JPMorgan: Ethereum 2.0 launch will turn staking into a $40 billion industry

JPMorgan sees Ethereum 2.0 triggering a $40B staking industry.

The launch Ethereum 2.0 with the transition to the Proof-of-Stake (PoS) consensus algorithm will turn cryptocurrency staking into an industry worth $40 billion a year and attract institutional investors to it. Forbes writes, citing a JPMorgan note.

According to the financial group, staking generates about $9 billion a year for the cryptocurrency industry. In the initial quarters after the transition to Ethereum 2.0 this figure could rise to $20 billion, and by 2025—to $40 billion.

“Staking not only reduces the opportunity costs of holding cryptocurrencies, but in many cases provides substantial returns in номинальном and реальном terms. […] In fact, in the current environment of near-zero interest rates we view staking profits as an incentive for investment,” the note says.

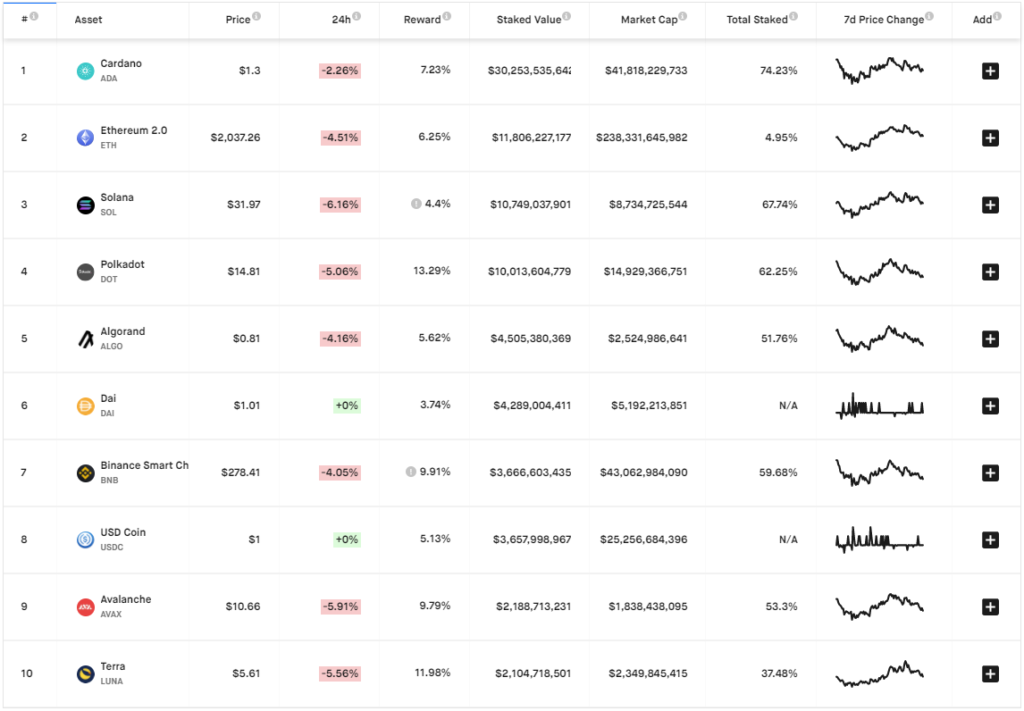

According to StakingRewards, the average staking yield of the largest Proof-of-Stake digital assets ranges from 3.74% to 13.29% per year. The lowest is the Dai stablecoin (DAI), the highest is the token of the Polkadot project (DOT).

JPMorgan believes that with lower crypto volatility, the ability to earn real returns will become an important factor that makes the market more mainstream.

Analysts expect staking to become a major source of income for intermediaries operating in the cryptocurrency industry, especially after the Ethereum 2.0 launch. They forecast that in 2022 the Bitcoin exchange Coinbase will earn about $200 million in this segment, whereas in 2020 the figure stood at $10.4 million.

JPMorgan estimates the current market capitalization of PoS tokens at more than $150 billion.

According to Staked’s January report, in 2020 crypto investors earned more than $20 billion for validating transactions on PoS-based blockchains.

Earlier, JPMorgan said that after the May market correction institutional interest in Bitcoin had waned and even turned negative.

Follow ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!