Media: Hedge fund to press Grayscale to resume GBTC buybacks

The hedge fund Fir Tree Capital Management has filed a lawsuit against Grayscale Investments demanding disclosure of internal documents that would allow an assessment of potential conflicts of interest and abuses in the management of GBTC. Bloomberg reports.

The plaintiff also did not rule out close ties with the parent company, Digital Currency Group (DCG).

This is “especially troubling, given recent events in the crypto ecosystem, including the rapid collapse of FTX and Three Arrows Capital.” Additional questions are raised about the lack of independent oversight of the bitcoin trust, according to the suit filed in the Delaware Chancery Court (USA).

Fir Tree intends to halt Grayscale‘s push to convert GBTC into an ETF, seen as the last “legitimate means of redeeming the bitcoin trust’s shares.”

According to the statement, from 2018 to 2021 the digital asset manager issued “a huge number” of GBTC shares. With a 2% management fee, Grayscale earned $615.4 million last year from this. During the period the company did not buy back a single share of the trust.

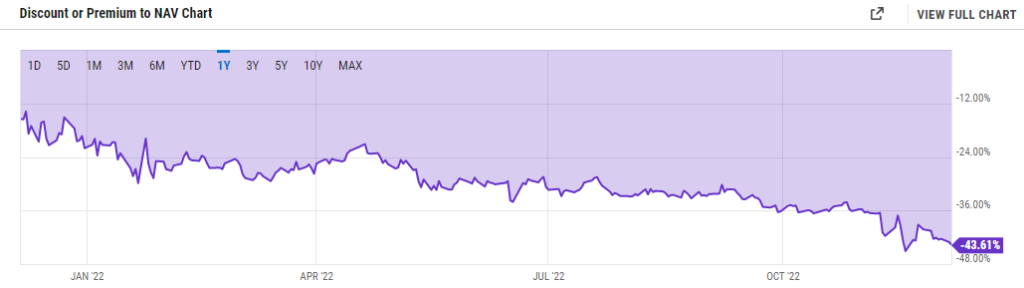

Insiders said that based on information obtained through the process Fir Tree Capital Management intends to compel the asset manager to resume buybacks of GBTC shares and to cut fees, which would reduce the observed discount to NAV.

As of December 6, the metric stood at around 43.61%, after having previously approached a record 45.08%.

“GBTC’s clients number around 850,000 retail investors. They have suffered from Grayscale’s unfriendly actions by Grayscale’s shareholders.” — according to the suit.

The hedge fund representatives noted that the company had unilaterally set a barrier to buybacks, while there are no legal grounds preventing investors from exiting GBTC if it complies with securities laws.

Grayscale’s filings state that the firm cannot offer a “permanent bitcoin-trust buyback program.”

As reported in November, Grayscale Investments declined to provide a transparency report on its reserves for security reasons. This has intensified rumors about DCG’s troubles following the suspension of Genesis Global Capital’s crypto-lending operations on its OTC platform.

Subsequently, Ergo, an analyst from The OXT Research confirmed that Grayscale holds 633,000 BTC.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!