Institutional Bulletin: Multimillionaires Favor Bitcoin as Crypto Firms Raise $900 Million

Institutional investors are increasingly backing Bitcoin as crypto firms attract about $900 million in VC funding in Q3 2020.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evidenced by new investments in infrastructure and by the growing attention they devote to Bitcoin as an asset class. The most important events of the past weeks are in ForkLog’s roundup.

Multimillionaire Club Invested in Bitcoin Ahead of U.S. Elections

Participants in Tiger 21, a club of high-net-worth individuals with assets of at least $100 million, invested in Bitcoin, silver and shares of gold-mining companies as a hedge against a Biden victory in the U.S. presidential election.

“Against the backdrop of near-zero interest rates in debt markets and due to uncertainty, many are increasing their allocation to gold and Bitcoin,” said Avi Weintraub, president of The Weintraub Companies, a real estate firm and head of the Tiger 21 Miami chapter.

According to Weintraub, investors who ignored Bitcoin eight months ago are now watching media coverage comparing gold and the first cryptocurrency with interest.

“We do not know where this topic is headed. It may be warranted, it may be madness, or something in between. So why not add a small share of Bitcoin to the portfolio? It is, in a sense, a hedge,” he explained.

The TIGER 21 club (The Investment Group for Enhanced Results in the 21st Century) was founded in 1999 as a networking platform for wealthy investors. It counts more than 500 members with assets under management totaling $50 billion.

Fidelity Digital Assets Begins Expansion into Asia

Fidelity Investments’ digital assets division announced a partnership with Stack Funds, a Singapore-based company.

The agreement envisions custody services for Stack Funds’ clients among family offices and high-net-worth individuals. The Singapore-based company commits to insuring client assets and conducting monthly audits.

According to Stack Funds co-founder Michael Collette, the collaboration with Fidelity will raise local investors’ trust in cryptocurrencies.

As reported in June, Fidelity said that one in three of the 774 large clients surveyed in the United States and Europe had already added digital assets to their portfolios.

British Mode Global Holdings to Move Up to 10% of Capital into Bitcoin

The London-listed fintech group Mode Global Holdings PLC became the first British public company to announce Bitcoin purchases. As part of its investment strategy for this purpose, it allocated about 10% of its capital.

Mode Global Holdings’ conviction in Bitcoin has grown amid the coronavirus crisis and the Bank of England’s lowest interest rates in its 326-year history.

“This decision is part of a long-term strategy to protect investors’ assets from currency depreciation,” the company said.

Genesis Global Capital Issued $5.2 Billion in Loans in Q3

A service oriented toward institutional investors, Genesis Global Capital reported activity for the third quarter of 2020. From July to September the company issued crypto loans totaling $5.2 billion.

Overall growth in the volume of active loans at the company was modest. In the third quarter the figure stood at $2.1 billion versus $1.4 billion in the second quarter.

In Genesis Global Capital’s loan portfolio for the period, altcoins and the U.S. dollar dominated. Bitcoin’s share of outstanding loans fell to 40.8%.

The main reason for the shift in client preferences, the company says, is the growth of the DeFi sector — against this backdrop, loans in Ethereum and in stablecoins have become more common.

Franklin Templeton Invests in Cryptocurrency Custodian Curv

Franklin Templeton and Illuminate Financial led a new Series A round for Curv, a provider of infrastructure for storing cryptocurrencies. The amount invested was not disclosed.

Franklin Templeton manages about $1.4 trillion in assets. In November 2019 the company announced the use of Curv technology to secure assets in a money-market fund on the Stellar blockchain.

Curv is expected to take on the role of managing private keys that enable “instant access and full autonomy over digital assets.” This allows signing transactions in a secure distributed manner to guard against data leaks and insider collusion.

The Curv CEO Itai Malinjer previously stated that the company’s client base spans both cryptocurrency market participants and traditional financial institutions worldwide. He said the strongest growth in demand was seen in Germany and across Europe.

In July, Curv attracted $23 million from Commerzbank Group, Coinbase Ventures and Digital Currency Group.

Crypto Firms Raised $900 Million in Venture Capital in Q3 2020

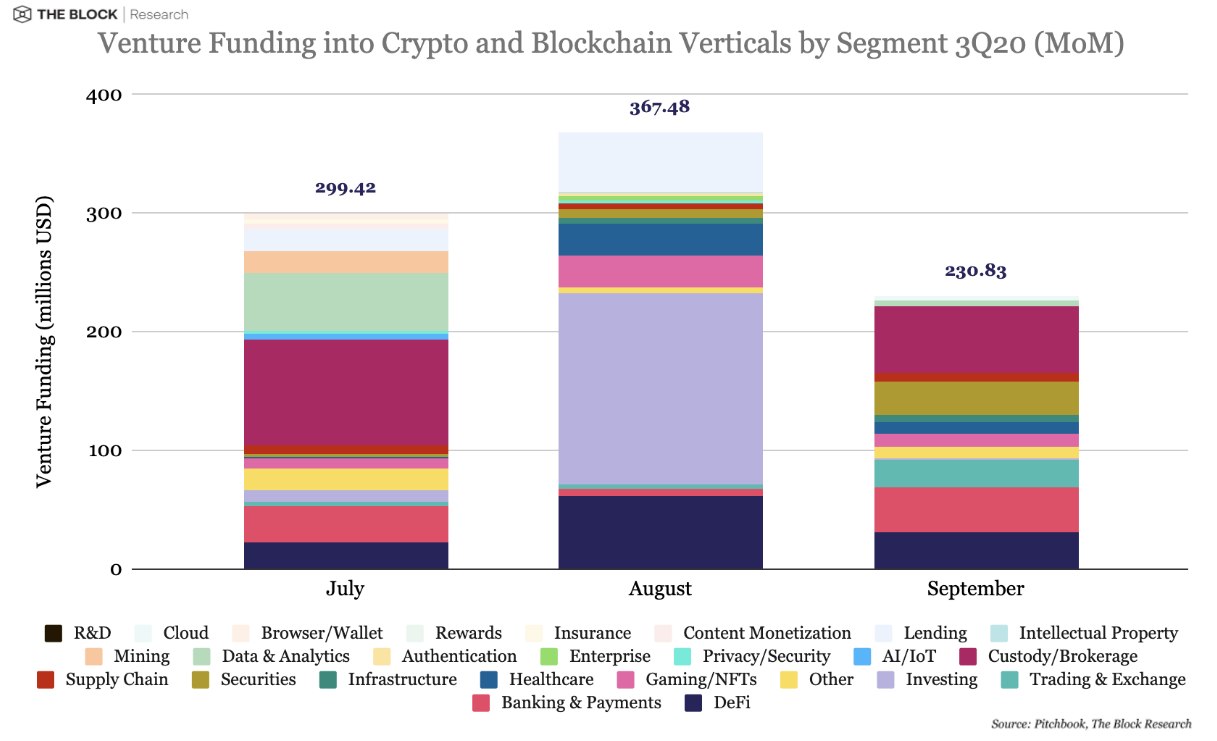

Two hundred twelve crypto and blockchain startups raised about $897.7 million in venture capital in Q3 2020, according to a Cointelegraph study by The Block Research.

The most common deal type during the period was early-stage and seed rounds. They accounted for half of quarterly activity: 59 early-stage deals and 60 seed deals.

Source: The Block Research.

The average deal size for early-stage startups was $7 million. The sum of these early deals amounted to about $272 million, or around 30% of total quarterly investments.

Seed deals averaged $2.1 million. Their total reached $126 million, equivalent to 12% of total quarterly investments.

61% of European Institutional Investors Have Already Invested in Cryptocurrencies or Plan To

European institutional investors are showing interest in digital currencies — many have already invested or plan to invest part of their assets in cryptocurrencies. This is according to a Cointelegraph study.

In the study, analysts surveyed 55 institutional investors, including banks, asset managers, and pension funds from Germany, Austria, Switzerland and Liechtenstein. The total assets under management of respondents exceed €719 billion.

Among the 64% of respondents who have not yet invested in cryptocurrencies, 39% plan to do so.

“As a result, 61.15% of surveyed professional investors either already own digital assets or plan to purchase them in the future,” the researchers said.

Thirty-six percent of respondents have already invested in crypto assets. Most of them hold less than 10% of their assets under management in crypto.

The most popular currencies among institutional investors remain Bitcoin and Ethereum. Stablecoins were acquired by 19% of respondents.

Also, we wrote:

- Tyler Winklevoss: The Fed signals to investors to buy Bitcoin.

- Paul Tudor Jones: investing in Bitcoin is like investing in early Apple or Google.

- KPMG joined with Coin Metrics to bring institutional players to cryptocurrencies.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!