Institutional Demand Drives Inflows to Bitcoin ETFs, Expert Explains

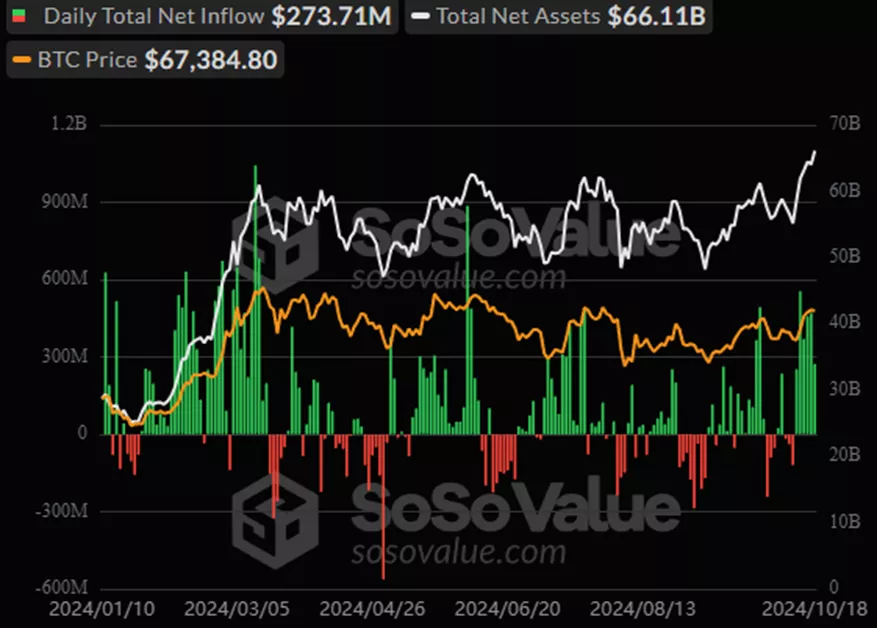

On October 18, inflows into spot Bitcoin ETFs reached $273.7 million, with a total of $2.38 billion over the past six days.

Cumulative inflows into these products since trading began in January have approached $21 billion.

Nate Geraci, president of ETF Store, commented on the data.

Monster day for spot btc ETFs…

$550mil inflows.

Now approaching *$20bil* net inflows in 10mos.

Simply ridiculous & blows away every pre-launch demand estimate.

This is NOT “degen retail” $$$ IMO.

It’s advisors & institutional investors continuing to slowly adopt.

— Nate Geraci (@NateGeraci) October 15, 2024

“This is simply ridiculous and blows away every pre-launch demand estimate. This is not ‘degen retail’ dollars. It’s advisors and institutional investors who continue to gradually adopt the market,” he noted.

Chris Aruliah, head of institutional relations at Bybit, explained the increased inflows in a conversation with Cointelegraph, attributing them to the upcoming US elections.

“As we approach November, investors may be more confident in betting on a renewed bullish trend. Both candidates have made positive statements regarding cryptocurrencies, and regulatory clarity is expected,” the top manager explained.

Alicia Kao, managing director at KuCoin, cited macroeconomic indicators that have reduced concerns about recession risks amid a decrease in the Fed key rate. She also noted the growing interest from institutions in ETFs.

The Role of Institutional Investors

A KuCoin representative referred to a PwC and AIMA study, which found that 47% of traditional hedge funds are investing in cryptocurrencies, up from 29% in 2023. Key drivers include regulatory transparency in the US and Asia, as well as the launch of ETFs.

Mythil Thakore, CEO and co-founder of Velar, described the current situation as a “perfect storm” for investing in digital assets globally.

“We have exceeded $20 billion [in AUM for BTC-ETFs]. It took gold more than four years to reach this,” the expert pointed out.

VALR’s market director Ben Caselin supported his colleague:

“The participation of financial advisors and pension funds is crucial for Bitcoin to reach new highs and to displace gold as an asset distinct from TradFi,” he emphasized.

Kao noted that in the second quarter, the number of institutional holders of BTC-ETFs increased by 27% (262), with their total number exceeding 1000.

According to her estimates, as of June 30, 2024, this category accounted for only 21.15% of the funds’ AUM. For comparison, at the end of the first quarter, the figure was 18.7%.

Caselin is convinced that while gold has a millennia-long history as a legitimate store of value, the modern digital era has brought Bitcoin and all its unique advantages:

“The 15-year evolution of the first cryptocurrency as a technological asset aligns with modern financial trends, allowing it to attract capital faster than traditional assets.”

Investments by Morgan Stanley in spot Bitcoin ETFs have reached $272 million.

Over the next 18 months, about 10% of American companies are expected to convert 1.5% of their reserves (approximately $10.35 trillion) into the first cryptocurrency, according to River.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!