Investors Inject $2 Billion into Bitcoin Products

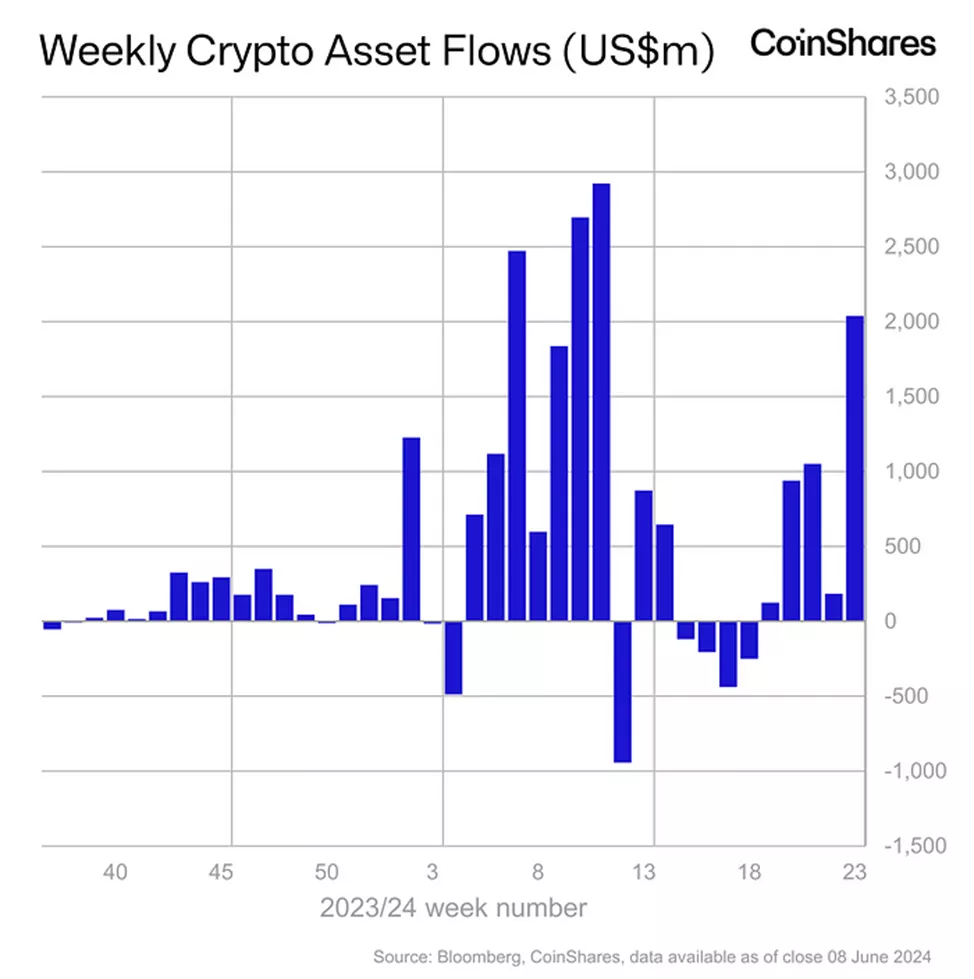

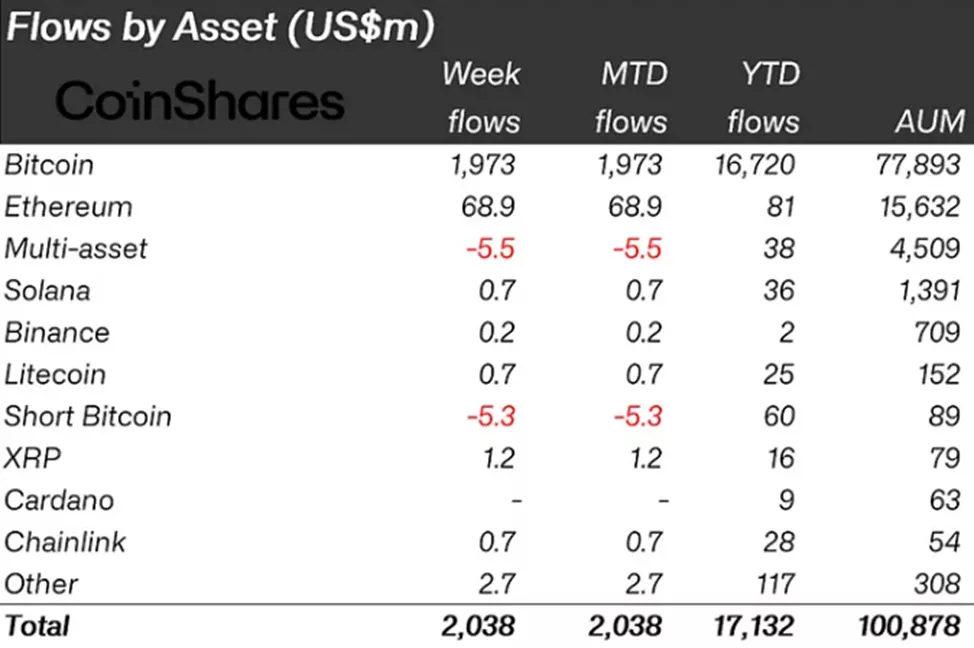

From June 1 to June 7, cryptocurrency investment products saw an inflow of $2.04 billion, with Bitcoin-based products accounting for $1.973 billion, according to calculations by CoinShares.

In both cases, the weekly figures matched the totals for the entire previous month.

Analysts attributed the accelerated pace to expectations of a monetary policy easing by the Fed.

“This shift in sentiment was a direct response to weaker-than-expected macroeconomic data in the US, leading to heightened expectations of a rate cut,” the report stated.

The positive trend continued for the fifth consecutive week. The total assets under management exceeded $100 billion for the first time since March.

Trading volume for ETP increased by 55% to $12.8 billion.

Clients directed $1.97 billion into Bitcoin-related instruments, compared to $148 million in the previous reporting period.

Investors withdrew $5.3 million from structures that allow short positions on the leading cryptocurrency, up from $3.5 million earlier.

In Ethereum funds, inflows continued for the third consecutive week, with the pace increasing from $33.5 million to a March high of $68.9 million.

Analysts cited the approval by the SEC of 19b-4 applications from ETH–ETF issuers as a driver. Trading will commence once the agency signs the registration statements on Form S-1.

Among other altcoins, notable inflows were seen in Fantom-based ($1.4 million) and XRP-based ($1.2 million) instruments.

Earlier, K33 Research estimated the net inflow into ETH–ETF in the first five months after trading began at $3.1 billion–$4.8 billion.

Previously, VanEck raised its Ethereum forecast for 2030 to $22,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!