2024, when Javier Milei took office, annual inflation was about 200%. A tough stabilisation programme has reduced it to roughly 30%.

According to Chainalysis, Argentina is the second-largest crypto market in Latin America, with turnover of $93.9bn. Use of digital assets continues to grow.

The main use case is preserving savings. At the state level, cryptocurrencies have not yet been adopted, despite a broadly positive stance from Milei and several lawmakers.

Turkey

Turkey’s inflation peaked in 2022 amid President Recep Tayyip Erdogan’s unorthodox policies. Defying conventional economics, he pushed for rate cuts, arguing that high interest rates drive inflation.

As production and import costs rose, inflation climbed to 85%. After a return to orthodox monetary policy it fell to 32%.

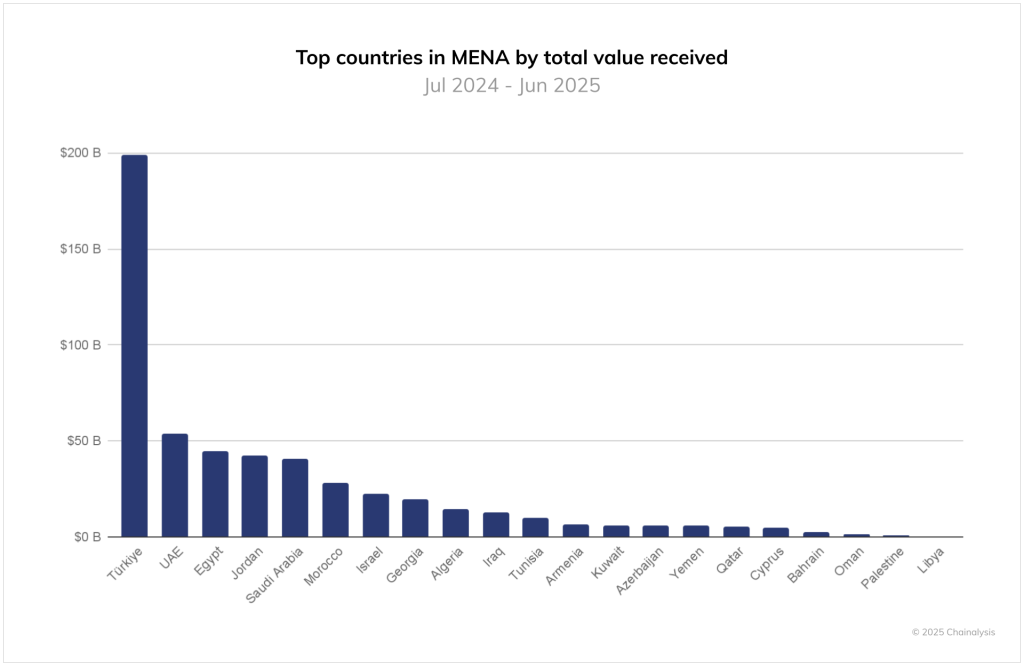

Amid economic instability, Turks have flocked to cryptocurrencies. Over the past year, transaction volumes reached $200bn—the highest in the Middle East and North Africa.

As inflation slowed, a marked shift from stablecoins to altcoins emerged.

“This likely reflects a search for yield by market participants who, amid declining purchasing power and tighter regulatory measures, are willing to take on greater risk in pursuit of outsized returns,” Chainalysis analysts noted.

Iran

Iran is experiencing a new wave of inflation: it exceeded 40% in June and reached 45.3% by September 2025. The economy is constrained by tough international sanctions that limit imports and access to global payment systems.

Rising government spending and a higher cost of living have pushed the authorities towards plans to redenominate the currency: transacting in rials is becoming increasingly cumbersome.

The country was among the first to embrace crypto’s potential for circumventing sanctions: mining was legalised in 2019, and residents actively use exchanges. However, the sector remains under strict state control.

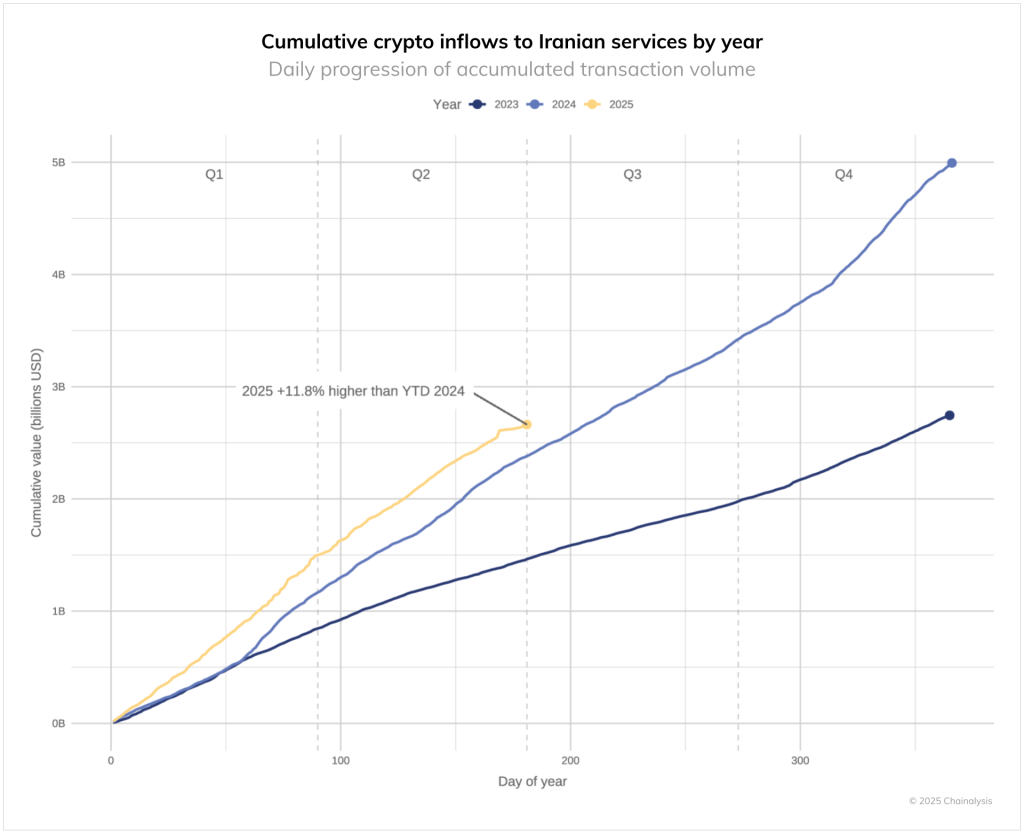

Despite regulatory and infrastructure challenges, crypto-transaction volumes in Iran continue to grow. Forecasts suggest turnover will surpass 2023–2024 levels.

Nigeria

Nigeria has made significant progress in taming inflation. Over the year, the rate fell from 30% to 16%—the lowest since 2022.

Improved supply conditions played a key role, easing food-price pressures. According to Reuters, food inflation fell to 16.87% in September from 21.87% in August.

Much of the success owes to President Bola Tinubu’s reforms, which scrapped fuel subsidies and unified the exchange rate. In August the Central Bank of Nigeria cut its policy rate for the first time in three years.

Despite improving macroeconomic indicators, Nigeria retains the lead in Africa by crypto-transaction volume—$92.1bn.

In the second quarter, the share of users employing crypto to hedge inflation rose from 29% to 46%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!