Inflow Resumes in Spot Bitcoin ETFs After Seven-Day Outflow

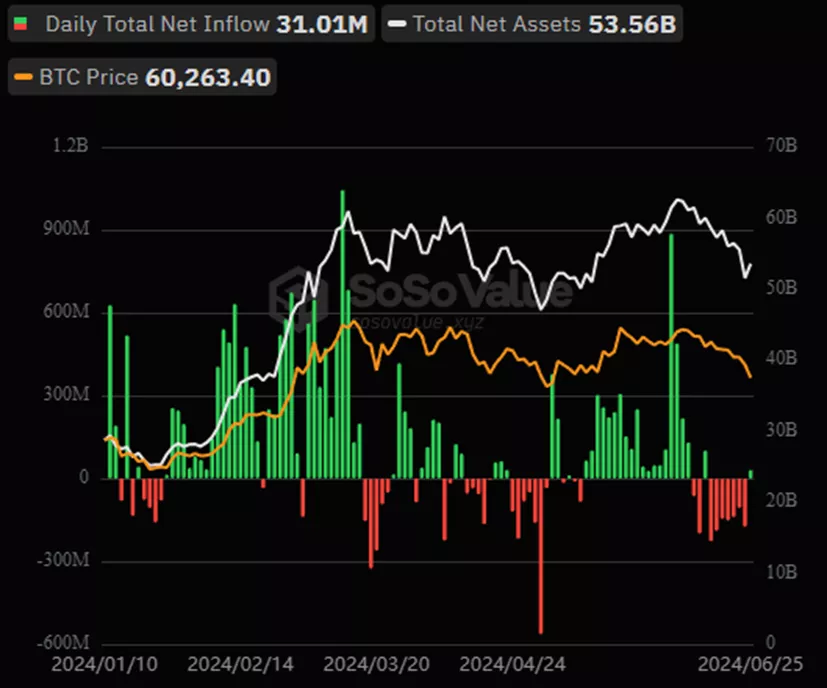

On June 25, inflows into BTC-ETFs amounted to $31.01 million, according to SoSoValue. This follows a seven-day period of negative trends during which investors withdrew $1.13 billion.

On June 25, clients withdrew $30.3 million from Grayscale’s GBTC. The situation was balanced by inflows into Fidelity’s FBTC ($48.8 million), Bitwise’s BITB ($15.2 million), and VanEck’s HODL ($3.5 million).

No changes were recorded for other instruments.

According to CoinShares, over the previous two weeks, outflows from cryptocurrency investment products reached $1.18 billion.

Analysts attributed the change in sentiment to the publication of the Fed’s key rate forecasts, which did not meet expectations.

News of Mt.Gox preparing to compensate creditors in early July also triggered a decline in prices.

CryptoQuant has pointed to signs of a potential bottom for Bitcoin. In addition to on-chain analysis indicators, they referred to the state of the derivatives market.

Earlier, Sam Callahan of Swan Bitcoin stated that the bearish pressure associated with Mt.Gox’s distribution might be less than market participants anticipate.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!