Institutional Demand to Drive Ethereum’s Future Growth, Says Derive

Ethereum is poised for "explosive growth" in Q4 due to institutional interest.

With the potential easing of the Federal Reserve’s policy and interest from major players, Ethereum is poised for “explosive growth” in the fourth quarter, according to a report by Derive.

Nick Forster, an analyst at the company, provided forecasts for two leading crypto assets:

- Bitcoin has a 7% chance of reaching $150,000 by the end of October and a 22% chance by the end of the year;

- Ethereum has a 30% chance of hitting $6,000 by the end of October, with a 44% chance by year-end.

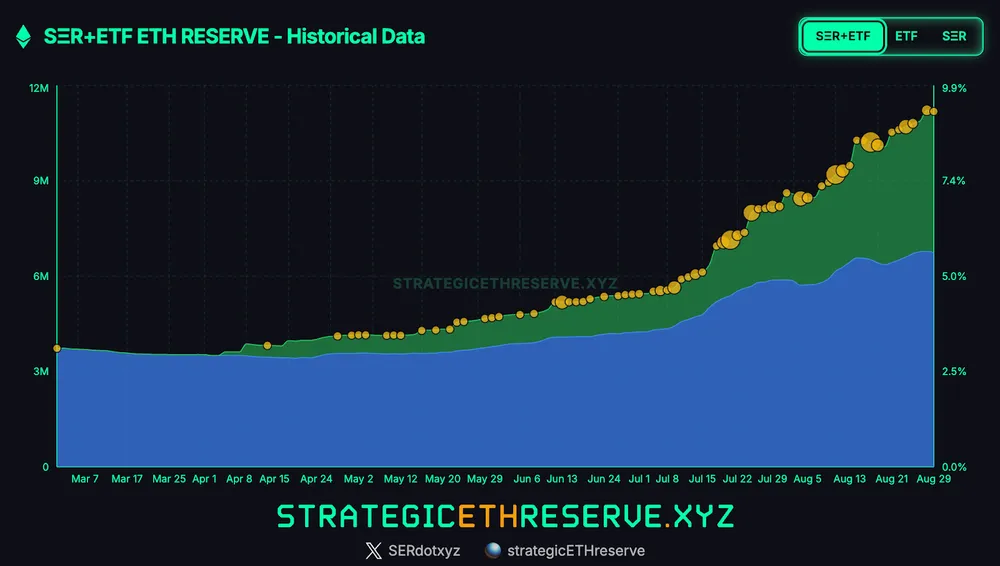

“Institutional adoption of Ether is gaining momentum. Just last week, the amount of ETH in ETF portfolios increased by 250,000 coins—from 6.5 million to 6.74 million. More notably, SER companies like Bitmine and Sharplink Gaming collectively increased their holdings by 330,000 ETH—33% more than exchange-traded funds over the same period,” Forster noted.

Ethereum treasuries now account for nearly 4% of the total coin supply, rapidly approaching 5.5%, the expert highlighted.

By the end of the year, the volume of assets under SER management is expected to reach 6-10% of the total issuance, providing a foundation for growth.

Additionally, in the options market, short-term ETH volatility sharply decreased over the past week—from 75% to 63%, Derive indicated. This suggests that investors anticipate a more stable and gradual rise.

Earlier in September, an expert identified a rare bottom signal for Bitcoin’s price. Analysts at Glassnode described the current market structure as “fragile.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!