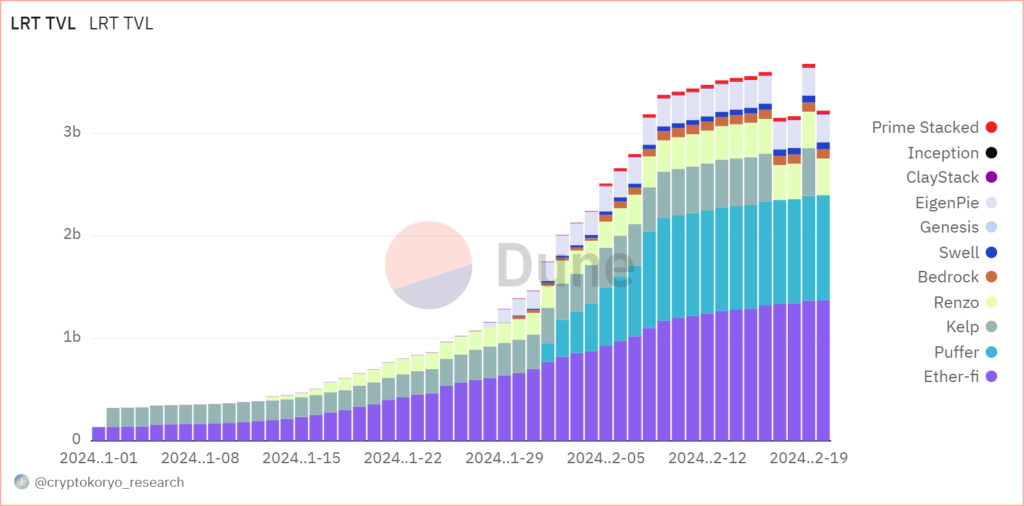

Liquid Restaking Protocols’ TVL Surpasses $3.6 Billion

On February 19, the total value locked (TVL) in liquid restaking protocols reached $3.67 billion, according to data from a dashboard on Dune.

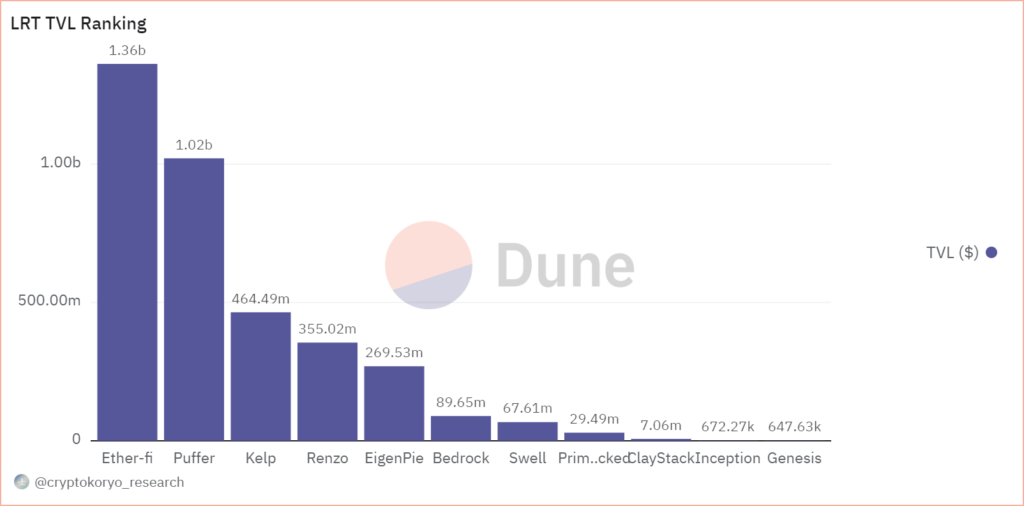

In February, the segment showed a sharp increase, dominated by EtherFi and Puffer, with TVLs of $1.36 billion and $1.02 billion, respectively.

The top five platforms by this measure also include Kelp ($464 million), Renzo ($355 million), and EigenPie ($269 million).

LRT platforms offer users the ability to stake LST assets through EigenLayer. The protocol also allows Ethereum validators to use locked ETH to enhance the security of networks outside the EVM ecosystem.

In mid-February, the TVL of the platform exceeded $7 billion.

The ability to deposit liquid staking tokens on EigenLayer is limited to certain periods. The last one closed on February 9. However, users can deposit LRT protocol assets for “native staking” without limits.

Experts from The Block noted that stakers on EigenLayer earn points, increasing their chances of participating in a potential protocol token distribution. Users of LRT platforms like EtherFi, Renzo, and Kelp also anticipate a retrodrop, enhancing their appeal with minimal economic risk due to the possibility of double rewards.

According to journalist Colin Wu’s team, EigenLayer, Puffer, and EtherFi are among the major projects expected to distribute tokens in 2024.

The WuBlockchain team has counted larger-scale projects that may have airdrops in 2024, including: zkSync, LayerZero, Magic Eden, EigenLayer, Berachain, Taiko, Blast, Aevo, Puffer Finance, EtherFi, Backpack and Friendtech. Among them, there are many L2 and related LRT and… pic.twitter.com/Yuaeji4GwS

— Wu Blockchain (@WuBlockchain) February 20, 2024

In January, LRT protocols caught the attention of venture investors: Binance’s division supported Puffer with an undisclosed amount, while Renzo raised $3.2 million in a seed round.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!