K33 Analysts Detect Late Bear Phase Signals in Bitcoin

K33 analysts see late bear phase signals in Bitcoin, resembling 2022's market.

The current state of the cryptocurrency market resembles the final stages of the 2022 bear phase, according to analysts at K33.

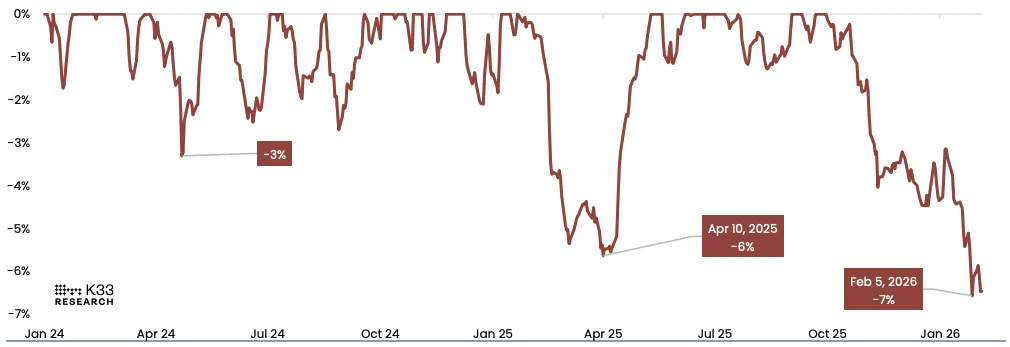

Vetle Lunde, the head of research at the firm, shared data from his proprietary market regime indicator. This tool analyses key metrics: derivatives yield, open interest, ETF flows, and macroeconomic signals such as the US yield curve.

The results showed a “striking similarity” to the situation in September and November 2022, when the market was near a global low.

Historically, such a regime has not indicated a quick reversal but rather a local minimum, followed by extended periods of weak price dynamics.

Since the beginning of January, Bitcoin has lost about 28%. Derivatives indicators point to defensive positioning. Funding rates have remained negative for more than 11 consecutive days, and open interest in futures has fallen below 260,000 BTC.

This situation, combined with reduced leverage, decreases the short-term risk of derivative-induced “squeezes,” Lunde added.

He expects digital gold to trade in the $60,000-$75,000 range for an extended period. The analyst described current entry levels as attractive but emphasized the need for patience. Historically, such regimes have yielded an average return of about 3% over 90 days.

At the time of writing, Bitcoin’s price stands at $68,000.

Institutional Behavior and Sentiment

Institutional traders on the CME remain largely inactive. Meanwhile, Bitcoin ETFs have recorded a record net outflow: investors have withdrawn 103,113 BTC from October peaks.

However, despite the negative dynamics, about 93% of the peak volume remains in the funds. This indicates that major players have reduced positions but have not exited the asset entirely.

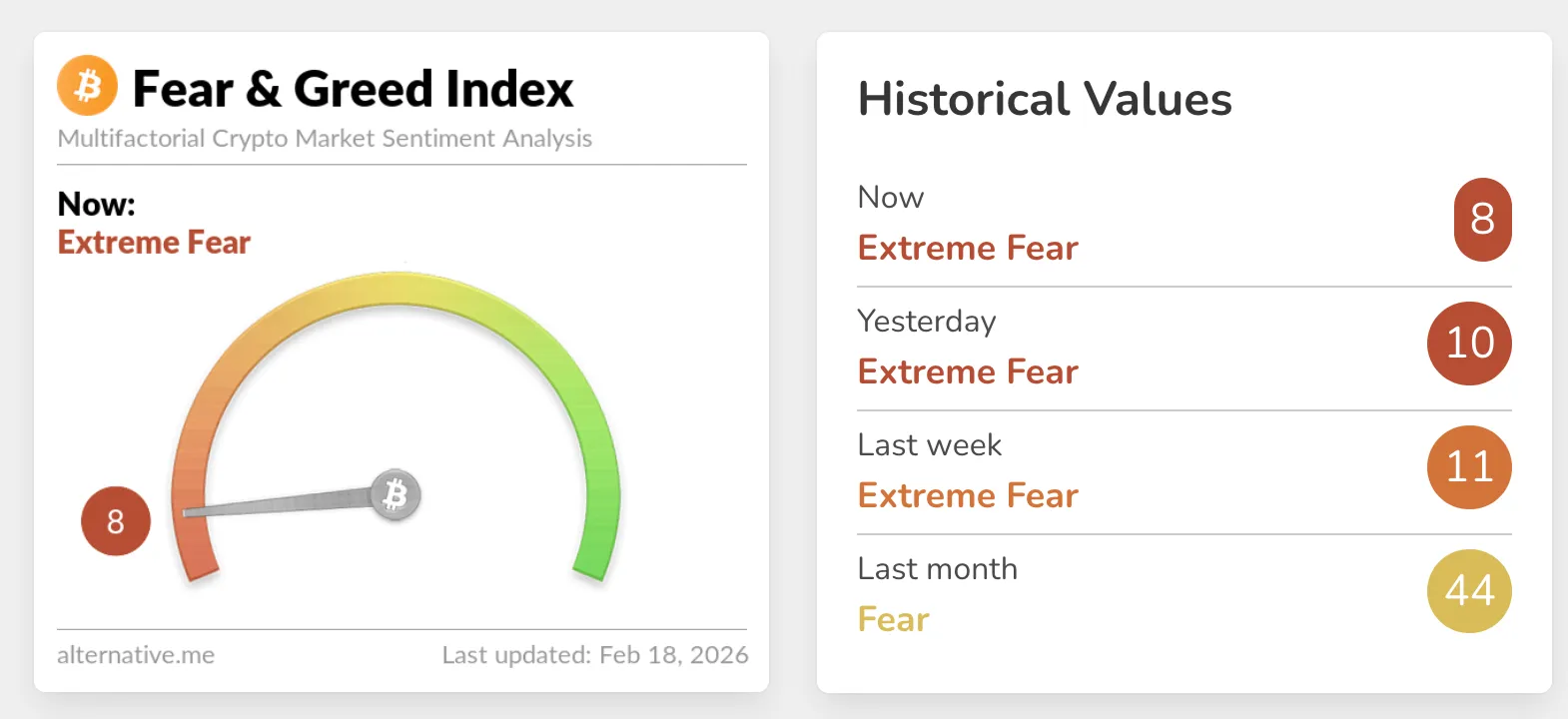

The Fear and Greed Index in the crypto market recently reached a historic low of 5 points, but Lunde believes this indicator is not a reliable signal for strong rebounds.

Buying Bitcoin during “extreme fear” has yielded an average 90-day return of 2.4% compared to 95% when purchased during times of extreme greed.

The room for further decline is limited, as it was during the late stage of the 2022 bear market. Investors should prepare for a prolonged period of consolidation before prices begin to recover confidently, Lunde concluded.

Back in the day, the “Bear Flag” pattern on the daily chart of the leading cryptocurrency indicated the possibility of its decline to $55,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!