Joseph Lubin: Ethereum Will Surpass Bitcoin in Market Capitalization

He also predicted a 100-fold increase in the altcoin's price.

The widespread adoption of Ethereum by institutional players will lead to a 100-fold increase in the ETH price, according to ConsenSys founder Joseph Lubin.

I am 100% aligned with almost all of what Tom @fundstrat says here.

Yes, Wall Street will stake because they currently pay for their infrastructure and Ethereum will replace much of the many siloed stacks they operate on (e.g. JPMorgam probably operates on several siloed stacks… https://t.co/bW93kkX1gW

— Joseph Lubin (@ethereumJoseph) August 30, 2025

“Yes, most likely, ETH will grow 100 times from its current level. Maybe even more,” he stated.

According to him, eventually, Wall Street companies will have to switch to “decentralized rails,” replacing their isolated systems with the decentralized infrastructure of the largest altcoin. Firms will begin using staking, launching validators, managing L2 networks, and participating in DeFi.

Lubin’s comments were in response to Fundstrat managing partner Tom Lee, who noted in early August that Ethereum would surpass Bitcoin in market capitalization. The ConsenSys founder agreed with his view.

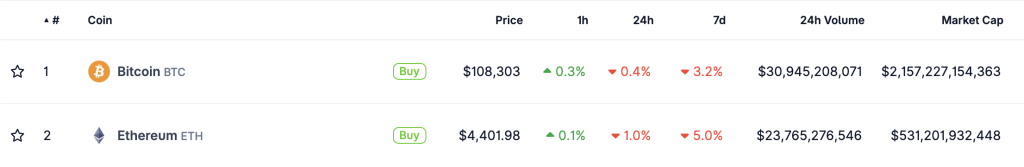

Despite optimistic forecasts, Ethereum currently lags significantly behind the leading cryptocurrency: its market value is about 25% of that of digital gold. The altcoin’s market share stands at 14.3%.

However, Lubin emphasized that even bullish statements from colleagues are “not optimistic enough.” No one can fully assess the potential of a decentralized economy based on Ethereum, he believes.

“No one can even imagine how quickly and on what scale a fully decentralized economy, combining human and machine intelligence and operating on the Ethereum platform, can grow. Trust is a new type of virtual resource. And ETH is the most powerful resource of decentralized trust, which over time will surpass all other resources in the world,” concluded the expert.

Companies Accumulate Ethereum

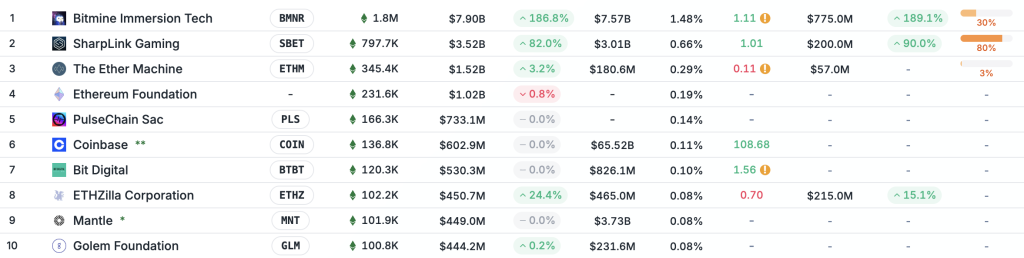

At the time of writing, corporate reserves have accumulated nearly 3.7% of the total ether supply. The largest holder is Bitmine Immersion, managing 1.8 million ETH worth $7.9 billion.

Between August 25 and 28, the firm acquired 269,300 ETH. Bitmine plans to accumulate 5% of the cryptocurrency’s issuance.

The top three holders of tokens also include SharpLink Gaming and The Ether Machine. They own 797,000 ETH ($3.5 billion) and 345,400 ETH ($1.5 billion) respectively.

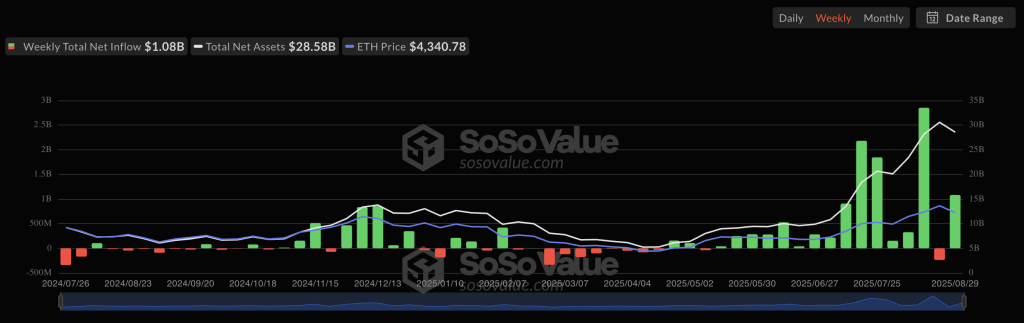

Throughout their operation, spot Ethereum ETFs have attracted 6.7 million ETH worth $29.7 billion. Net inflow from August 25 to 29 exceeded $1 billion.

At the end of August, the CEO of VanEck referred to Ethereum as “Wall Street’s token.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!