Investors Withdraw $1.43 Billion from Crypto Funds Amid Fed Decision Concerns

This marked the largest withdrawal since March.

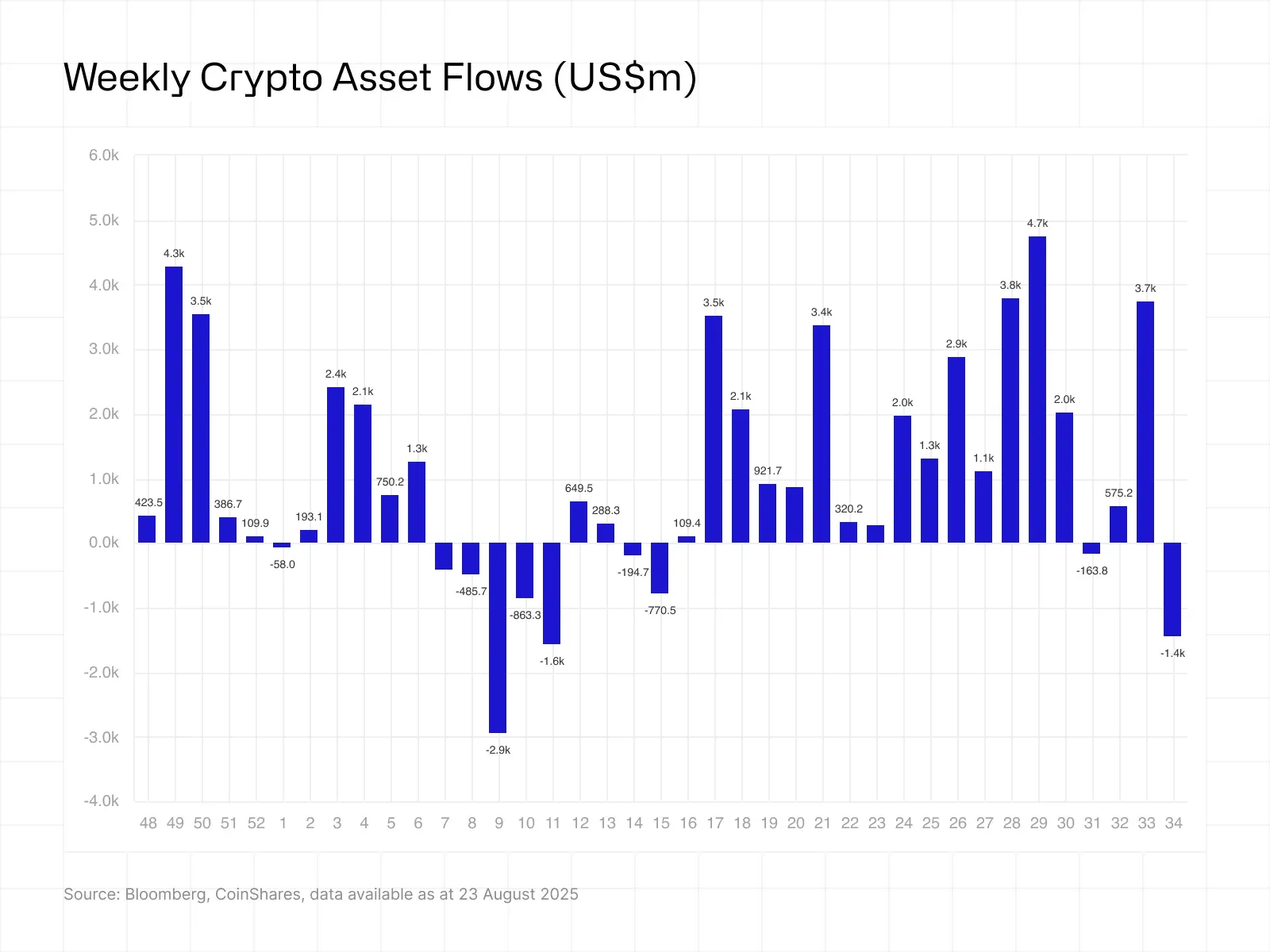

Between August 16 and 22, digital asset investment products saw an outflow of $1.43 billion. This marked the largest withdrawal since March, according to a new report by CoinShares.

Due to pessimistic market sentiment, investors withdrew $2 billion from crypto funds at the start of the week. However, the speech by Fed Chair Jerome Powell at the Jackson Hole symposium gave market participants hope for a monetary policy easing, leading to an inflow of $594 million.

Trading volumes for exchange-traded funds reached $38 billion, 50% above the annual average, analysts noted.

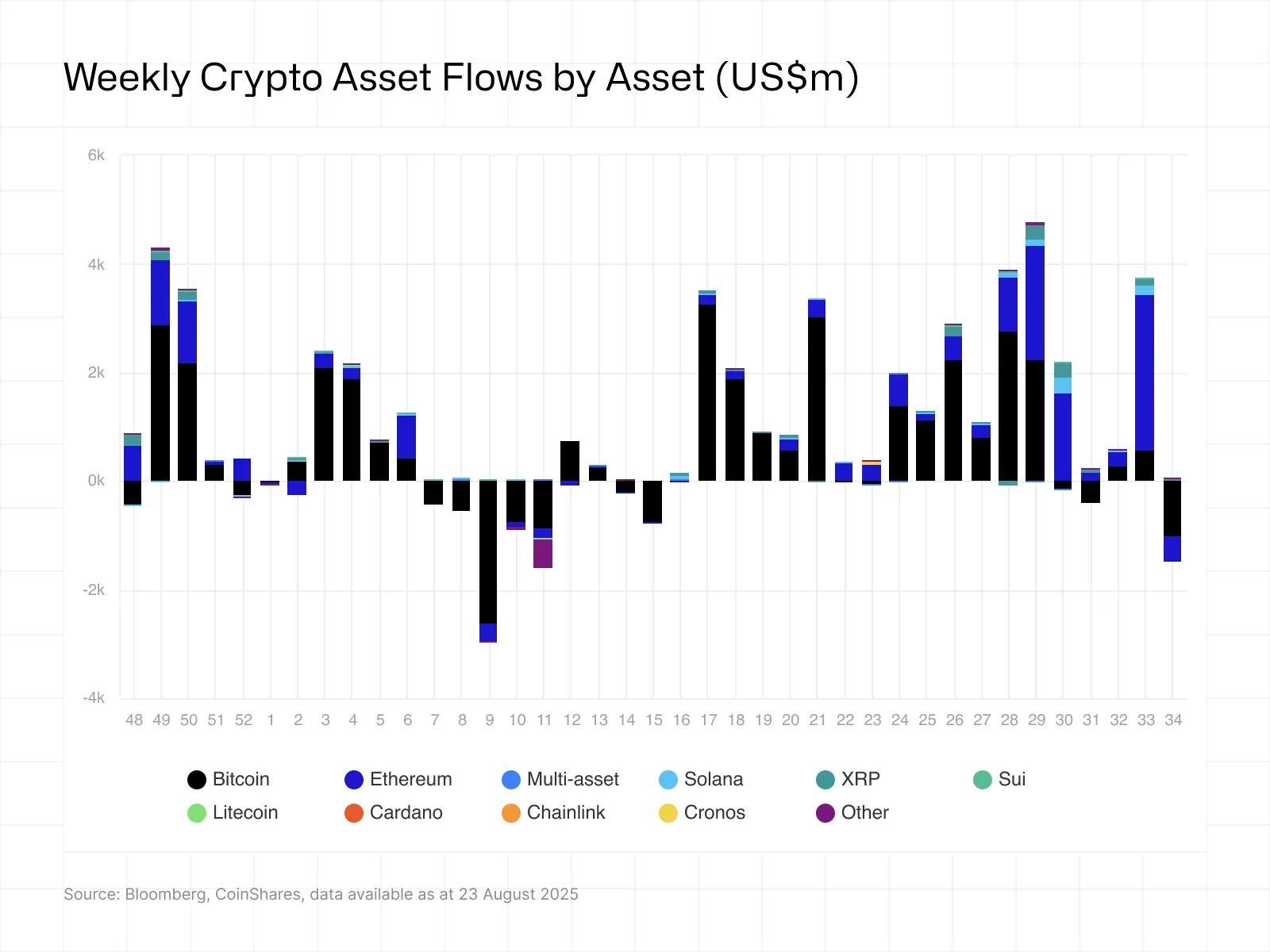

Ethereum ETFs lost $440 million. However, since the beginning of August, these products have attracted $2.5 billion. In comparison, $1 billion was withdrawn from Bitcoin-based investment products over the month.

Annually, the gap is even more pronounced: inflows into Ethereum-focused structures account for 26% of all assets under management, whereas for digital gold, this figure is only 11%. Experts suggest this indicates a shift in institutional investor preference towards Ethereum.

Among altcoins, funds based on XRP, Solana, and Cronos stood out, attracting $25 million, $12 million, and $4.4 million, respectively. Meanwhile, investment products for Sui lost $12.9 million, and Toncoin saw a $1.5 million outflow.

Earlier, from August 9 to 15, inflows into cryptocurrency funds reached $3.75 billion, with Ethereum ETFs receiving a record $2.8 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!