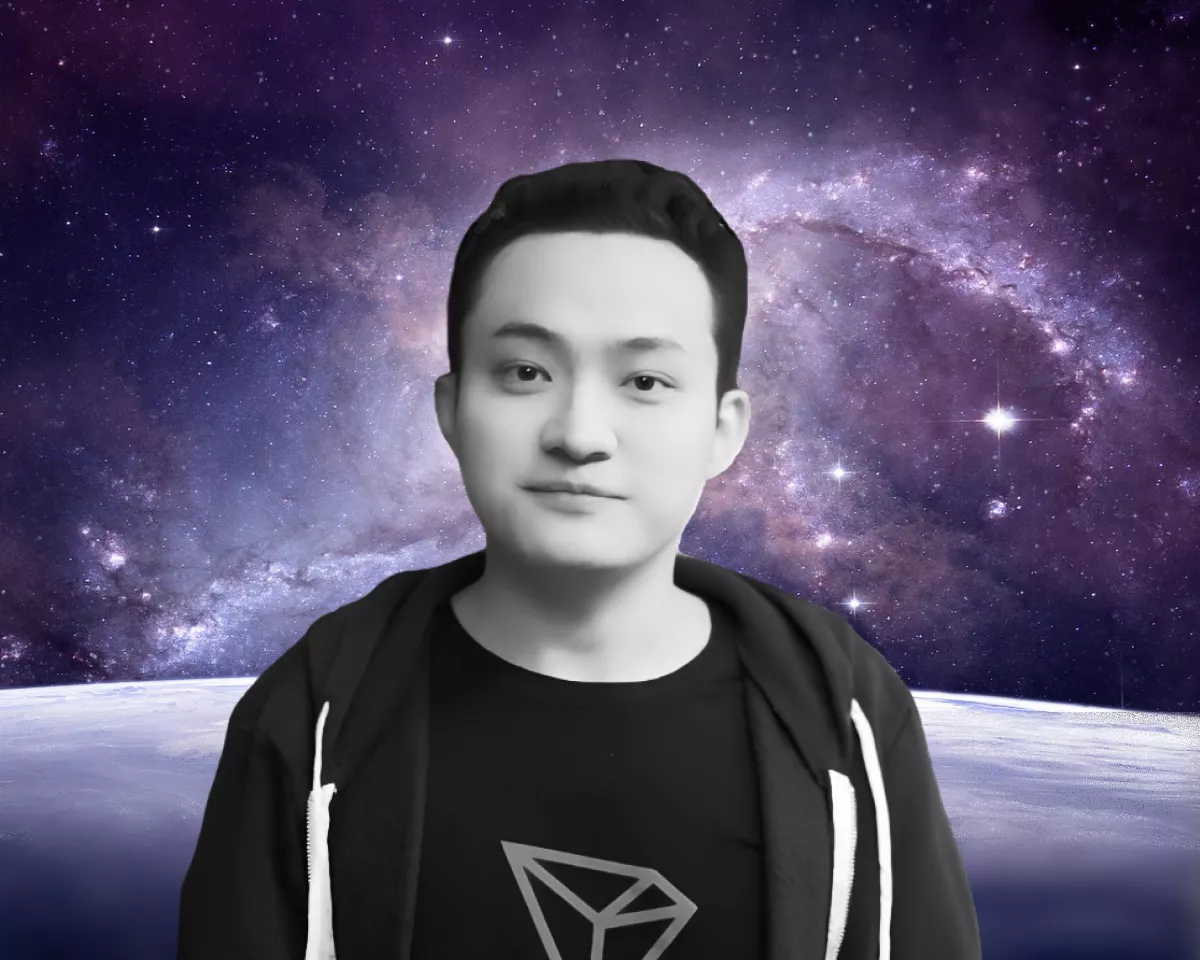

Justin Sun and his team: How TRON became Ethereum’s chief rival

The TRON (TRX) project began as a token issued on Ethereum before moving to its own blockchain. In an ICO in 2017, the TRON Foundation raised 15,200 bitcoin, selling 40bn TRX at 0.00000038 BTC apiece.

From the outset the project embraced the era’s favourite narrative, styling itself an “Ethereum killer” while being based on Ethereum’s own codebase. It went so far that Vitalik Buterin publicly accused TRON founder Justin Sun of plagiarism.

Despite a torrent of criticism directed at the platform and its founder, the project ranks among the most active in crypto, rivaling even Ethereum. Oleg Cash Coin examines how Sun’s team pulled it off.

TRON revenues

In 2024 the aggregate revenue earned by participants securing TRON’s consensus surpassed that of the second-largest cryptocurrency: since May the figure has not fallen below $140m a month. For comparison, over the same period Ethereum brought its validators no more than $140m per month.

ETH’s financial metrics are highly volatile, swinging by 40–60% in either direction, whereas TRON has shown a steady upward trend.

In September the TRX network out-earned ETH by a factor of three, making $198.5m versus $65.3m. A similar stagnation in beneficiaries’ revenues is observed across Ethereum’s layer-2s.

If the trend persists, TRON could become the leading blockchain by revenue. As of early October 2024, Ethereum’s cumulative revenue stood at $1.56bn versus TRON’s $1.36bn. The two networks appear to be the principal rivals in the altcoin market—at least in 2024.

TRON’s business model

Among the top 20 projects by market capitalisation, Sun’s brainchild was the third-best performer after SUI and XRP in Q3 2024, rising 21%.

Over the same period many coins shed double digits: Ethereum and Toncoin fell by more than 20%. TRX is one of the few cryptocurrencies trading near its all-time highs from both 2018 and 2021—around $0.15–$0.16 per coin.

This may be linked to the expansion of TRON’s user base, evidenced by several statistics. Daily transactions grew from roughly 4m at the start of the year to 8m by late September. According to Tronscan, daily active accounts over the same period rose about 60% to 2.7m.

These observations are reinforced by the pace of new account creation: the number of new daily accounts also increased by around 40% over the period, reaching 240,000.

Roughly 35% of transactional activity is generated by USDT transfers. Despite attempts to lure USDT users back to Ethereum, nearly 75% of transactions in the largest stablecoin occur on TRON.

Notably, the largest number of new USDT users have come to Sun’s project. Since the start of 2024 roughly 400,000 weekly new users of the stablecoin have turned to the TRON network.

DeFi on TRON

The standard metric for assessing smart-contract networks and decentralised finance (DeFi) applications is total value locked (TVL).

Unlike its rivals, TRX ranks second by TVL among all networks, with $7.85bn, yet its ecosystem counts just 29 projects. Almost 100% of the TVL sits in three of them (JustLend, JustStables and SUN).

JustLend, the largest lending protocol, has $5.5bn in TVL, 50% of which is wrapped BTC and only 25% TRX. That suggests TRON DeFi consists of roughly 30% bitcoin, with the rest mostly in its native token. USDT has no meaningful share, yet remains the most used asset after the native coin.

It is plausible that such a high share of bitcoin in the ecosystem stems from the TRON Foundation itself, which conducted its 2017 ICO by raising BTC rather than ETH, as was customary then. Consequently, it may still hold the leading cryptocurrency.

Conclusions

Despite early scepticism, TRON has seized one of the most sought-after niches in crypto—USDT. This has enabled a revenue stream not from TRX price gains, DeFi or NFTs, but from using the stablecoin as a fiat transfer rail. This circumstance makes TRON one of the most observed blockchains by regulators in 2024.

At the same time, it became known that the leading blockchain analytics firm TRM Labs began publicly cooperating with Tether and TRON. They established the T3 Financial Crime Unit (T3 FCU), an alliance to combat financial crime. According to the participants, the initiative is aimed at curbing the illegal use of USDT.

Meanwhile, TRM Labs CEO Esteban Castaño said the company has worked with TRON since 2019, and Sun’s team has long funded monitoring tools.

Thus, the TRON blockchain is no longer a grey zone for shadow operations, but seeks to meet regulators’ standards.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!