JPMorgan Introduces Tokenized Money Market Fund on Ethereum

JPMorgan unveils its first tokenized money market fund on Ethereum.

Banking giant JPMorgan has unveiled its first tokenized money market fund (MMF) based on Ethereum.

The product, My OnChain Net Yield Fund, with the ticker MONY, is issued through the bank’s proprietary platform, Kinexys Digital Assets. It is structured as a private placement fund 506(c) and targets qualified investors. These investors can subscribe to it via the institutional platform Morgan Money to earn income in US dollars.

“There is tremendous client interest in tokenization. We aim to be leaders in this field and work with clients to build a product lineup that offers them the same choice on blockchain as they have in traditional money market funds,” commented John Donovan, head of the liquidity division at JPMorgan Asset Management, in an interview with WSJ.

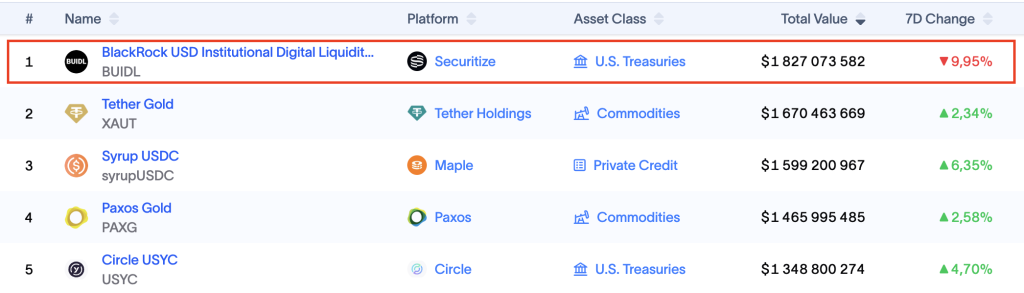

The release of MONY makes JPMorgan the first globally significant bank to issue an MMF on a public blockchain. The leader in this sector is BlackRock with BUIDL, managing $1.8 billion.

In July, American financial giants Goldman Sachs and BNY announced the launch of tokenized funds.

JPMorgan is increasing its activity in the blockchain sector. In November, the bank issued the JPMD deposit coin for institutional clients on the L2 network Base. In December, the company conducted a $50 million transaction on the Solana network for Galaxy Digital.

Digital Bonds on a Private Blockchain

Qatar’s Doha Bank has executed the primary issuance of a $150 million digital bond. It was listed on the London Stock Exchange. Settlement was carried out through the private blockchain platform Euroclear — Digital Financial Market Infrastructure.

Standard Chartered acted as the sole coordinator and underwriter.

“Doha Bank’s debut digital bond issuance highlights the tangible, real efficiency that advanced digital infrastructure brings to capital markets, as well as the growing demand from our clients for next-generation opportunities and execution,” said Salman Ansari, global head of the capital markets division at Doha Bank.

The key feature of Euroclear is its focus on the regulated market. Unlike public blockchains, this system is designed from the outset to operate within strict legal and financial frameworks. It provides:

- controlled access for approved participants;

- legal finality of transactions;

- direct integration with traditional custody and settlement systems.

A similar platform is available from British bank HSBC — Orion. It has already been used for issuing corporate digital bonds in key jurisdictions in Asia and the Middle East.

At the end of November, the Bank for International Settlements warned of the risks of tokenization for the entire financial system.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!