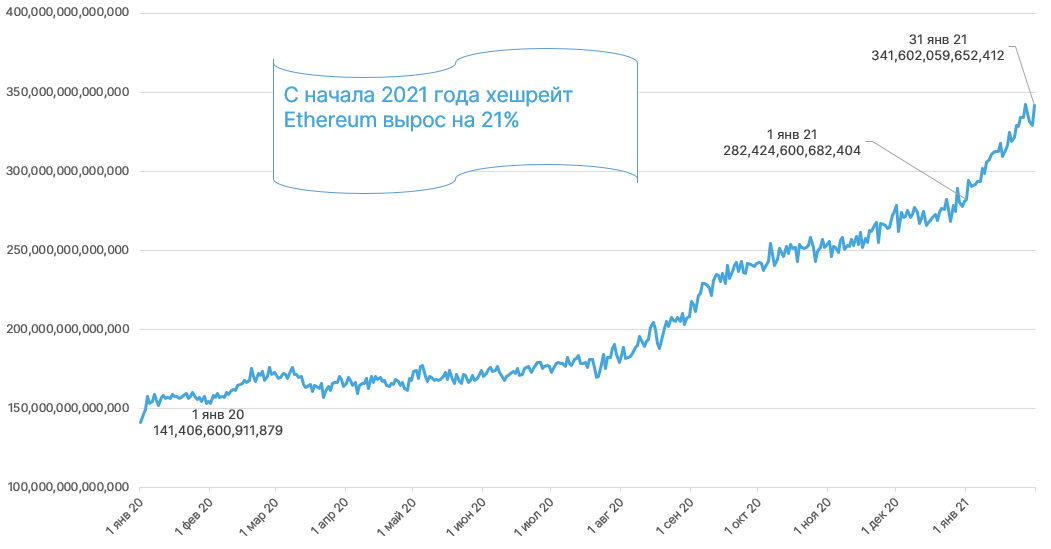

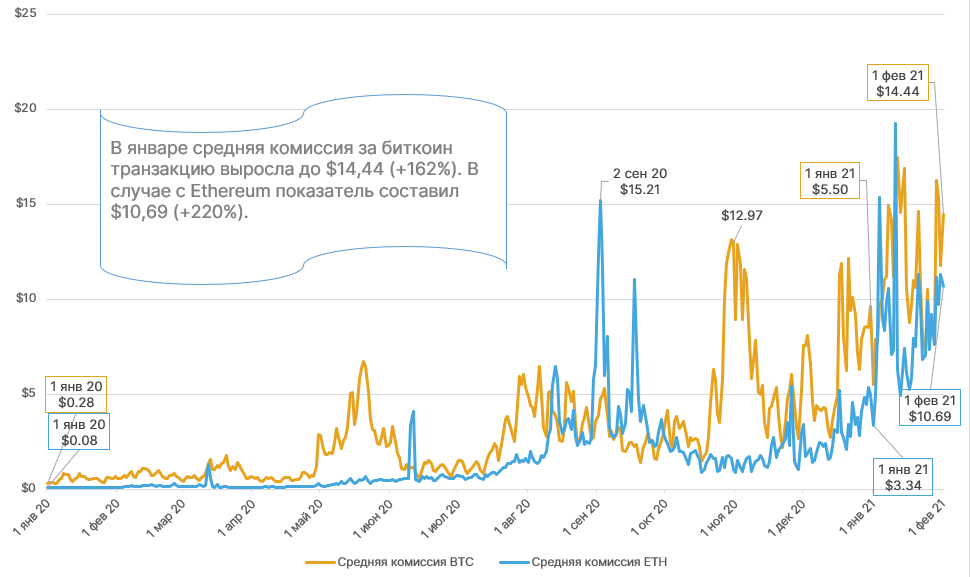

January 2021 in Numbers: Bitcoin and Ethereum Hit New Highs, Miner Revenues Reach Record Levels, and the Reddit Factor

Key Highlights

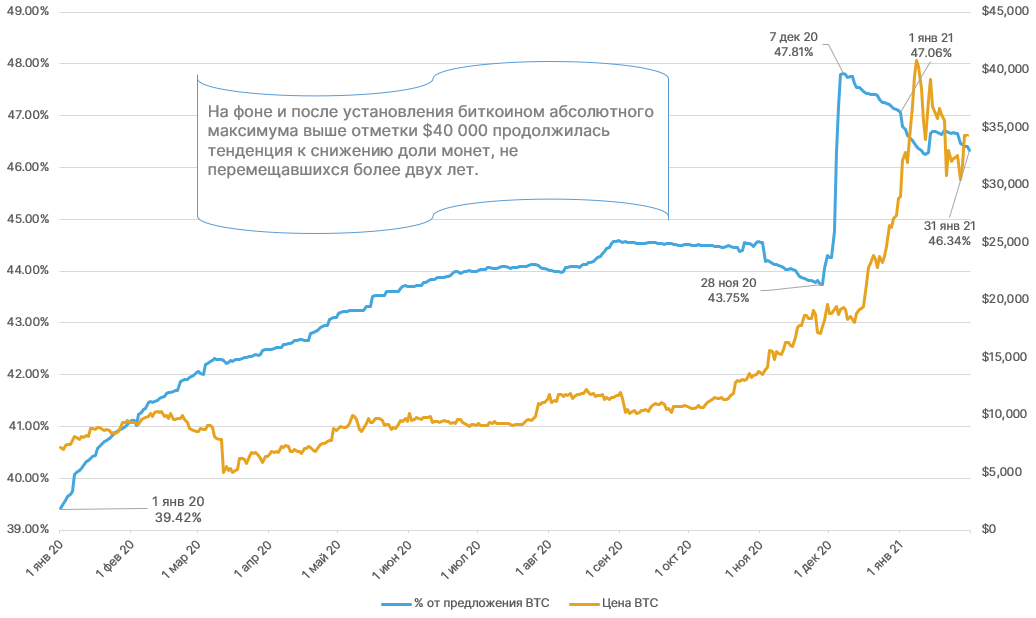

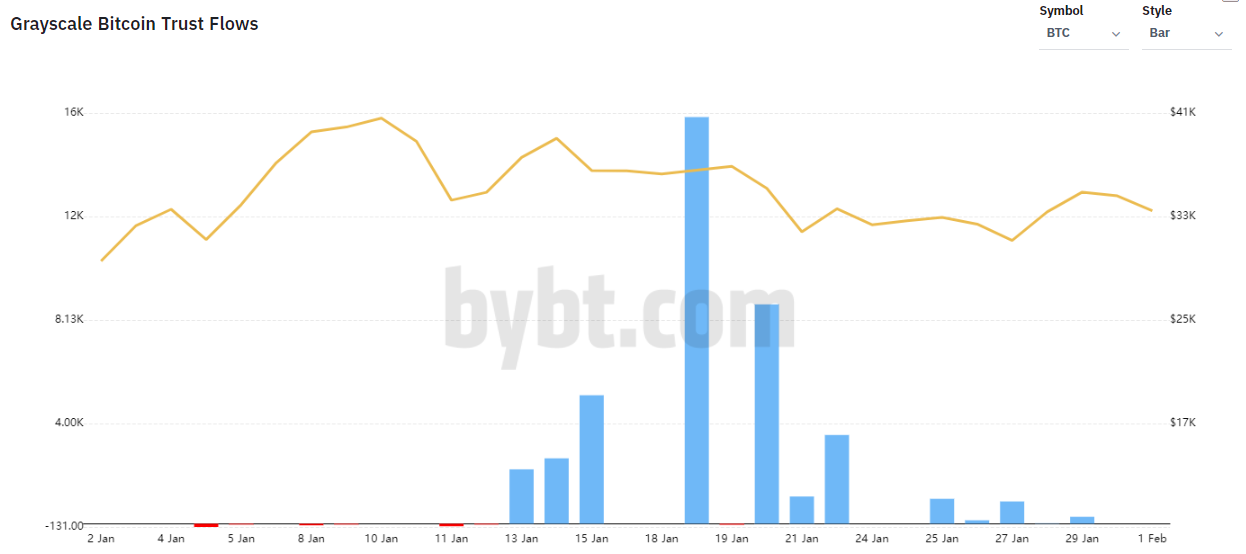

- On 8 January, Bitcoin price hit a new all-time high around $42,000.

- The cryptocurrency market cap surpassed $1 trillion for the first time.

- Ethereum posted a new all-time high above $1,430.

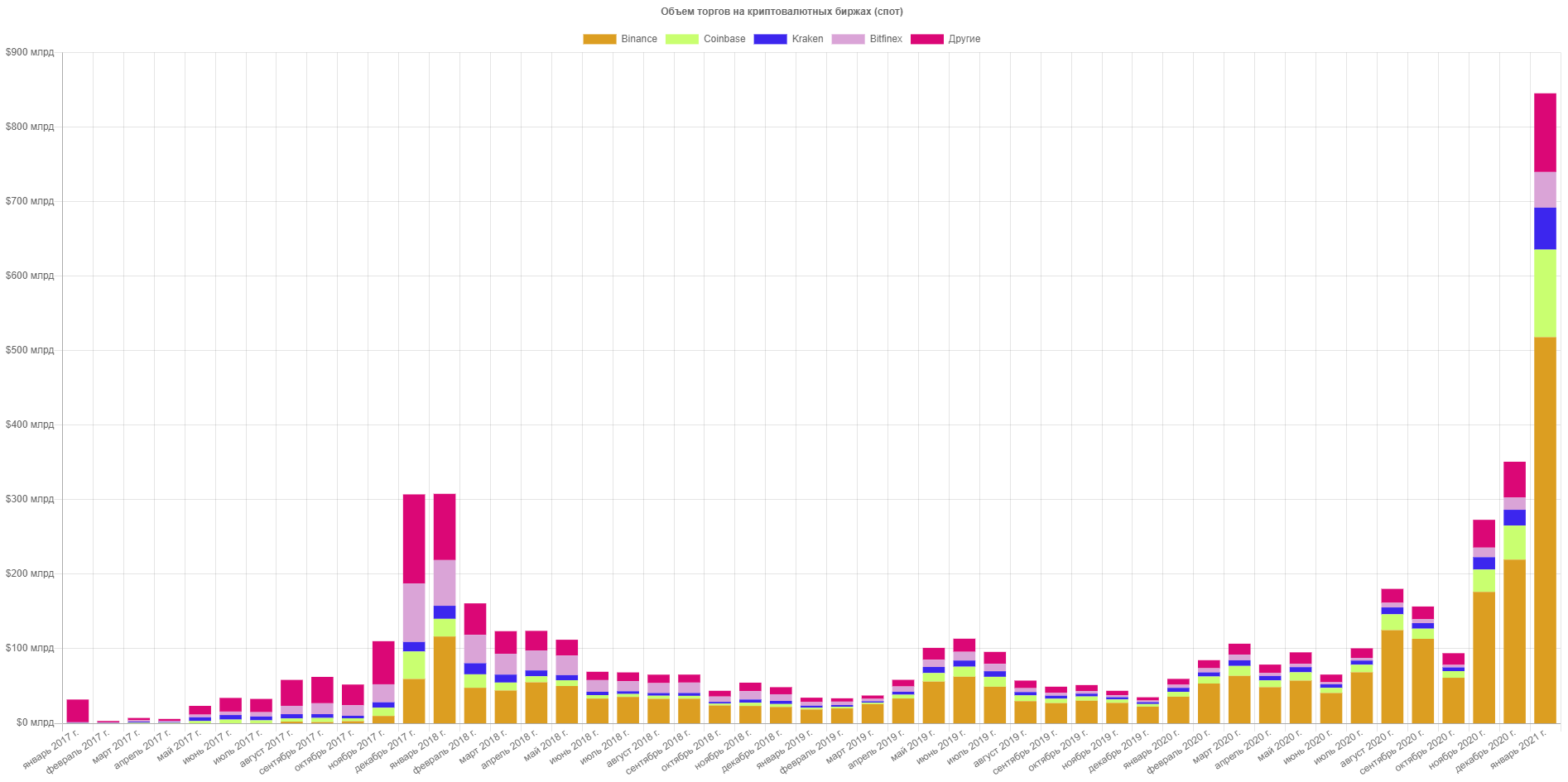

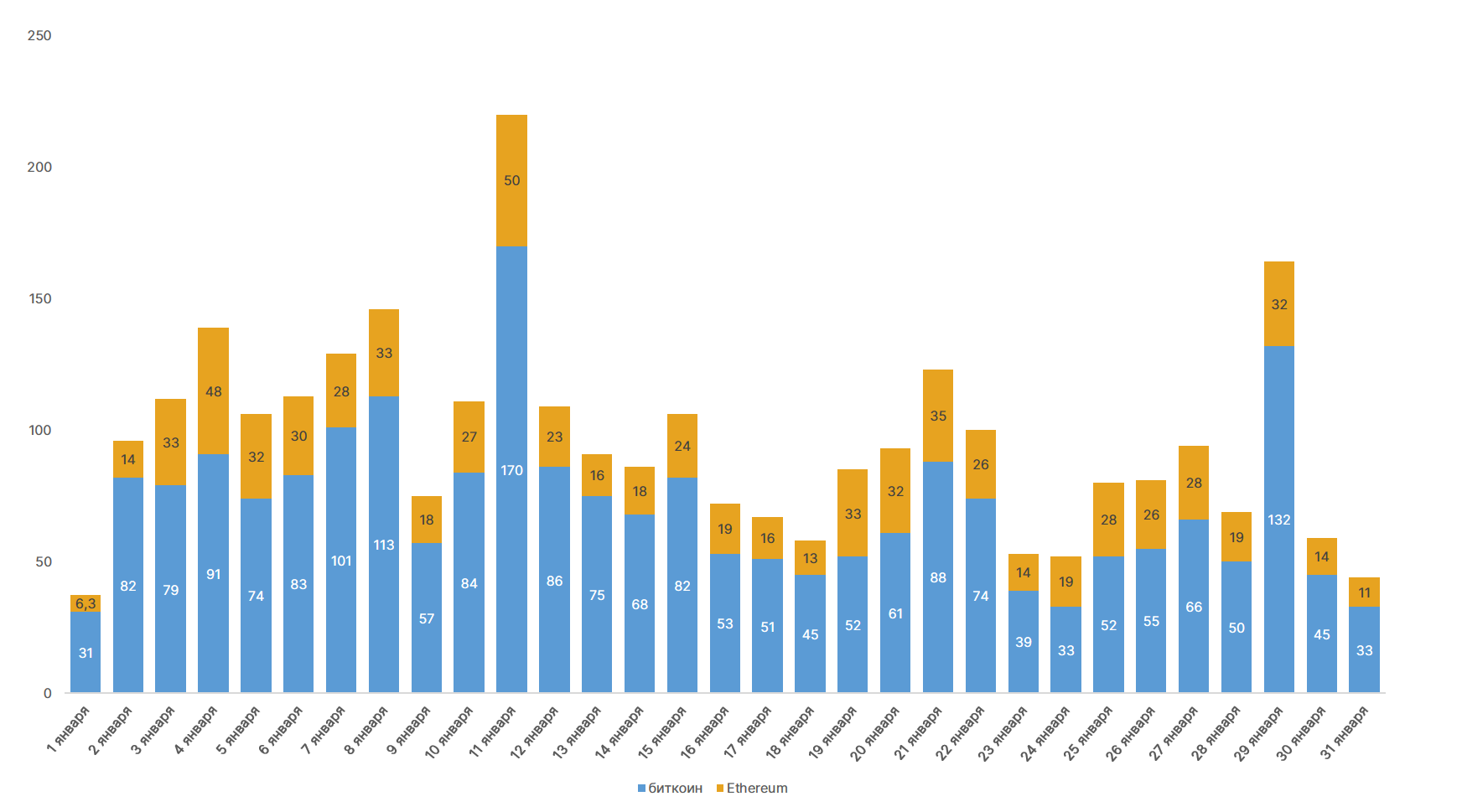

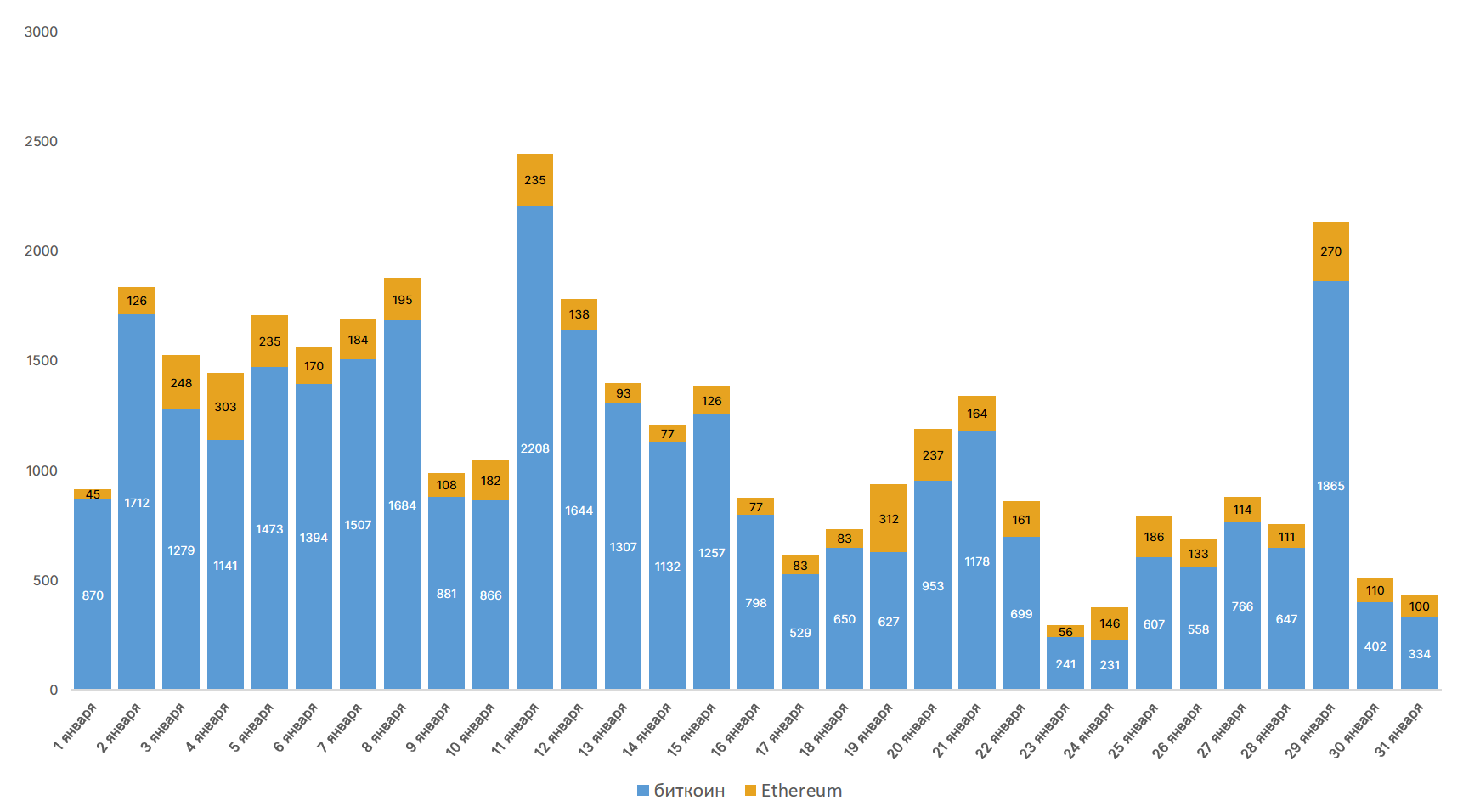

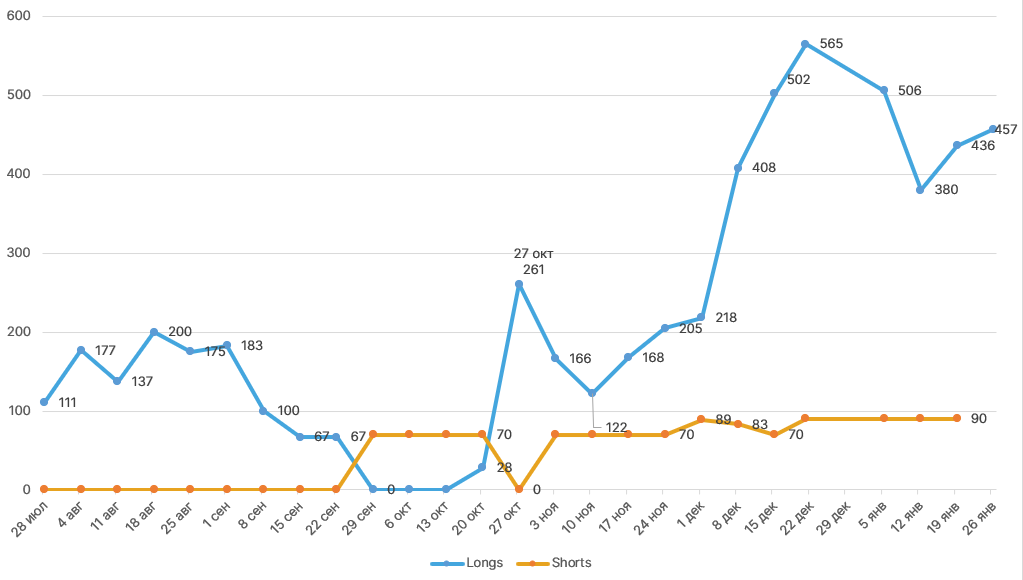

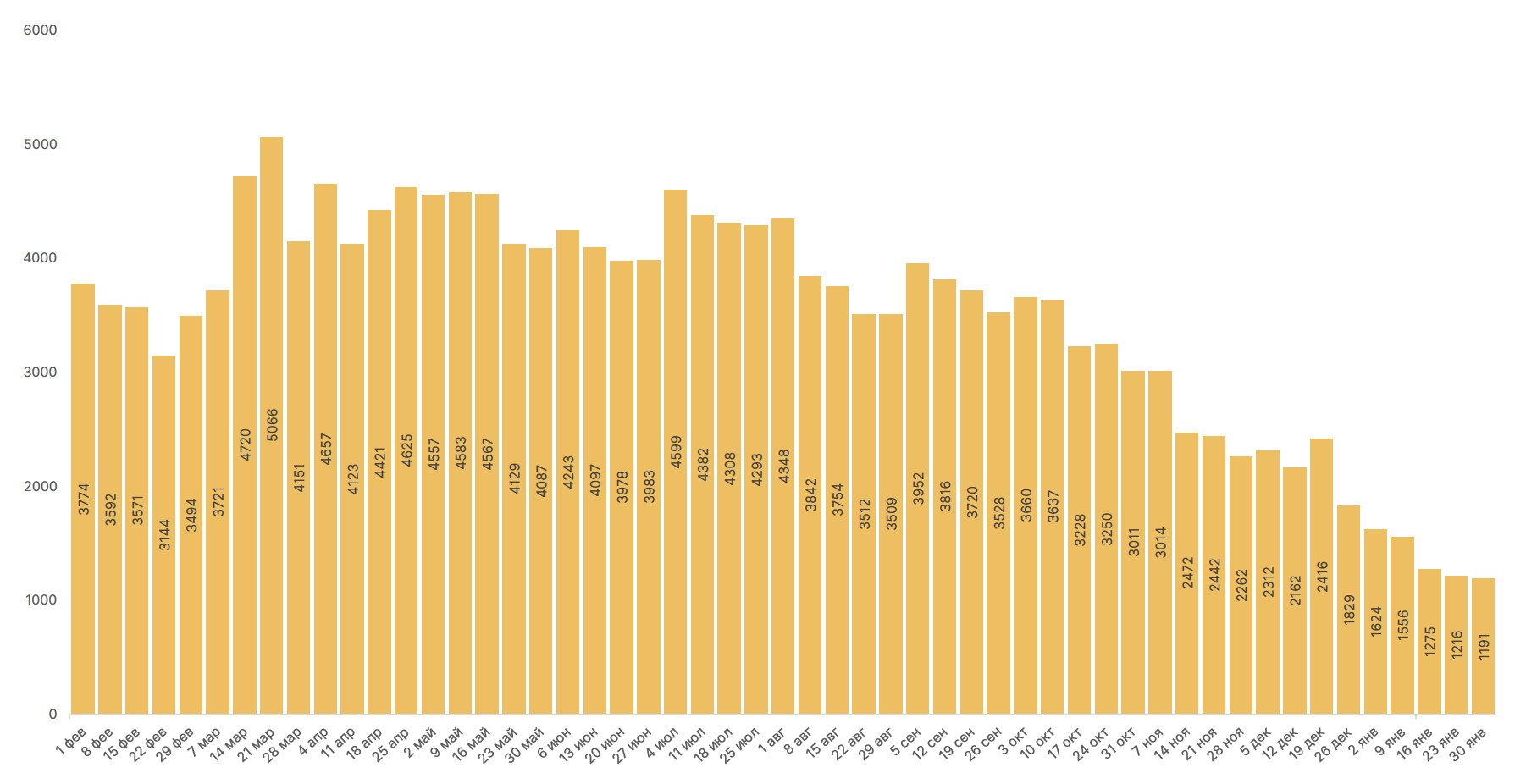

- The month proved record-breaking for spot and derivatives trading volumes.

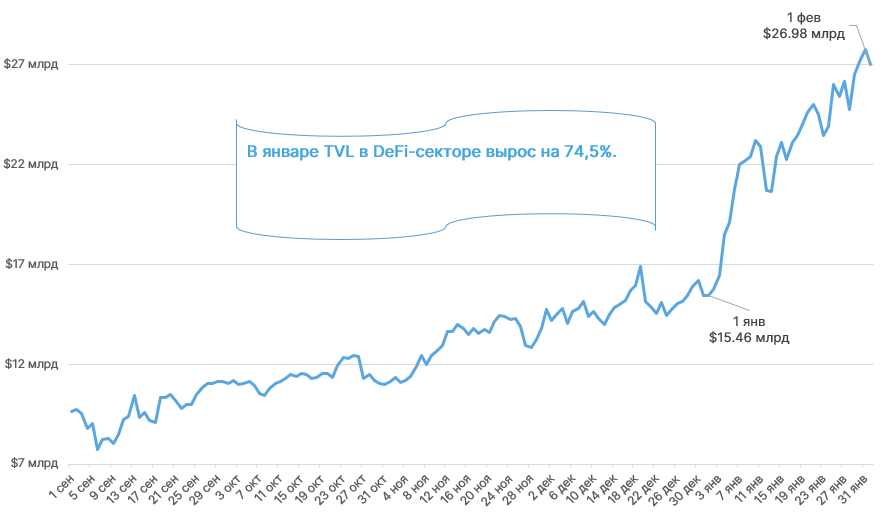

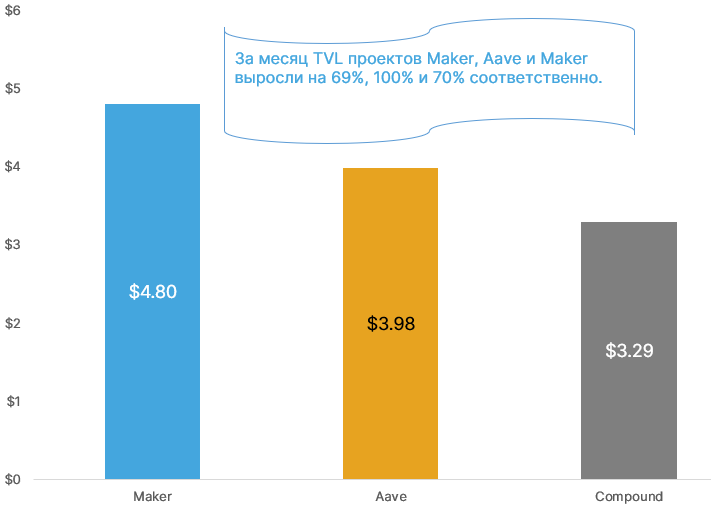

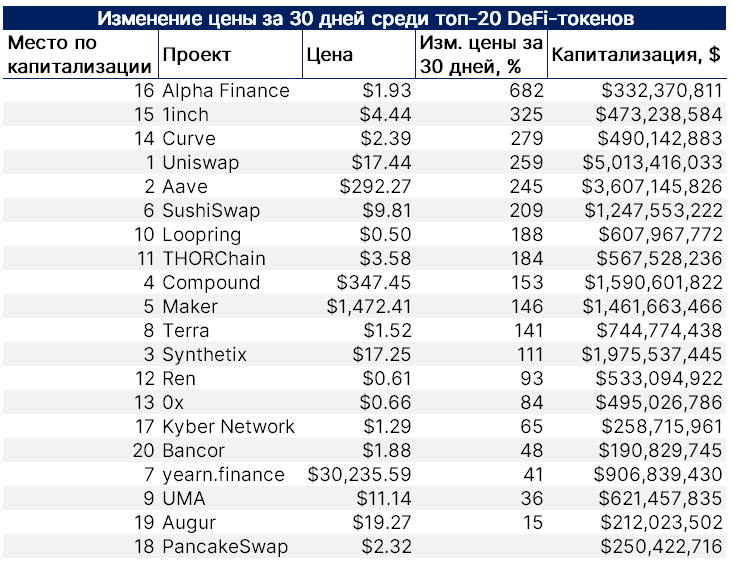

- The value of assets locked in DeFi applications approached $27 billion. Tokens such as 1inch, Curve and others surged several-fold.

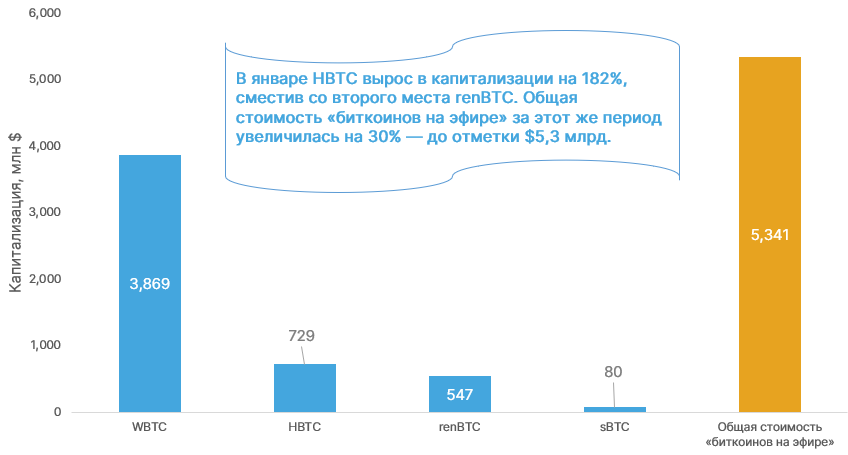

- The market capitalization of “Bitcoin on Ethereum” surpassed $5 billion.

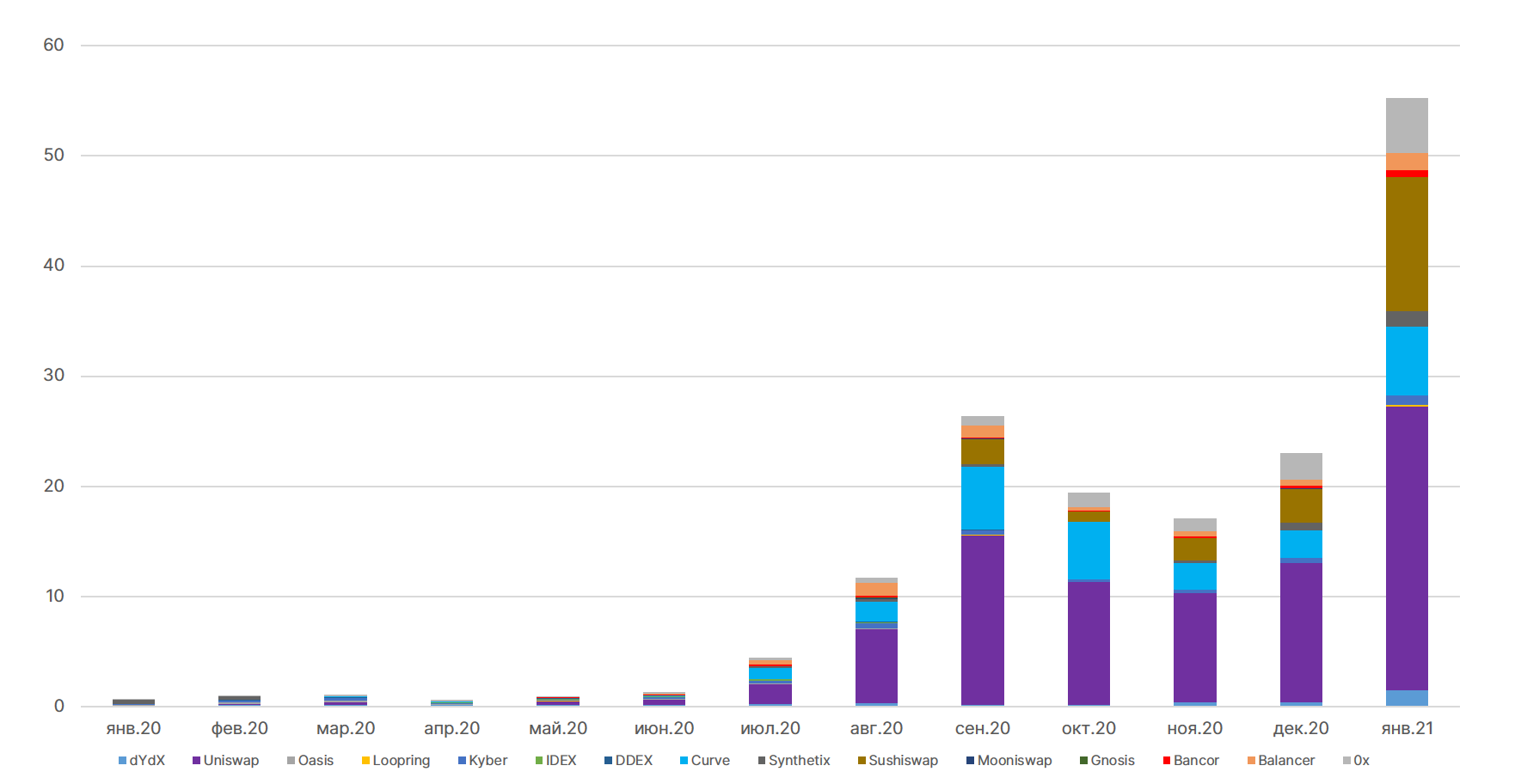

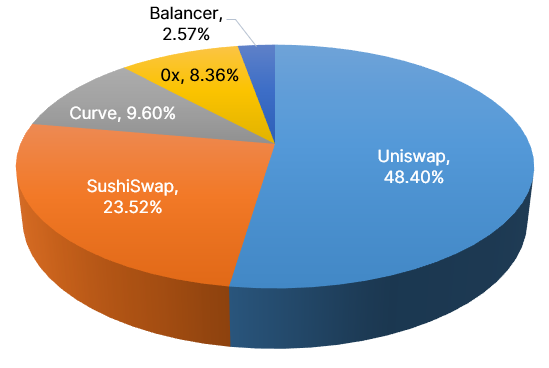

- In January, trading on decentralized exchanges (DEX) reached a record $55 billion.

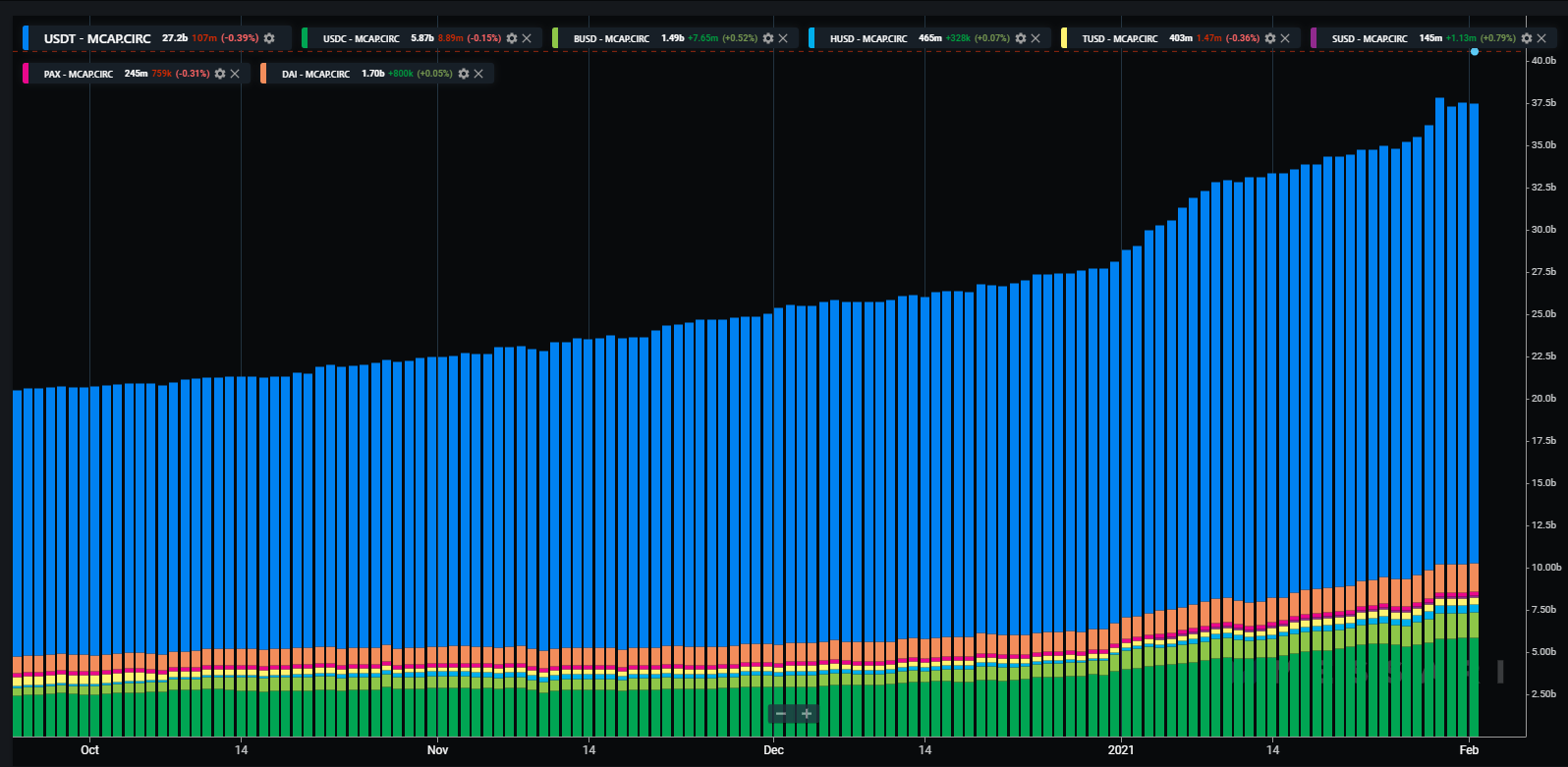

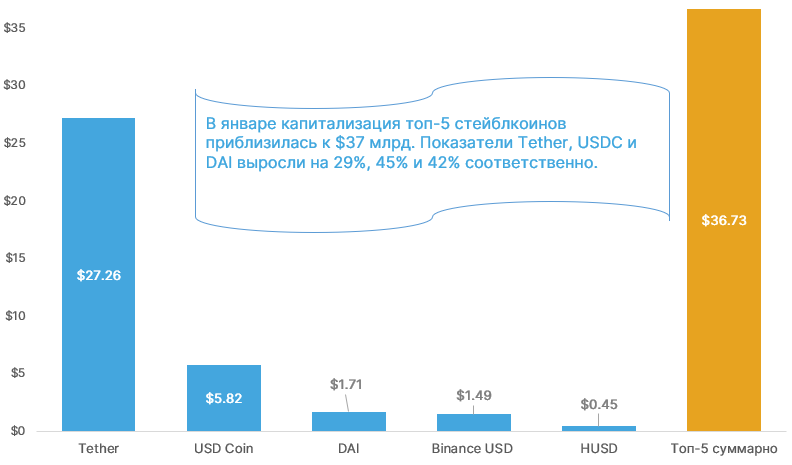

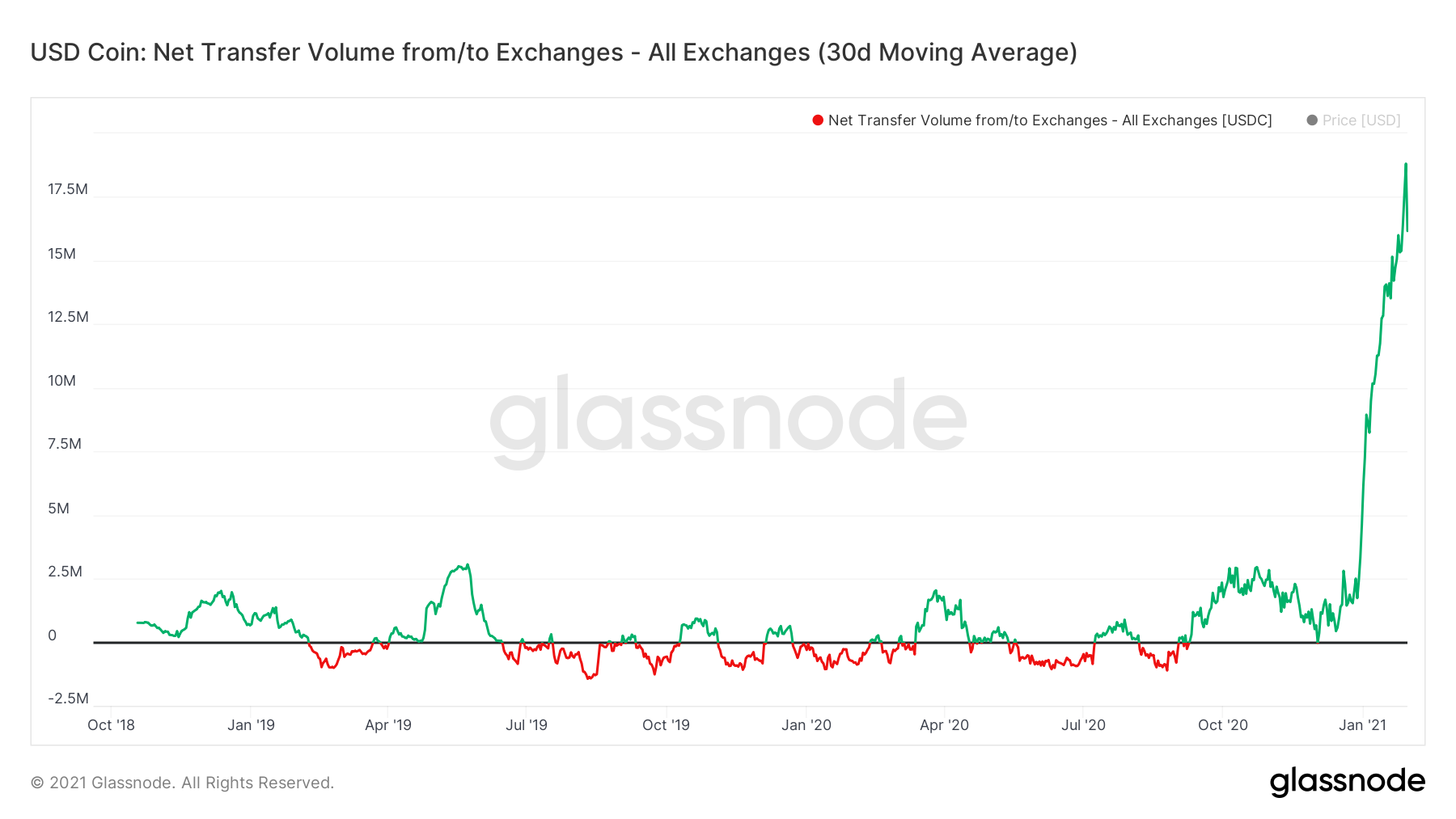

- Total market cap of stablecoins rose to $37.5 billion.

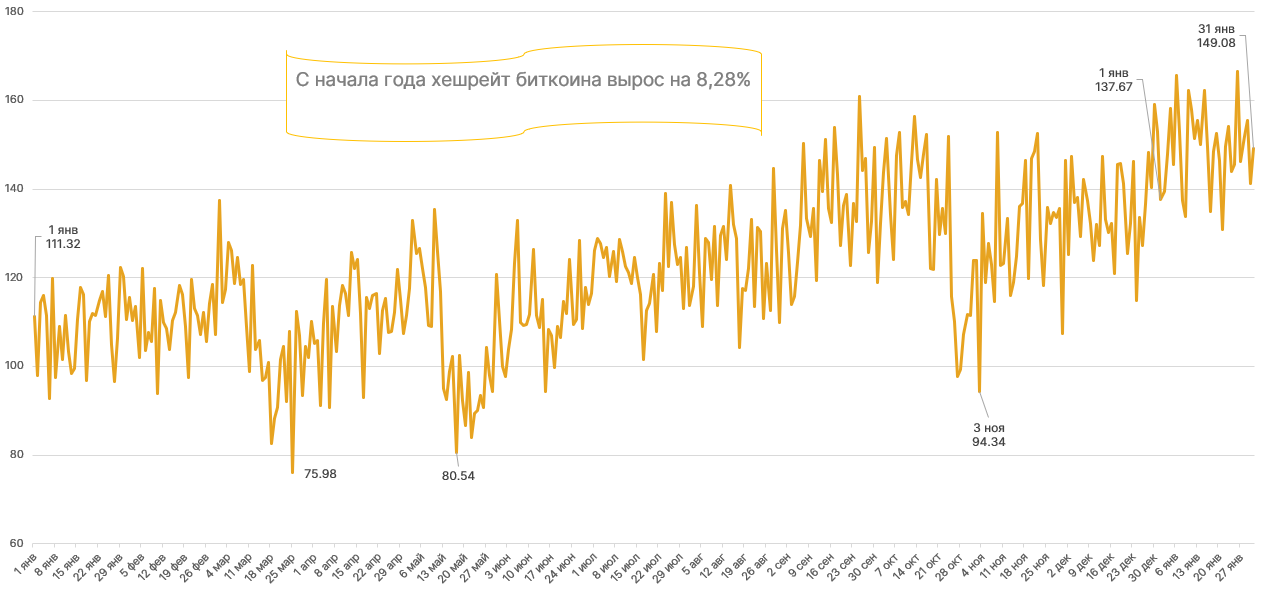

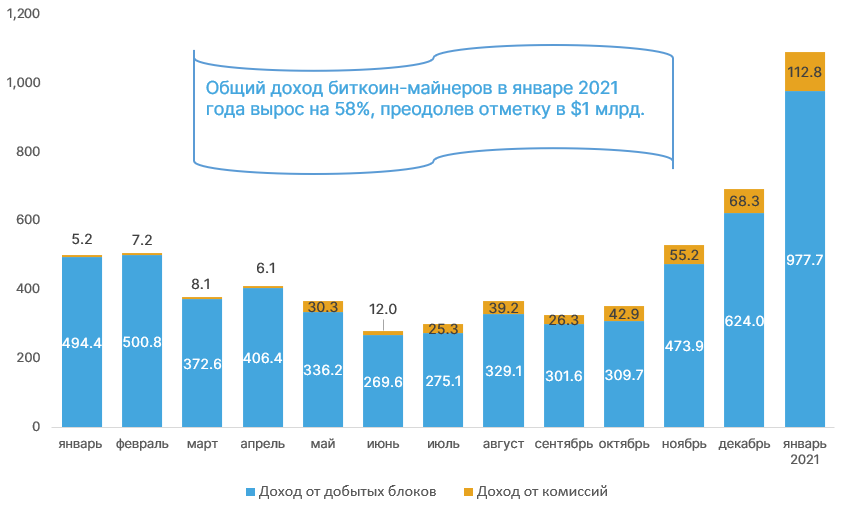

- Bitcoin miners’ revenues in January rose 58%, surpassing $1 billion — the highest since December 2017.

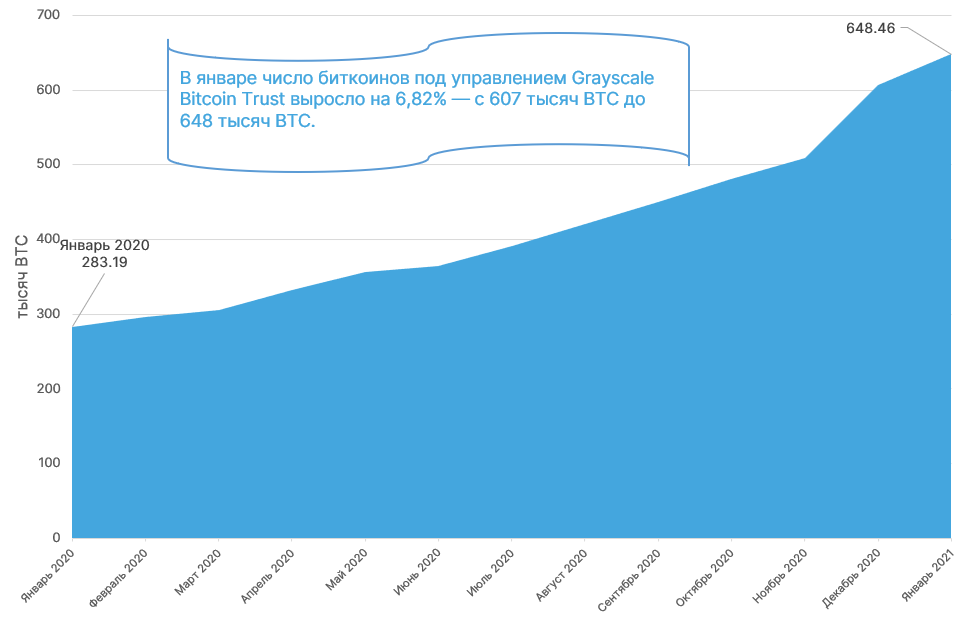

- Billionaires shifted their rhetoric on Bitcoin. Financial firms are launching Bitcoin funds aimed at big players.

- Reddit users’ battle with Wall Street spurred a rally in several stock prices. Its effects spilled over into Dogecoin and created headaches for Robinhood.

- Elon Musk described himself as a Bitcoin supporter.

Movements of Leading Assets

Daily BTC/USD chart on Bitstamp. Data: TradingView.

Daily ETH/USD chart on Bitstamp. Data: TradingView.

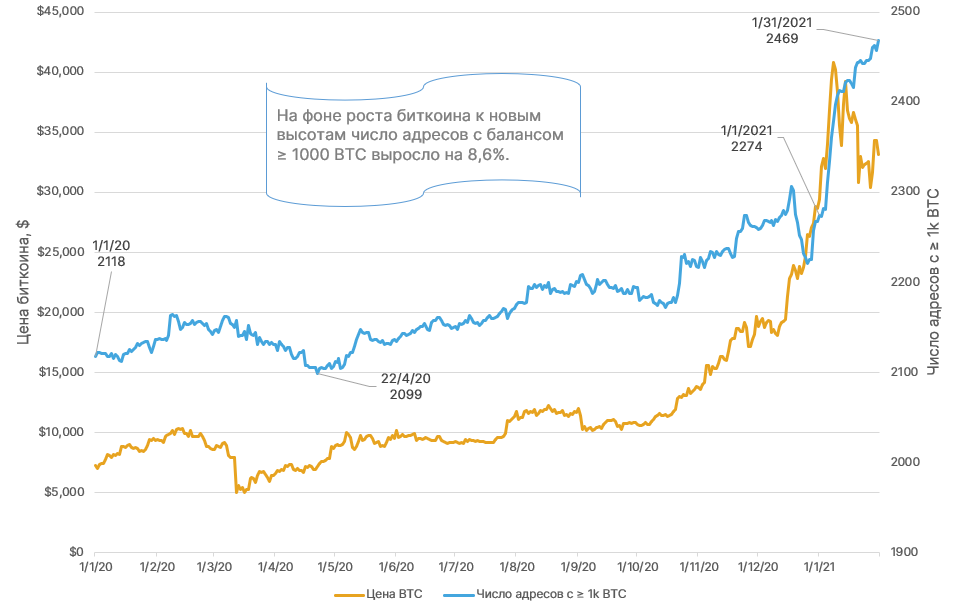

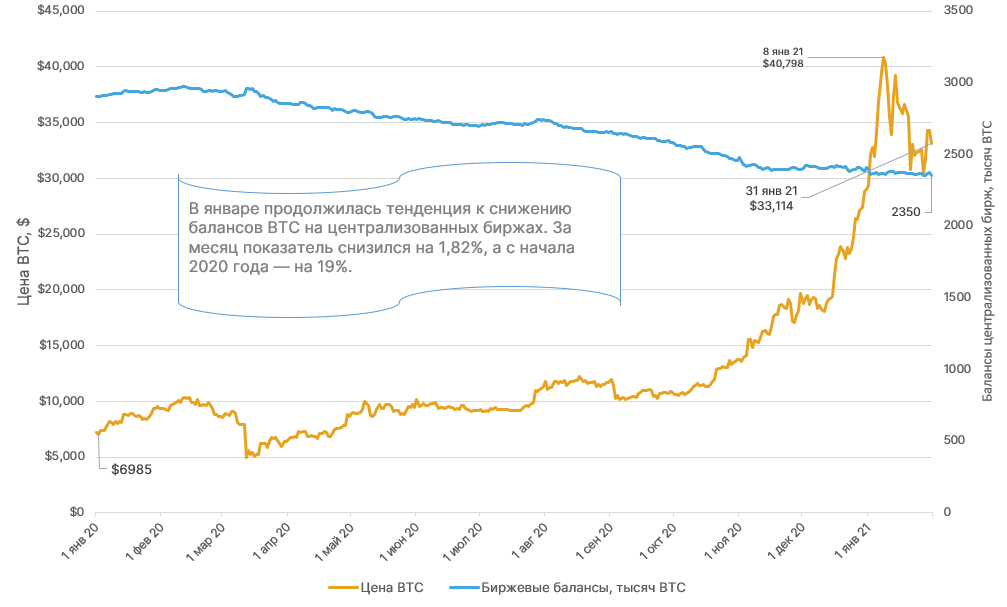

- In the first week of 2021, Bitcoin crossed the important psychological level of $30,000, having set on 8 January a new all-time high around $42,000. The rapid rise of digital gold pushed the market cap above $1 trillion. A correction followed, and the first cryptocurrency declined by about a quarter. By month-end, Bitcoin’s price was up 15%, to $32,192.

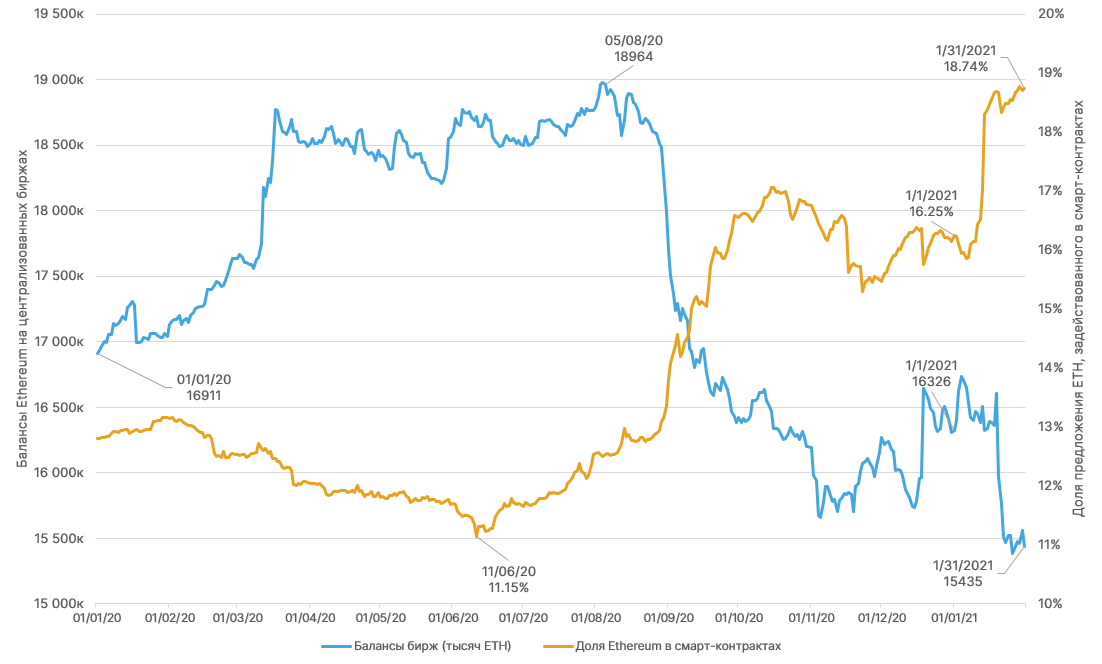

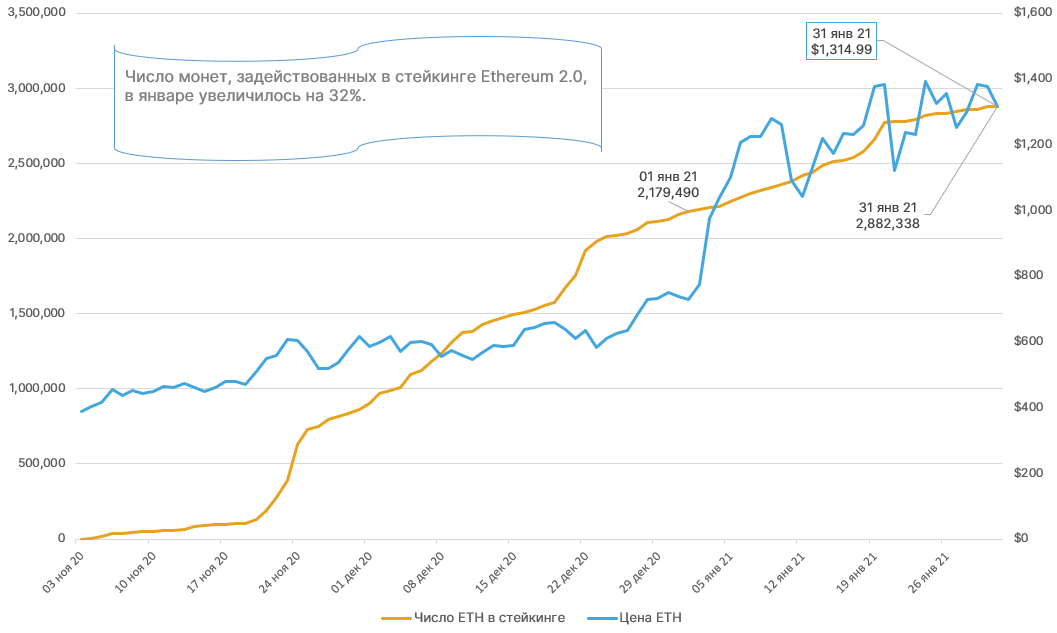

- The second-largest cryptocurrency also set an all-time high — on 19 January Ethereum traded above $1,430. During January the asset rose by 120%.

Market Sentiment and Correlations

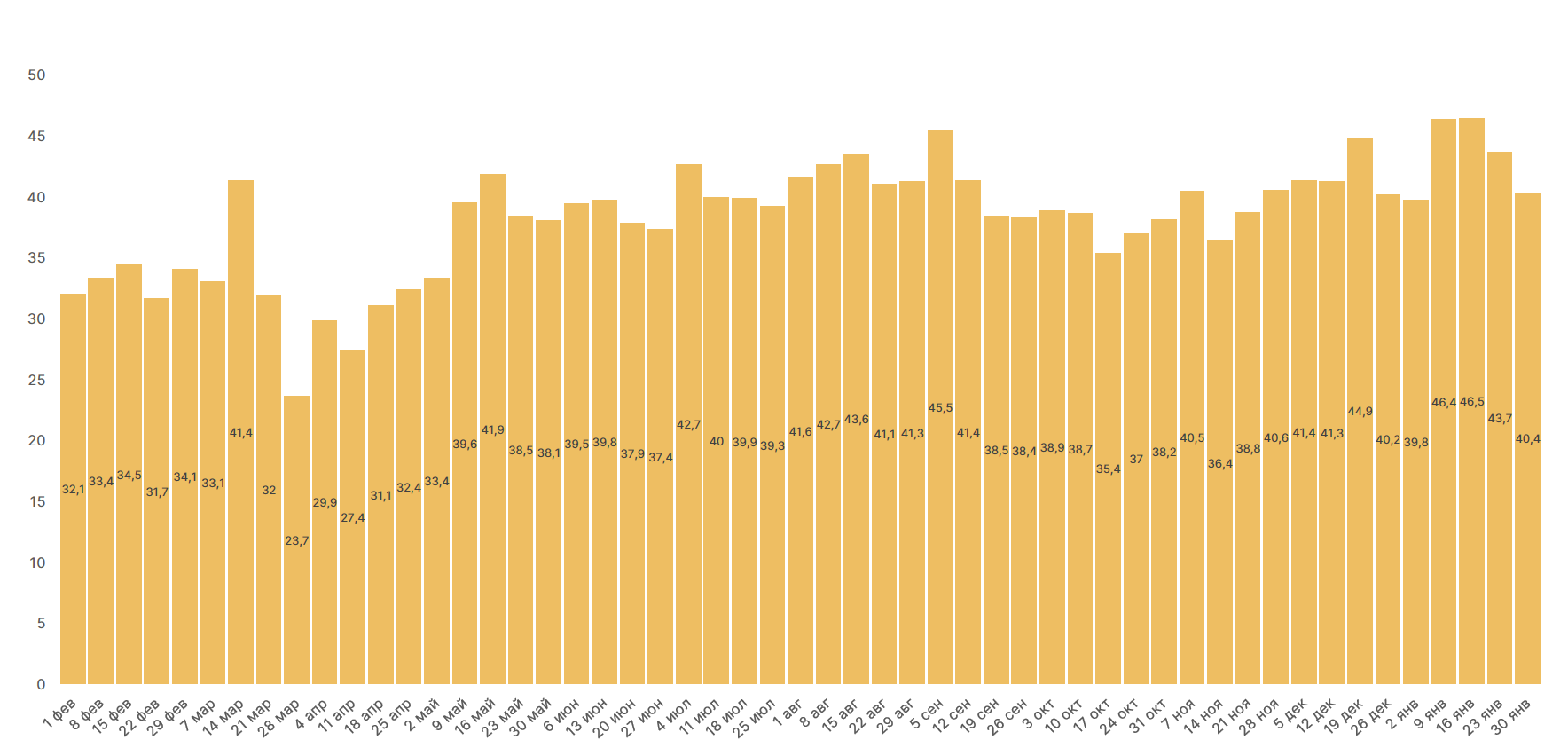

Fear and Greed Index dynamics. Data: alternative.me.

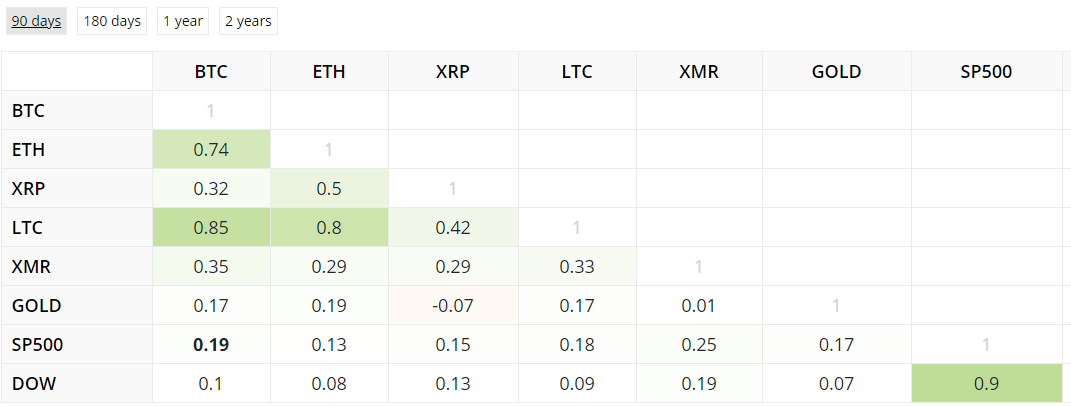

90-day asset correlation readings. Data: Blockchain Center.

- In January, correlations of Bitcoin with gold and the S&P 500 were below the 2020 averages.

- Historically, digital gold has shown a tight relationship with other Proof-of-Work assets, especially Ethereum and Litecoin, which tend to move in tandem during volatility spikes.