JPMorgan Suggests Crypto Market Sell-off May Be Ending

Signs suggest the crypto market sell-off may be ending, say JPMorgan analysts.

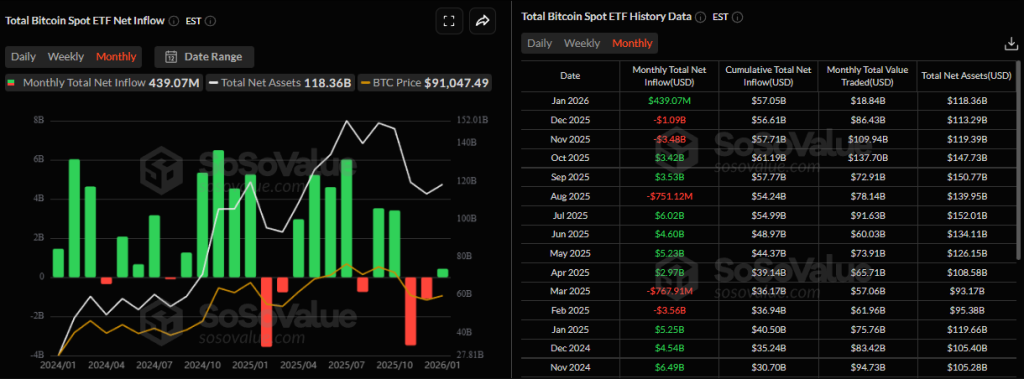

There are increasing signs in the crypto market indicating the end of the sell-off, including the stabilization of outflows from ETFs. This was stated by analysts at JPMorgan, as reported by CoinDesk.

“Signs of a bottom in January are also observed in other crypto indicators related to perpetual futures and positions on the Chicago Mercantile Exchange,” the experts noted.

Researchers highlighted the divergence in the dynamics of equity funds and crypto ETFs in December 2025. The former attracted $235 billion, while the latter lost more than $1 billion.

However, data from January indicates a reduction in selling pressure and stabilization of inflows into bitcoin and Ethereum exchange-traded products.

According to JPMorgan analysts, the preliminary recovery is supported by MSCI’s decision not to exclude the leading cryptocurrency and DAT companies from its global stock indices during the review in February 2026.

The bank also pointed out misconceptions regarding the reduction of liquidity in the crypto market. According to the report, the indicators were within normal ranges even during the correction, and the negative trend was mainly driven by investors’ panic.

Experts concluded that the majority of the cryptocurrency sell-off is “already behind us.” Current factors suggest a possible bottoming out rather than the start of a new decline phase.

Earlier, co-founder of the trading resource Material Indicators, Keith Alan, stated that during 2026, the leading cryptocurrency is unlikely to reach a new all-time high.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!