In Russia, a proposal to block Binance over restrictions on Russians

A refusal to service sanctioned Russian banks could, in the future, spread to all cryptocurrency exchanges, risking the emergence of ‘grey’ exchange schemes and a rise in fraud. As a countermeasure, one of the ForkLog experts interviewed proposed considering blocking the platforms that impose the restrictions in Russia.

Recently Binance, Bybit and OKX removed from their P2P services banks under US sanctions — Sberbank, Tinkoff and Alfa-Bank. Binance, in addition, banned Russians from exchange operations with any fiat currencies other than the ruble.

According to Yulia Privalova, head of the FinTech & Crypto Practice at the law firm DRC, this is linked to investigations by U.S. regulators regarding helping Russians bypass sanctions.

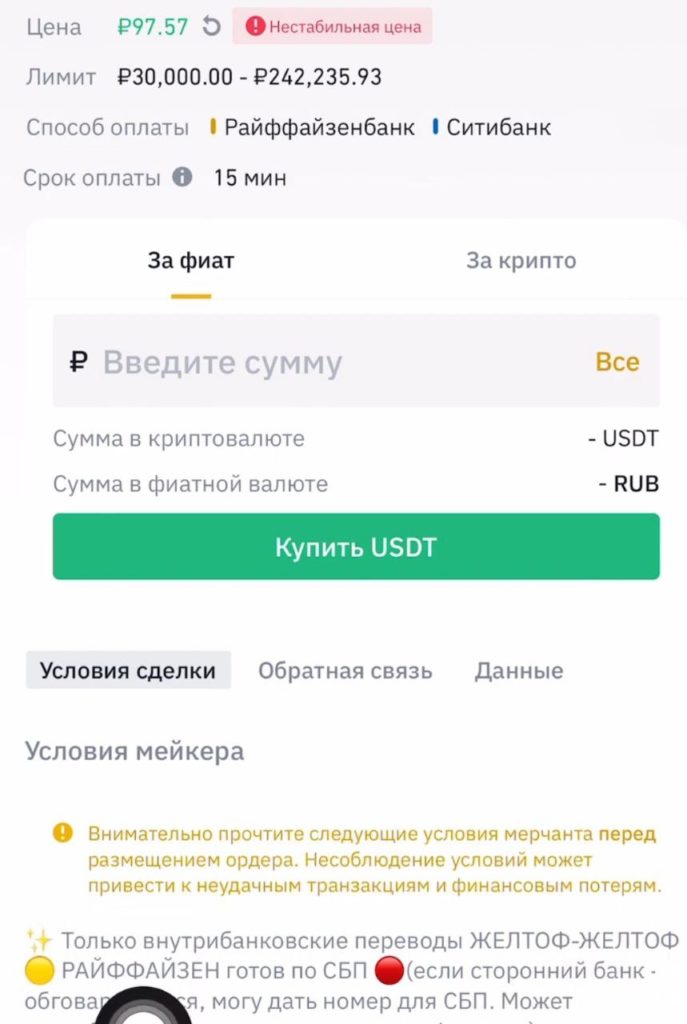

Privalova noted that despite the restrictions, merchants in the course of transactions substitute the names of sanctioned banks with ‘Yellow’, ‘Green’, ‘Yellow Oleg’ and others. Previously, alternative names were available directly in the drop-down list of payment methods, but Binance later removed them.

The lawyer added that, at present, Russian users can still use alternative crypto platforms. However, in the future she did not rule out that a similar ban could spread to them.

“Undoubtedly, in the long run, there will be restrictions on Russian users across all exchanges, which will complicate the process of buying and selling cryptocurrencies, drive the use of decentralized platforms and push toward more ‘grey’ methods of withdrawing funds through third parties. This, in turn, could trigger a new wave of fraud and losses for the population,” Privalova warned.

She recommended that users increase financial literacy and store funds in cold wallets, rather than on exchanges.

Sergey Mendeleev, CEO of Indefibank, argues that the simultaneous removal of sanctioned banks from three exchanges resembles collusion among those specific companies:

“Why did this happen only on these exchanges, while on Gate.io or Huobi everything remains as before?”

Moreover, the more serious problem, according to the expert, is Binance’s fiat restrictions for residents of the Russian Federation.

“If sanctions on certain banks create only minor difficulties (which the community quickly resolved by arranging deals with Sber via Russian Standard), then with the first one you have to figure out how to counter it, as it disrupts a large number of linkages— primarily in international dealings, on which many earned quite well,” explained Mendeleev.

Overall, he believes that in this situation the market will sort it out and Russian users will move from Binance to “more sensible and loyal exchanges.”

The expert stressed that there were no grounds for imposing such strict restrictions.

“From the side of the Russian leadership, it would be nice to see some countermeasures, for example blocking the mentioned resources or even tougher — declaring their activity on the territory of the Russian Federation undesirable with all the consequences that follow. But I fear that the people who make such decisions are not even aware of the situation, unfortunately,” concluded Mendeleev.

Imposing restrictions on Russians is linked to crypto exchanges’ obligation to comply with the laws of the countries where they are registered, including sanctions policy, adds Andrey Tugarin, managing partner at GMT Legal.

According to him, crypto operations are no longer a way to circumvent restrictions.

“Potential tightening of service could occur if sanctions pressure intensifies. We see that crypto operations do not shield from sanctions, so all restrictions in the traditional world will be mirrored onto the crypto sphere— on exchanges and other VASP,” he said.

As reported in May, media reported that the U.S. Department of Justice’s National Security Division was investigating the parent company — Binance Holdings Ltd.— for possible sanctions violations related to Russia.

In March, a suit against the exchange — by the CFTC was filed. It also states that the exchange’s support staff “teaches people how to circumvent sanctions.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!