Kraken rethinks IPO stance after Coinbase debut

The cryptocurrency exchange Kraken could abandon a direct listing in favour of a more traditional procedure IPO. This was disclosed by the company’s chief executive, Jesse Powell, in Fortune.

Earlier Kraken planned to follow Coinbase’s example and conduct a direct listing of its shares in 2022. But Powell has now questioned such an approach. In his words, the company is taking a ‘more serious’ look at an initial public offering.

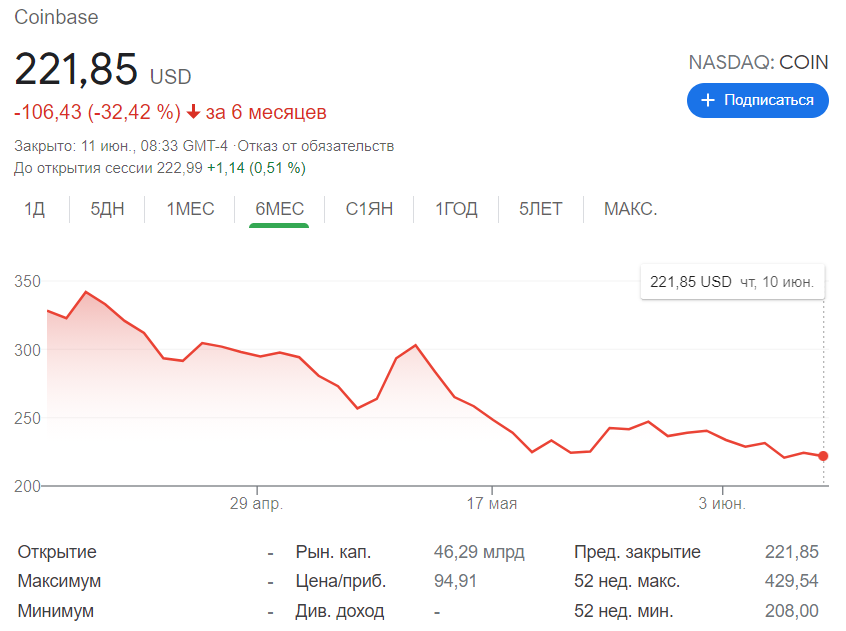

In April 2021 Coinbase listed its shares on the Nasdaq under the ticker COIN. On the first day of trading, shares closed at $328.28, and the Bitcoin exchange’s market capitalization stood at $85.7 billion.

On June 10, Coinbase’s shares traded at around $221.85 — the stock had fallen more than 32% from its initial value. The company’s market capitalization was $46.29 billion.

Powell blames the volatility on the competitor’s chosen route to public status. Unlike an IPO, where investment banks control the pricing process, a direct listing allows the market to determine the price more independently.

During a direct listing, existing shareholders are also not prohibited from selling their shares after the company’s debut.

“In light of the direct listing results, the IPO looks somewhat more attractive. I would say we are taking this possibility more seriously now, with Coinbase in view as an example,” Powell said.

The CEO confirmed that Kraken plans to list its shares on a public market in the second half of 2022. He also ruled out a SPAC deal, as the Bitcoin exchange is already ‘too big’.

He said that by then Kraken would gain access to a more detailed analysis of Coinbase’s listing, and investors would begin to place greater trust in the cryptocurrency industry.

In April 2021, the Rothschild-founded investment fund RIT Capital Partners, founded by Lord Jacob Rothschild, became a co-owner of Kraken. The fund’s interest in the company is linked to its plans to go public.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!