K33 Research Warns of High Risk for Crypto Traders Ahead of Fed Meeting

- The cryptocurrency market is “highly exposed to risk” ahead of key inflation data and the Federal Reserve meeting.

- The Committee’s rate trajectory forecast and Jerome Powell’s press conference predictions will significantly impact prices.

Clients of unregulated crypto derivatives platforms remain “highly exposed to risk,” increasing the potential for long liquidations ahead of key macroeconomic events, according to K33 Research.

Analysts estimate that open interest (OI) in perpetual bitcoin contracts has risen to a yearly high following a steady two-week upward trend. Investors who made bullish bets during this period faced “paper” losses on their positions.

On the CME, annual premiums on bitcoin and Ethereum futures fell from 12% to 6% — the lowest since May 23.

“While short-term positioning indicates cautious behavior among institutional traders, open interest is near historical highs,” experts commented.

K33 noted that the significant inflow of funds into BTC-ETFs may only partially reflect arbitrage between spot and futures markets amid aggressive basis trading on CME. It is more a matter of demand than hedging.

“Since May 1, ETF issuers have added 36,000 more BTC than the OI on CME, indicating that most flows into the instruments come from participants seeking to establish a directional long position,” analysts explained.

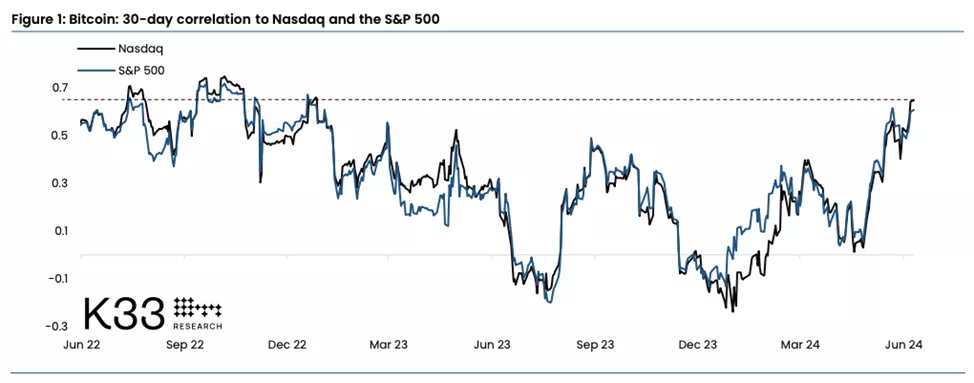

According to specialists’ calculations, bitcoin’s correlation with the Nasdaq stock index (30 DMA) has risen to 0.64 — the highest since 2022.

The price correlation strengthened following the June 7 US employment report. The data weakened expectations of the Fed beginning to lower the key rate.

QCP Capital linked the continuation of negative dynamics to deteriorating risk appetites in global markets.

In addition to the US employment report, which ruled out a policy easing by the Fed at the July and September meetings, experts cited three more factors:

- French President Emmanuel Macron called for early elections. Increased geopolitical risk in the EU contributed to the strengthening of the dollar and a general deterioration in sentiment.

- Markets are awaiting the Fed meeting and the inflation report. This month, the Rate Committee will also release the Dot Plot, which will inform how many cuts the Fed expects by the end of 2024.

- On the eve of June 12 events, investors withdrew $64 million from BTC-ETFs as a precaution.

K33 Research also noted that cryptocurrency traders are focused on US inflation statistics on Wednesday, after which the Fed will make a monetary policy decision, specialists indicated.

“The Committee’s rate trajectory forecast and Jerome Powell’s press conference predictions will be the most significant factors affecting prices,” K33 emphasized.

Technical analyst Ali highlighted signs of a volatility spike and significant risk.

Former BitMEX CEO Arthur Hayes previously noted a change in the macroeconomic backdrop and urged buying the first cryptocurrency.

According to Bitfinex experts, during the current bull market, bitcoin will form a peak at some point in the fourth quarter of 2024. They also noted the potential for further growth.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!