K33 Research Predicts Up to $4.8 Billion Inflows into ETH ETFs Within Five Months

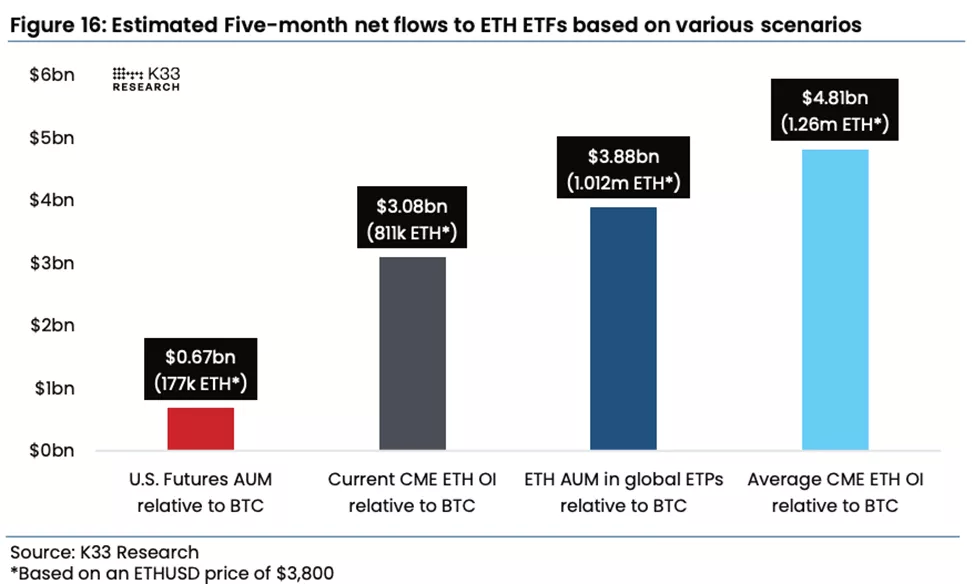

In the initial five months following the commencement of trading, net inflows into spot Ethereum-based ETFs are projected to range from $3.1 billion to $4.8 billion, according to calculations by K33 Research.

Markets remain rangebound with low volatility, but moderate ETH ETF excitement is reflected in trader positioning.

A relatively quiet week, but we expect the inevitable ETH ETF launch to follow a similar (explosive) path to Bitcoin’s.https://t.co/nXd89cthCb

— K33 Research (@K33Research) June 4, 2024

At the current price of $3800, this implies an absorption of between 811,000 ETH and 1.26 million ETH (0.7–1.05% of supply). These estimates are based on comparing the market sizes of the first and second largest cryptocurrencies by market capitalization.

According to analysts, about 3.3% of the available Ethereum supply is concentrated in investment products and has shown a steady decline since the peak of the bull market in November 2021.

A similar situation was observed with Bitcoin, where the figure fell to 4.1% before the ETF launch but subsequently rose to 5.6%.

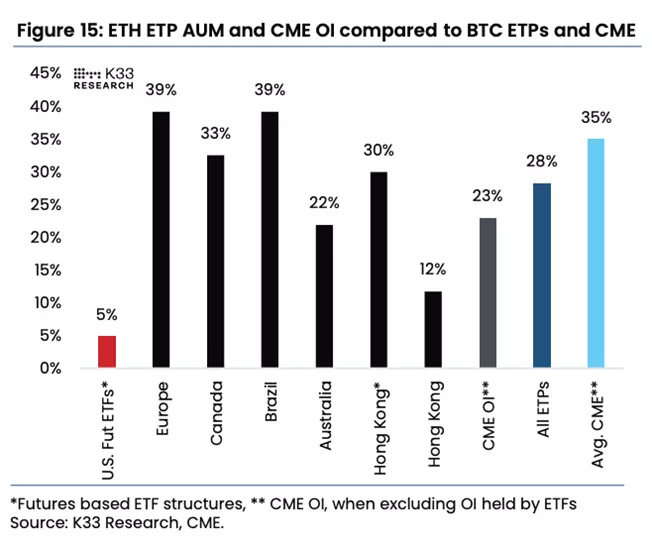

Overall, the AUM of Ethereum ETP is equivalent to 28.2% of the digital gold metric or 33% if U.S. BTC ETFs are excluded from the calculations.

American futures ETFs on Ether reduce this global share, accounting for only 5% of their counterparts in the first cryptocurrency. Experts attribute this to the mismatch in trading start times, which is not representative of investment demand.

“The thesis is supported by the open interest in Ethereum on the CME. It has currently dropped to 22.9% of the Bitcoin metric, whereas the average since their launch corresponds to 35%. This indicates significant institutional demand for Ether in the U.S.,” the specialists emphasized.

Applying these weights to the total net inflow of $14 billion into spot BTC ETFs since their trading debut in January, experts concluded that their Ethereum-based counterparts could absorb between 811,000 ETH and 1.26 million ETH over the same period.

K33 specifically noted that they “still do not bet against [BlackRock CEO Larry] Fink.” The “Midas touch” of the top manager towards Ethereum creates conditions for the relative strength of this asset during the summer, analysts added.

“Such significant absorption of supply is likely to lead to price increases,” the specialists concluded.

From May 23 to June 2, the total exchange balance of Ethereum decreased by 797,000 ETH ($3 billion).

Previously, Arthur Cheong, founder and CEO of DeFiance Capital, predicted a target of $4500 for the asset even before the launch of ETH ETFs.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!