Lido’s Share in Ethereum Staking Drops to 25%

Once dominant in the Ethereum staking market, Lido Finance has seen its share shrink to 25%. This marks the lowest level since March 2022, as noted by Tom Wan of Entropy Advisors.

Lido’s Market Share in ETH Staking has dropped to 25%, which is the lowest point since March 2022. pic.twitter.com/zEGPLZAQHD

— Tom Wan (@tomwanhh) July 24, 2025

In February, the figure was 32%, and by March, it had decreased to 29.6%. Over the past six months, Lido’s share has fallen by a total of 5%, the expert added.

The leading trio includes centralized exchanges Binance and Coinbase, with shares of 8.3% and 6.9%, respectively.

Meanwhile, 19% of the sector is occupied by unidentified validators. Wan noted that these could be individual stakers or large organizations that do not disclose their wallet information for various reasons.

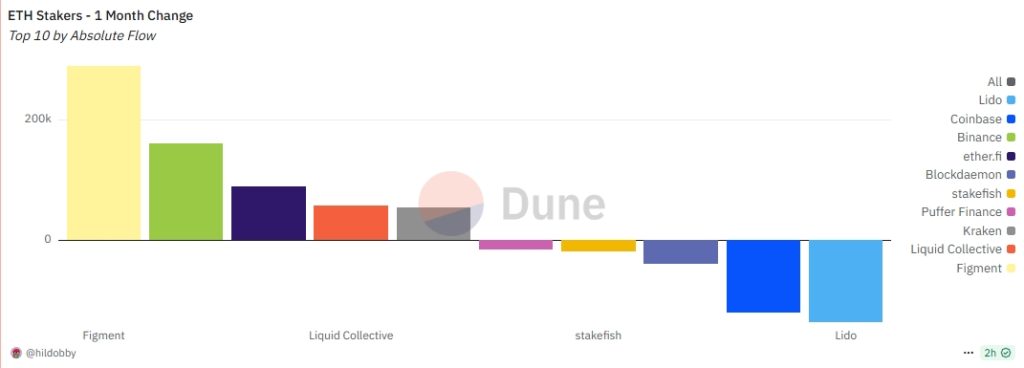

On July 16, the total volume of deposits in staking reached a record ~36.5 million ETH, before declining to 36.1 million ETH at the time of writing. Lido led in net outflows over the past month.

The validator exit queue surged from 1,920 to over 475,000 within a week, and waiting times increased to nine days. Galaxy Digital Research partially explained the spike by the heightened requirements introduced by the Pectra update. However, the primary factor cited by experts was the cascading deleveraging in LST assets.

“This volatility was triggered by a sharp reduction in ETH supply on Aave, caused by a large withdrawal from the platform by a wallet linked to the HTX exchange,” analysts explained.

Within a week, borrowing rates for WETH on Aave rose from 2% to 18%, rendering popular leveraged “looping” staking strategies unprofitable. In this so-called looping, users borrow ETH against LST or LRT assets on platforms like Aave and convert the funds back to increase staking returns.

As a result of rising rates, investors began closing positions, leading to the stETH token from Lido losing its peg to ETH, noted Glassnode.

Rising WETH borrow rates on Aave made the stETH leverage loop unprofitable, triggering unwinds that imbalanced the ETH/stETH pool and depegged stETH, contributing to ETH sell pressure. Additionally, a growing validator exit queue adds friction to arbitrage, slowing peg recovery. pic.twitter.com/TaZddEkBwe

— glassnode (@glassnode) July 24, 2025

Aavechan co-founder Marc Zeller confirmed that large withdrawals from Aave influenced the situation, leading to a spike in the utilization rate on the lending platform. However, in his assessment, the situation is stabilizing, and borrowing rates have nearly normalized.

In July, Aave became the first DeFi lending protocol to reach a total net deposit volume of $50 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!