Institutional Roundup: Pantera Capital Reaps the Rewards of Its Bets as Coinbase Custody Bitcoin Assets Reach $20 Billion

The cryptocurrency industry is drawing an increasing number of institutional players. This is reflected in new investments in infrastructure and the growing attention they pay to bitcoin as an asset class. The most important developments of the past weeks are in ForkLog’s roundup.

Galaxy Digital’s Bitcoin funds attracted $58.7 million from institutional investors over the year

Led by Mike Novogratz, Galaxy Digital привлекла $55.1 million in Galaxy Institutional Bitcoin Fund LP and $3.6 million in Galaxy Bitcoin Fund LP over the year since the funds were launched.

The minimum investment for institutional investors in the first fund is $250 000. Since November last year Galaxy Institutional Bitcoin Fund LP привлекла assets from 33 investors with an average investment of $1.6 million.

The minimum for participation in the second fund is capped at $25 000. The Galaxy Bitcoin Fund LP привлекла 33 investors as clients during this period.

MicroStrategy’s profit from bitcoin investments has vastly exceeded net income from its core business

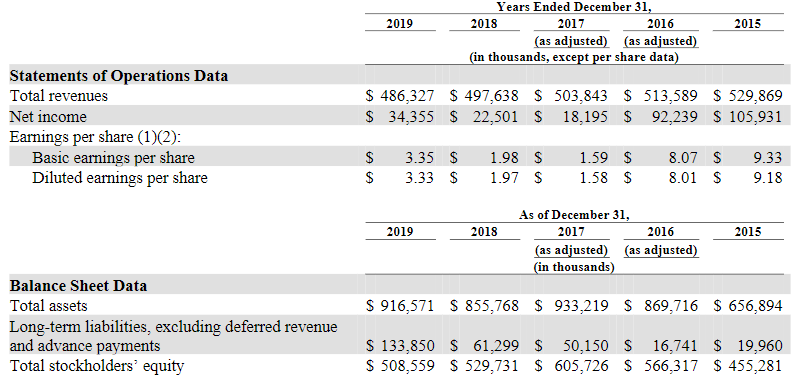

The value of the cryptocurrency MicroStrategy, the analytics software provider, purchased this year rose from $425 million to $661.7 million (as of 28 November 2020). Its core business last year принес $34.35 million.

Фрагмент отчетности MicroStrategy.

From January to September this year, the company, in its core business заработала $1.98 million.

MicroStrategy became the first public company to allocate part of its capital to bitcoin. In August the company купила 21 454 BTC (~$250 million at the rate at the time of the deal), and in September приобрела an additional 16 796 BTC for $175 million.

Pantera Capital’s Bitcoin Fund grew to $134 million

The venture firm Pantera Capital увеличила the fundraising for its flagship bitcoin fund by $5 million, bringing this figure to $134 million.

Launched in 2013, Pantera Bitcoin Fund was the first bitcoin fund in the United States. From the start of the year through November 17, it has delivered 142% to investors before fees.

Source: Pantera Capital.

According to the company’s July report, the Pantera Bitcoin Fund’s seven-year return составила свыше 15 000%.

Assets under institutional custody at Coinbase Custody reach $20 billion

Assets under custody at Coinbase Custody rose from $6 billion in April to $20 billion this year, with увеличился.

«We are witnessing explosive growth in interest. I joined the team in April, when institutional assets stood at $6 billion. Today it’s more than $20 billion. That’s more than a threefold increase,» said Coinbase’s head of institutional sales, Brett Tejpaul.

According to him, Coinbase Custody’s successes are largely due to the acquisition of crypto broker Tagomi, as well as partnerships with JPMorgan and Deloitte.

Globe, the institutional exchange, attracted $3 million from Tim Draper, Y Combinator and Pantera Capital

Globe, the crypto-derivatives exchange, привлекла $3 million in seed funding with backing from Pantera Capital, Y Combinator, Draper Dragon Fund Tim Draper and Wavemaker Partners.

Globe is registered in the Seychelles and based in London, with its launch expected in the coming weeks.

The platform is aimed at institutional clients and will offer them perpetual contracts on bitcoin, Ethereum, the Bitcoin Volatility Index and DeFi tokens. Trading on the exchange will be unavailable to US residents.

Fireblocks, an infrastructure company, raised $30 million

The institutional-focused infrastructure company Fireblocks привлекла $30 million in a Series B financing round led by venture firm Paradigm.

Also participating were prior investors Cyberstarts, Tenaya Capital, Swisscom, Galaxy Digital, Digital Currency Group (DCG) and Cedar Hill Capital.

As part of the new investment, Fireblocks joined the board with Coinbase co-founder and Paradigm CEO Fred Ehrsam.

In 2019, New York–based Fireblocks launched a cloud platform to safeguard cryptocurrency transactions from a range of risks—from theft of private keys to spoofing.

Since then, the Fireblocks Network has welcomed more than 120 corporate and institutional clients and more than 30 partners in Asia, Europe and North America. Among them are Fidelity, Revolut, Celsius, BlockFi, PrimeTrust, Genesis, Nexo and other industry players.

Fireblocks also provided institutional access to DeFi services on the Compound platform.

We also reported:

- Cypherpunk Holdings увеличила инвестиции в биткоин за счет Ethereum и Monero.

- Grayscale: инвесторы рассматривают биткоин как средство сбережения и страховку от инфляции.

- SkyBridge Capital с активами на $9,2 млрд планирует инвестировать в биткоин.

Subscribe to ForkLog’s news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!