Market Correction Triggers $106 Million Ethereum Whale Liquidation

A major Ethereum holder faced a forced position closure of 67,570 ETH ($106 million) on the DeFi platform Sky after the collateral ratio fell below the liquidation threshold.

As $ETH plummeted, the 67,570 $ETH($106M) held by this whale on #Maker was liquidated!https://t.co/kXSkKh1H0P pic.twitter.com/IDjzbQ8P3z

— Lookonchain (@lookonchain) April 7, 2025

The catalyst was a 12.5% drop in the price of the second-largest cryptocurrency by market capitalization on the evening of April 6. The following day, prices had already fallen 9%, dropping below the $1500 mark.

In the event of a liquidation, Sky seizes the collateral coins for auction to recover the borrowed DAI plus fees. Any remaining amount after covering obligations is returned to the platform user. Subsequently, the protocol burns the received stablecoins, reducing issuance.

According to DeFi Llama, there is a user on Sky with a $79.4 million position that could be forcibly closed if oracles record the Ethereum price below $1495.

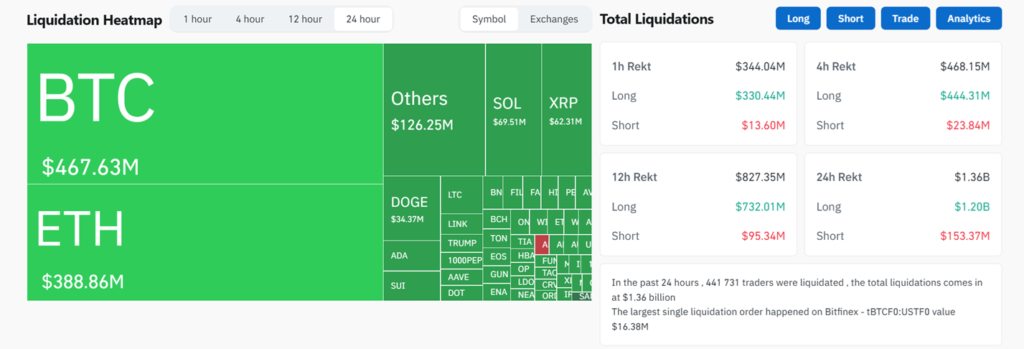

According to Coinglass, over the past 24 hours, more than 440,000 traders were liquidated for $1.36 billion, including $388.9 million in the second-largest cryptocurrency by market capitalization.

Back in August 2024, MakerDAO rebranded to Sky.

In March 2025, Lookonchain identified a forced position closure of 67,675 ETH ($121.8 million). The user deposited 2,000 ETH ($3.73 million) and 1.54 million DAI to lower the liquidation level to $1836.43, but spot market prices fell below this threshold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!