Lido Founders Secretly Back EigenLayer Rival

The co-founders of the DeFi platform Lido are covertly financing a competitor to the rapidly popular liquid restaking protocol EigenLayer, according to CoinDesk, citing its own sources.

Konstantin Lomashuk and Vasiliy Shapovalov have supported a project named Symbiotic through their venture firm Cyber Fund. Paradigm, a major investor in Lido, also participated in the funding.

Documentation obtained by the publication reveals that, similar to EigenLayer, the new protocol will offer decentralized applications and solutions collective protection via AVS—active validation services.

Restakers have the opportunity to earn income by placing assets to support various AVS.

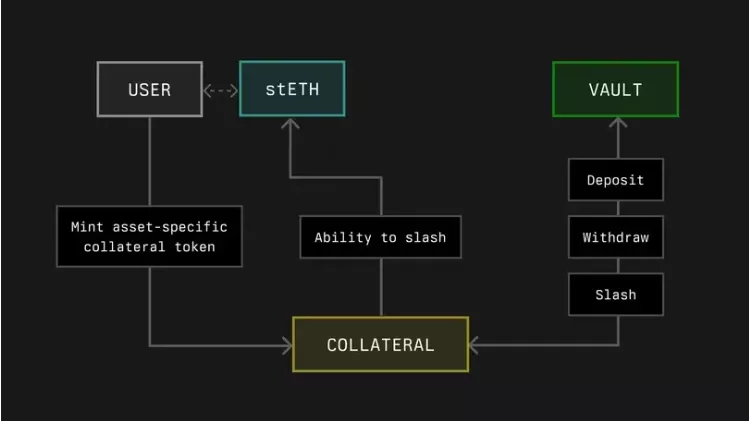

The main distinction of Symbiotic is that it allows the direct use of Lido’s liquid token (stETH) and other ERC-20 standard assets. EigenLayer only accepts ETH, whereas the competitor’s mechanism does not impose this restriction.

“Collateral in Symbiotic can include ERC-20 tokens, Ethereum validator credentials, or other on-chain assets such as LP positions, without restrictions on which blockchains the positions are stored,” the publication quotes the project documentation.

Moreover, the team’s approach to collateral is designed to provide significantly greater flexibility for applications on the platform.

According to DeFi Llama, the TVL of EigenLayer, which emerged in January, had already approached $16 billion by April. At the time of writing, the figure had adjusted to $14.4 billion.

Having launched about three years ago, the liquid staking platform Lido continues to dominate the Ethereum ecosystem in terms of locked funds. However, after reaching a peak of ~$39.8 billion in March, the value has retreated to ~$27.5 billion, a decline of about 31%.

CoinDesk’s sources reported that some protocols operating on EigenLayer, such as Renzo, are already in talks with Symbiotic about using its infrastructure.

Sources also noted that Paradigm approached EigenLayer founder Sriram Kannan with an investment offer, but he opted for the venture firm Andreessen Horowitz. At that time, the company informed Kannan that it would support a competing firm.

Regarding potential competition, experts expressed confidence that the liquid restaking sector is large enough to accommodate several major players.

Back in February, Kannan stated that EigenLayer had no plans to launch a token. By the end of April, the team announced an EIGEN airdrop. The first phase of distribution began in May.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!