Institutions are the main driver of bitcoin’s record high, says Bitwise researcher

The first cryptocurrency has hit fresh record highs above $118,000, yet retail investors are “almost nowhere to be found”, said André Dragosch, Bitwise’s head of research in Europe.

🚨WATCH: Bitcoin is at new all-time highs but retail is almost nowhere to be found.

Latest leg up is mostly driven by institutions. pic.twitter.com/PTziyUUAri

— André Dragosch, PhD⚡️ (@Andre_Dragosch) July 11, 2025

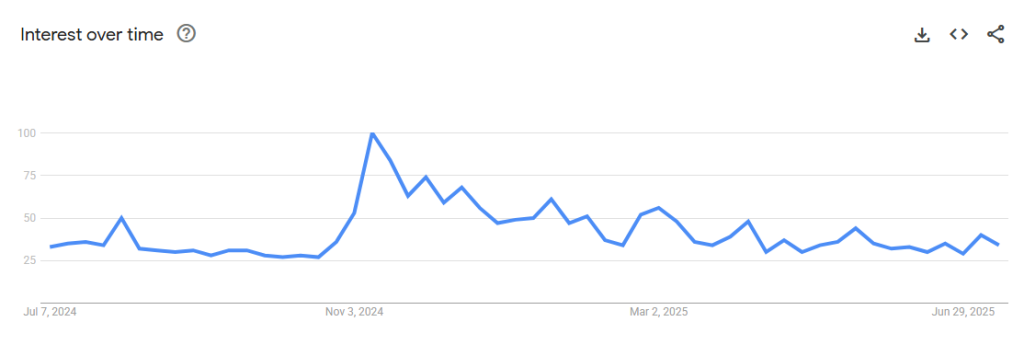

The expert pointed to a decline in interest in the Google search query “bitcoin”.

According to Google Trends, in the week of 6–12 July the metric reached 40. While it rose alongside the rally, it remains far from the peak reading of 100 recorded in November 2024 ahead of the break above $100,000.

“The recent rise is mostly driven by institutions,” Dragosch emphasised.

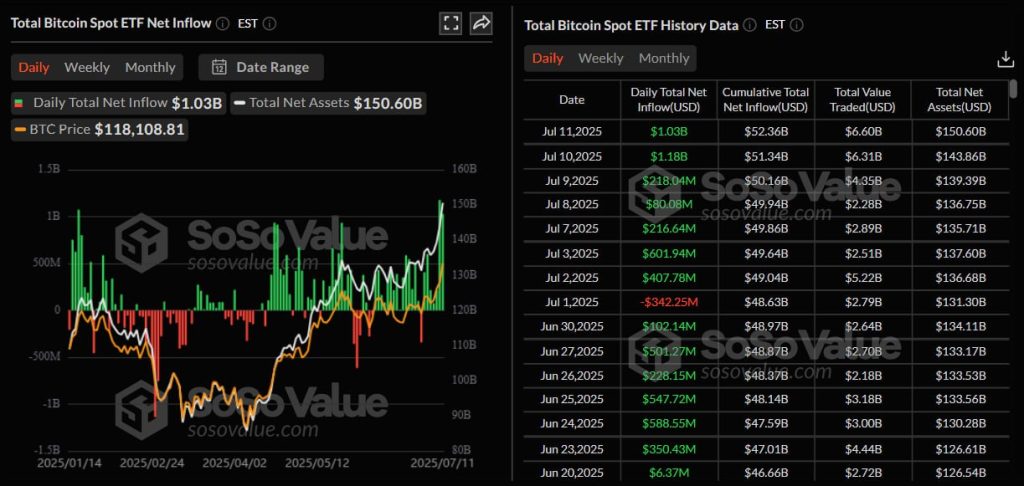

His comments are corroborated by inflows into exchange-traded funds (ETFs) in recent sessions. On 10 and 11 July, US spot bitcoin ETFs took in $1.18bn and $1.03bn respectively, bringing cumulative net inflows to a record $52.36bn.

Ethereum funds also posted sizeable inflows — the cumulative total since launch has exceeded $5.3bn.

Some industry participants suggested that the price of digital gold has become too high for ordinary investors.

“I suppose many retail traders learn that the price of one bitcoin is $117,000 and think: ‘No, I missed my chance,’ and do not even consider [buying],” — noted digital-asset advocate Lindsay Stamp.

Discussing the topic, Bitcoin Matrix podcast host Cedric Youngelman said he was confident that bitcoin “will not come back to life” for retail for a long time.

On cycles

According to Xapo Bank CEO Seamus Rocca, market cycles of setting new all-time highs followed by deep corrections still persist, contrary to popular belief.

He believes the risk of a prolonged bear market is very real and does not require a “catastrophic” event to trigger it. Simple things such as an overall slowing of news, the development of negative events or routine portfolio rebalancing could spark the next downturn.

“We all like to think that bitcoin is a hedge against inflation, and I believe that one day it will be. But I’m not sure we’ve reached that point yet. I still see it as a very risky asset. At least, the correlation between bitcoin, the S&P 500 index and equities is still very strong,” Rocca explained.

In his view, a “contagion effect” could simply remove all news from the market. That would lead the crypto sector to “exhaust its potential” through a natural and prolonged process.

“Many say: ‘Oh, institutions exist, therefore bitcoin’s cyclicality is dead.’ I don’t quite agree with that,” Rocca emphasised.

Santiment analysts saw signs of the start of an altcoin season.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!