In Turkey, Tether and Shiba Inu Rival Bitcoin as Lira Tumbles

Trading activity in Turkish lira pairs with Shiba Inu and Tether more than five times the Bitcoin level amid the lira’s sharp devaluation. CoinDesk reports this on CoinDesk.

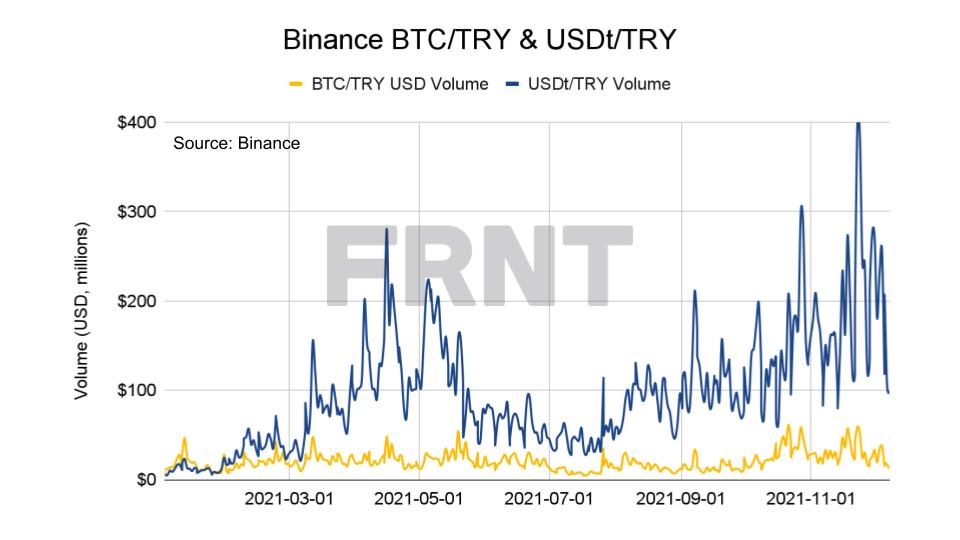

In November, on Binance the lira trading volume with BTC totaled $918 million, with SHIB and USDT — $5.26 billion and $5.58 billion respectively.

“Local traders are still attracted by the exceptional returns associated with coins such as SHIB”, said Strahinja Savic, head of data and analytics at FRNT Financial.

The lira has weakened against the dollar for the ninth year running. In November, the pace reached 39.7%. Since the start of the year the currency has fallen 46.5% — the third-worst result in the world. Only Cuba’s peso (-95.8%) and Libya’s dinar (-70.9%) fared worse.

Inflation in Turkey rose to a three-year high of 21.31%, according to Trading Economics.

“Turkish citizens prioritise gold and the dollar. They also buy cheap cryptocurrencies, such as SHIB, VET, XRP, because BTC is expensive”, explained Sabri Aygun, a crypto investor from Istanbul.

According to CoinGecko, at the time of writing Bitcoin was valued at 679,904 lira, Tether at 14 lira, Shiba Inu at almost 0.0005 lira.

Cryptocurrencies are seen by the population as a store of value. This may exert additional pressure on the exchange rate of the local currency.

In May, Turkish-based cryptocurrency exchanges obliged to notify the Financial Crimes Investigation Board of transactions by users exceeding the limit of 10,000 lira (~$1,200).

Earlier, the Central Bank of Turkey defined cryptocurrency as a non-monetary asset and prohibited its use as a form of payment.

In June, the regulator criticised Bitcoin for its negative impact on the environment.

Subscribe to ForkLog news on Telegram: ForkLog Feed — full news feed, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!