KyberSwap announces liquidity-mining pools for Arbitrum tokens

The non-custodial exchange KyberSwap will launch liquidity pools and liquidity mining for ARB tokens.

4/10

KyberSwap also has liquidity mining farms on @arbitrum. Farming pairs are in #stablecoins & #altcoins, so there’s something for everyone looking to #WorkYourAssets. pic.twitter.com/ms7b8C4vov— Kyber Network (@KyberNetwork) March 23, 2023

The KNC tokens will be accrued for the following trading pairs:

- ARB/ETH (2%);

- ARB/ETH (5%);

- ARB/USDT (2%);

- ARB/USDT (2%);

- ARB/KNC (5%).

In total, the Kyber Network behind the exchange will allocate 70,000 KNC to liquidity providers.

KyberSwap was among the protocols whose users connected to the Arbitrum testnet and executed transactions on the platform, thereby earning eligibility to participate in the airdrop.

“We are pleased to launch the first pools for ARB liquidity mining. These services mark the start of a broad Arbitrum-focused campaign planned by KyberSwap. Soon we will announce additional rewards and events for both liquidity pools and traders,” said the CEO and founder of the project, Victor Tran.

In addition, users will be able to set their own buy or sell prices for ARB using limit orders and exchange the token at “optimized rates” through the exchange’s aggregator.

KyberSwap also plans to introduce additional rewards, which may include ARB and KNC airdrops, as well as non-fungible tokens.

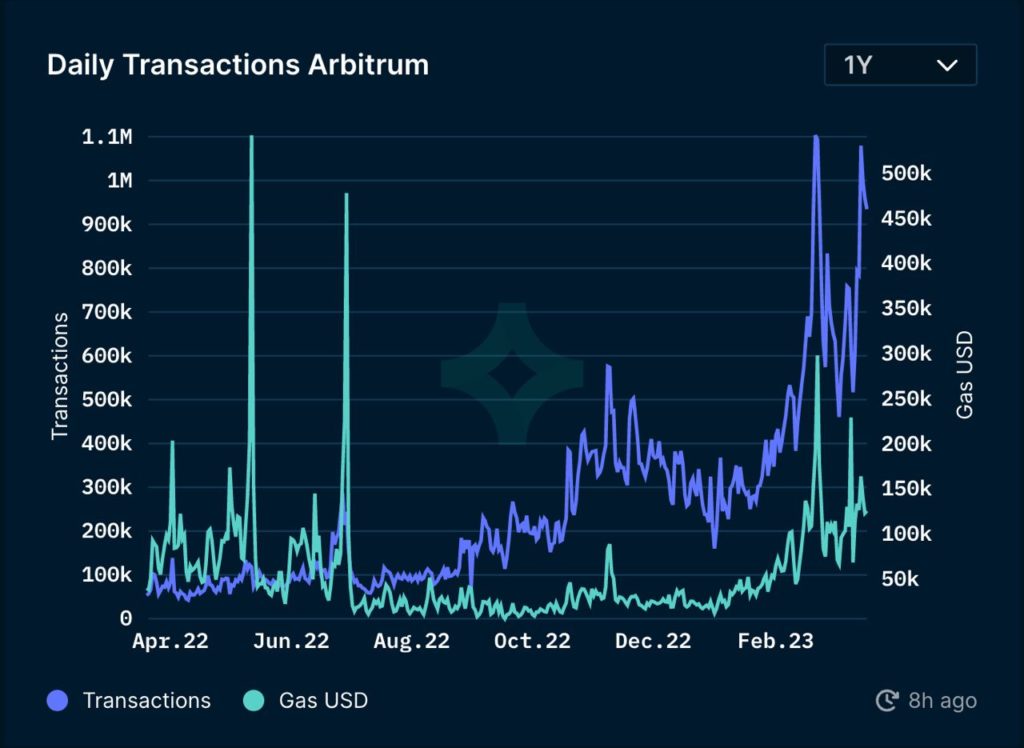

According to analytics firm Nansen, Arbitrum was one of the fastest-growing blockchains in 2022. Its TVL is at the data-descr=”Total value locked in smart contracts” class=”old_tooltip”>TVL reached $1.1 billion, and the average daily transactions stood around 300,000.

The Arbitrum planned a token airdrop on March 23, followed by a shift to a decentralized governance model (DAO).

The team will distribute 44% of the total supply of 10 billion ARB among early users and investors. Additionally the community and the DAO will receive assets that will allow them to control 56% of votes. The first phase includes the distribution of 12.75% of the total coin supply.

Earlier, cryptocurrency exchanges Binance and Huobi set the listing date for the new token on March 23.

Even before the official airdrop, the community began selling unreleased ARB on OTC markets. BitMEX introduced futures on future Arbitrum coins, with quotes peaking at $1.77.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!