Matrixport Observes Waning Bitcoin Selling Pressure

Sentiment in the cryptocurrency market has plummeted to extreme lows.

Sentiment in the cryptocurrency market has plummeted to extreme lows, potentially leading to the formation of a “durable bottom” and a reduction in selling pressure, according to analysts at Matrixport.

📊Today’s #Matrixport Daily Chart — February 17, 2026 ⬇️

Bitcoin Sentiment Hits Extreme Lows ⁰— Durable Bottom Are Emerging?

#Matrixport #Bitcoin #BTC #CryptoMarkets #MarketSentiment #FearAndGreed #RiskManagement #Volatility #CryptoResearch pic.twitter.com/WxJg3xrHSf

— Matrixport Official (@Matrixport_EN) February 17, 2026

Experts noted widespread pessimism among investors. Matrixport’s proprietary fear and greed indicator signaled stabilization: the 21-day moving average fell below zero and began to turn upwards.

This shift indicates a depletion of sales. Historically, deep negative sentiment values have offered attractive entry points. However, analysts cautioned about the possibility of further price declines in the short term.

“Given the cyclical relationship between sentiment and price dynamics, the market is likely approaching a turning point,” stated Matrixport.

Similar metric readings were observed in June 2024 and November 2025 following sharp market downturns. The popular fear and greed index from Alternative.me also dropped to its lowest since June 2022 — 10 points out of 100.

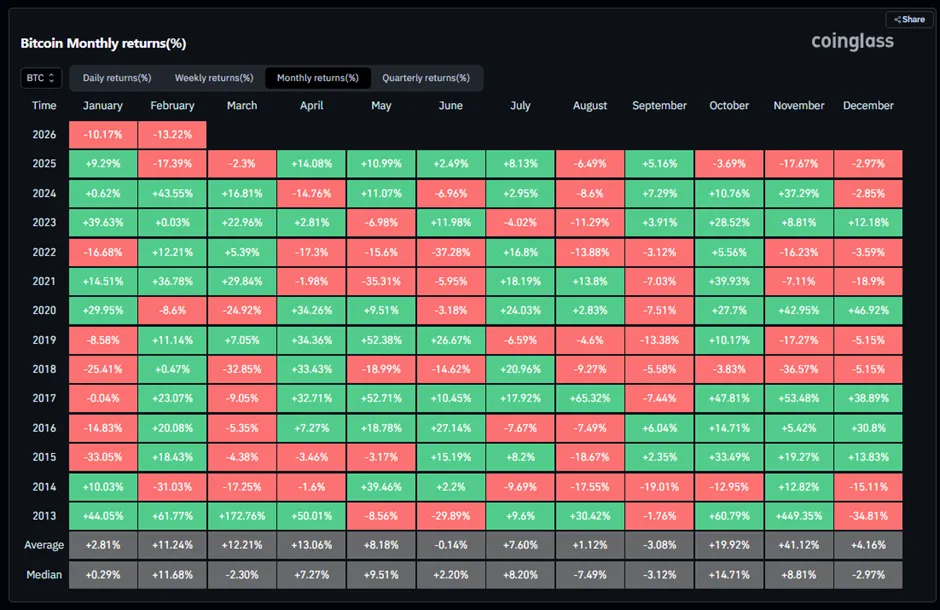

If Bitcoin closes February in the red, the asset will record five consecutive losing months, marking the longest streak since 2018.

Frank Holmes, chairman of mining company Hive, pointed to the record oversold condition of the leading cryptocurrency. The asset is trading two standard deviations below its 20-day norm. In the past five years, this has occurred only three times.

— HIVE Digital Technologies (@HIVEDigitalTech) February 16, 2026

“Historically, such extremes have favored short-term rebounds over the next 20 trading days,” explained Holmes.

He added that he remains optimistic in the long term due to strong fundamentals, despite the current market jitters.

Earlier, analysts at K33 Research suggested that Bitcoin’s drop on February 6 to $60,000 marked a local bottom before a consolidation phase. Standard Chartered allowed for a dip in digital gold to $50,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!