Matrixport says Bitcoin’s break above $40 000 is ‘inevitable’

Bitcoin could surpass $40 000 by year-end after the US authorities settle their claims against Binance and its former CEO Changpeng Zhao, Matrixport said.

Despite initial concerns, Bitcoin is poised to surpass $40,000 in December, showing resilience post-#Binance news. #Tether’s rising market cap suggests a trend of institutional funds flowing into #stablecoins, impacting Bitcoin and elevating fees. Overall, the #crypto market is… pic.twitter.com/J0WGFmNpQn

— Matrixport (@realMatrixport) November 24, 2023

Analysts called this event a “turning point” for the crypto industry.

On November 21, the company agreed to pay $4.3 billion to FinCEN and OFAC, Changpeng Zhao stepped down as CEO and put up a $175 million bond to stay free.

According to experts, the fine could have reached $10 billion, the platform place among the largest crypto exchanges in the next two to three years.

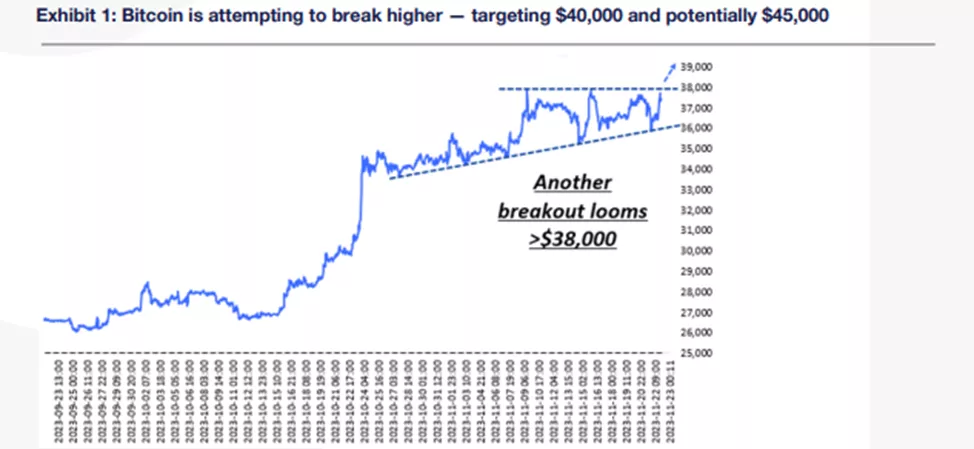

In light of the news, Bitcoin slipped into a temporary correction, but bounced off $36 000, confirming a strong trend in which a rise above $40 000 appears “inevitable,” according to experts.

“We expect the price to exceed $38 000 by the end of November with an 80% probability, followed by a rise above $40 000 in December with 90%.” — the document states.

Based on the chart below, analysts expect a rise to $45 000.

The driver will be the expectation of approval for the spot Bitcoin ETF. Additionally, seasonality supports it — in the last month of the year, digital gold tends to rise on average by 12%. A positive signal is also the growth in Tether’s market capitalization by $5 billion in recent weeks, suggesting inflows from institutional funds.

“600 million USDT issued on the eve after the Binance/CZ deal, which increased the odds of ETF approval by January”, analysts noted.

The first cryptocurrency continues to be supported by the macroeconomic backdrop. Matrixport expects inflation to ease to 1.6% and yields on 10-year US Treasuries to 2.6% by 2024–2025. An improvement in US Treasuries will lead to a sharp rise in the stock market, which often correlates with digital assets, the analysts added.

Earlier, JPMorgan noted the positive effect of the Binance deal.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!