JPMorgan Highlights Risks to Industry from Tether’s Dominance

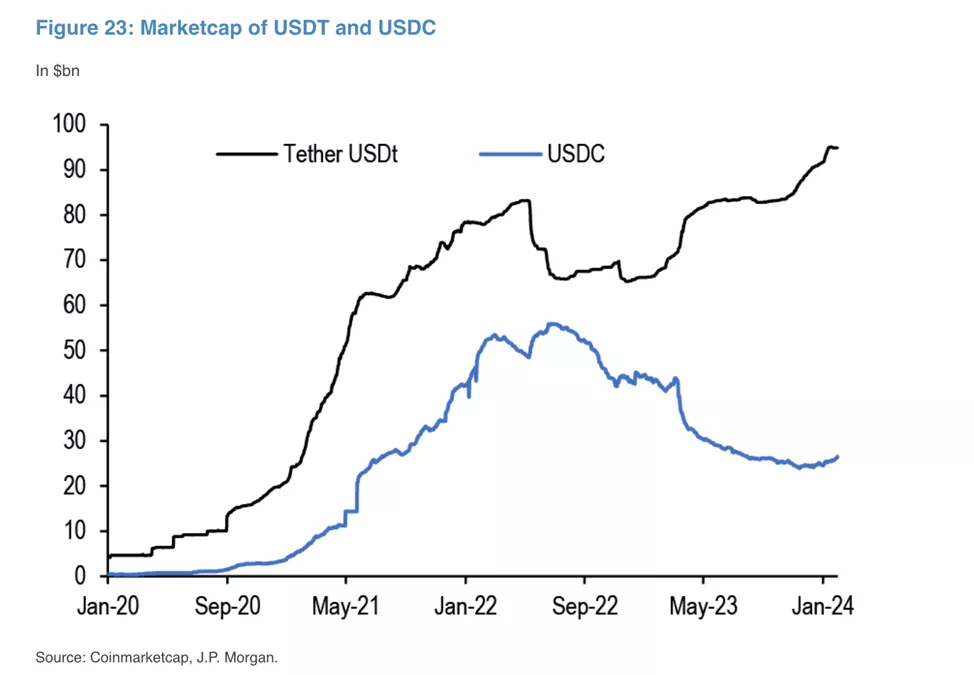

The increasing dominance of Tether poses a negative factor for the stablecoin market and the broader crypto ecosystem, according to analysts at JPMorgan, reports The Block.

“Tether is at risk due to a lack of regulatory compliance and transparency,” the report states.

Experts noted the US Congress’s consideration of the Stablecoin Transparency Act and the establishment of regulatory frameworks for stablecoins in other jurisdictions. In particular, partial implementation of MiCA is expected in the EU in June.

According to analysts, stablecoin issuers that strictly adhere to existing rules will benefit from upcoming regulatory oversight and potentially increase their market share.

“I am pleased to see JPMorgan acknowledge the importance of Tether and the stablecoin technology created by the company. However, I find it somewhat hypocritical to hear concerns about concentration from JPMorgan, the largest bank in the world,” commented Paolo Ardoino, CEO of the USDT issuer.

According to him, Tether’s success is due to its financial reliability, significant reserves, and commitment to developing economies where entire communities use USDT as a “lifeline” to protect their families from high inflation and currency devaluation.

JPMorgan also noted Circle’s filing for an IPO. Experts see this initiative as an intention to pursue international expansion and prepare for upcoming sector regulation.

In the fourth quarter, Tether achieved a record net profit of $2.9 billion.

Since December 1, 2023, the issuer has been freezing wallets linked to the SDN list of the US Treasury’s Office of Foreign Assets Control. The company also highlighted its assistance to agencies like the Department of Justice, Secret Service, and FBI.

Previously, Tether expressed disappointment with the UN’s assessment of USDT’s use in illegal activities and the disregard for the asset’s role in developing economies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!