Market Sentiment Indicator Stuck in ‘Extreme Fear’ for 14 Days

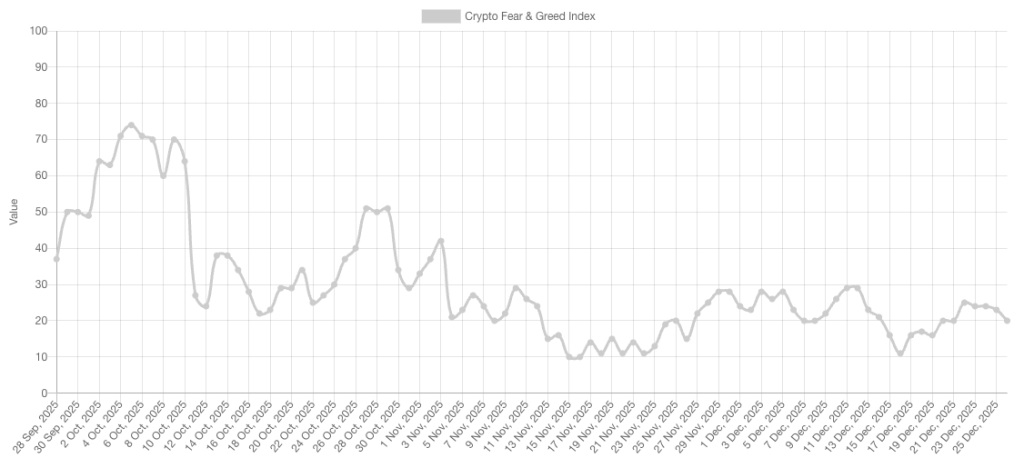

Market sentiment index shows 'extreme fear' for two weeks since December 13.

The popular market sentiment index has indicated ‘extreme fear’ for two consecutive weeks since December 13.

At the time of writing, the metric stands at 20. This marks one of the longest periods of negative sentiment since the indicator’s launch in February 2018.

The chart below shows that the index’s figures plummeted on October 10-11 amid a large-scale market correction with record deleveraging.

At the time of writing, Bitcoin is trading around $88,480—nearly 30% below its all-time high of $126,000, recorded shortly before the aforementioned ‘Black Saturday’.

The current ‘fear index’ levels are below those of November 2022—the period of the FTX collapse. This event dealt a severe blow to the industry’s reputation and triggered a decline in the price of the leading cryptocurrency to $16,000.

The metric takes into account market volatility, trading volumes, social media sentiment, trends, and the degree of digital gold’s market dominance.

Decline in Social Metrics

The platform Alphractal reported a sharp decline in attention to the industry. The downturn is evident across all fronts: from search queries and Wikipedia reading to community discussions.

📉 Crypto social volume has returned to levels typically seen during bear markets

🔍 Google searches are declining

📚 Wikipedia page views are falling

💬 Posts and discussions on forums like 4chan are also decreasing➡️ Social sentiment is clearly bearish.

In December 2025,… pic.twitter.com/TQuW7FILs5— Alphractal (@Alphractal) December 20, 2025

Social activity indicators have reverted to ‘typical crypto winter values’. Researchers noted that by December 2025, retail investors had become apathetic and exited the market.

Despite the widespread pessimism, companies Bitwise and Grayscale anticipate new price records for Bitcoin in 2026.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!