Kaiko forecasts a difficult period for crypto exchanges

Cryptocurrency exchanges will be tested by adverse market conditions, shrinking client activity and problems among several industry participants. Some may go bankrupt if they are not bailed out by firms such as FTX or Alameda, Kaiko notes.

In our latest Deep Dive, @riyad_carey covers the trouble exchanges could be in as volumes slow and fees compress.

Check it out here: https://t.co/1heLXy4SUS

— Kaiko (@KaikoData) June 23, 2022

Analysts note that bear market symptoms include reduced liquidity and shrinking trading volumes. Such a situation exerts pressure on the financial results of crypto platforms, which derive most of their income from fees.

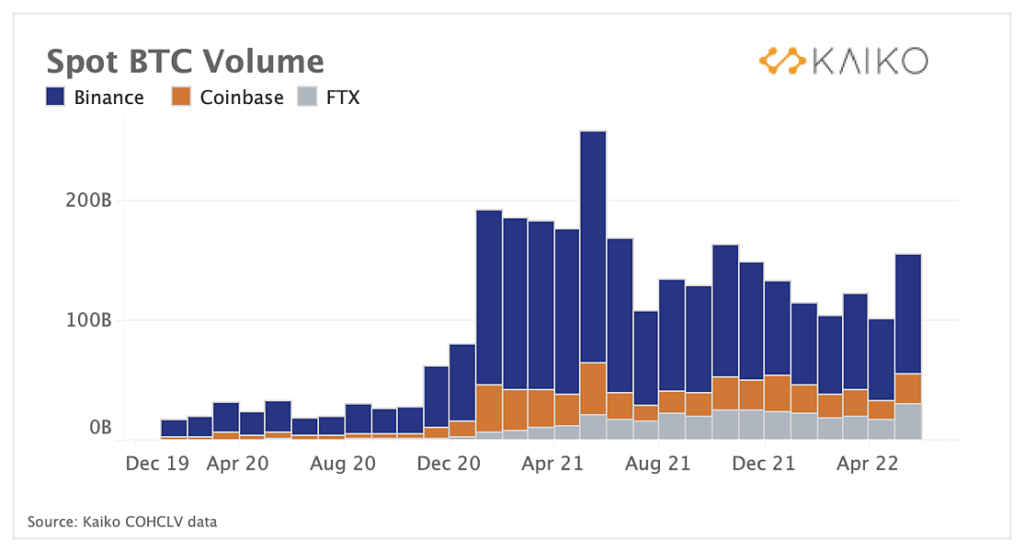

Analysts’ calculations show that in recent months trading volumes of Bitcoin have fallen. The May spike was an exception, driven by volatility linked to the Terra collapse.

Among risk factors for crypto platforms, analysts also cited shrinking fee sizes and challenges in ancillary lines (staking, venture investments).

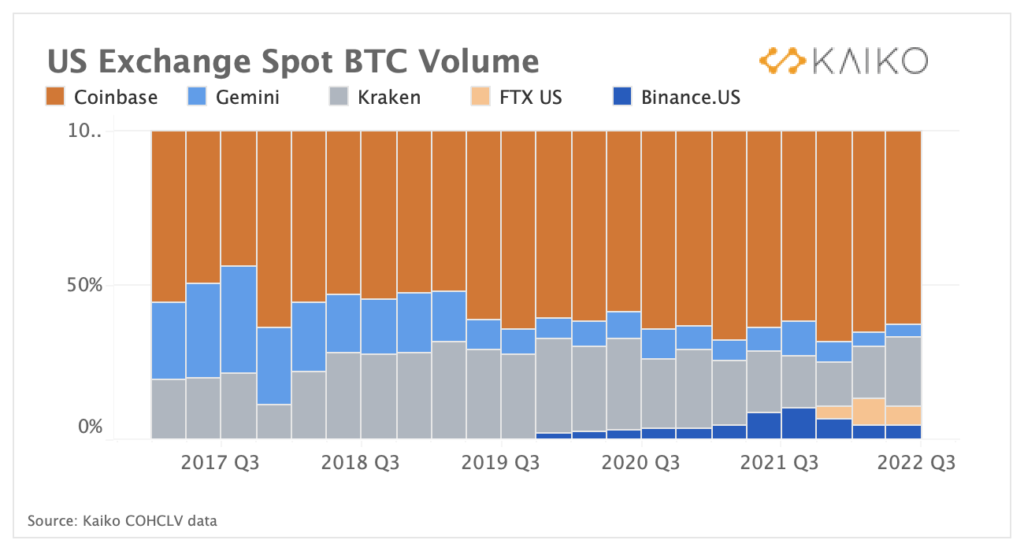

Binance.US’s decision to waive fees on some BTC pairs could intensify competition in the US market, where previously the most vulnerable positions were at Gemini.

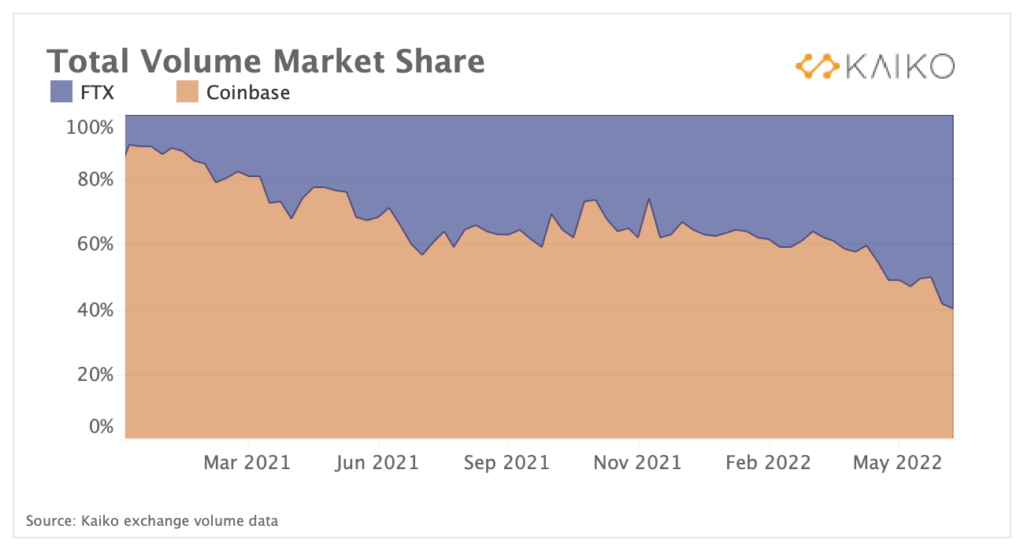

In global terms, experts noted a noticeable rise in FTX’s market share, which squeezed Coinbase’s positions. By setting a new standard of low exchange fees, Sam Bankman-Fried’s firm managed to grow its client base.

Analysts also noted expansion of services to attract new users. The details of such products often remain opaque, they added.

In this context, the real danger comes from smaller exchanges, whose market share has fallen. As an example, analysts cited a platform from Japan offering up to 5% annual yield on BTC, ETH and XRP. In its documents the firm warned that “the provided cryptocurrency loans are not managed as separate funds” and there is no guarantee that users will be reimbursed if it goes bankrupt.

Another worrying trend is the plunge of crypto platforms into venture capital. To illustrate, Kaiko recalled Voyager’s troubles as a result of liquidity difficulties at Three Arrows Capital, and also Tether’s loans to Celsius.

Bloomberg reported that Bitcoin’s drop has put at risk miners’ loans worth $4 billion.

Follow ForkLog’s Bitcoin news on our Telegram — for news on cryptocurrencies, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!