Messari: Asia remains the epicentre of cryptocurrency market activity

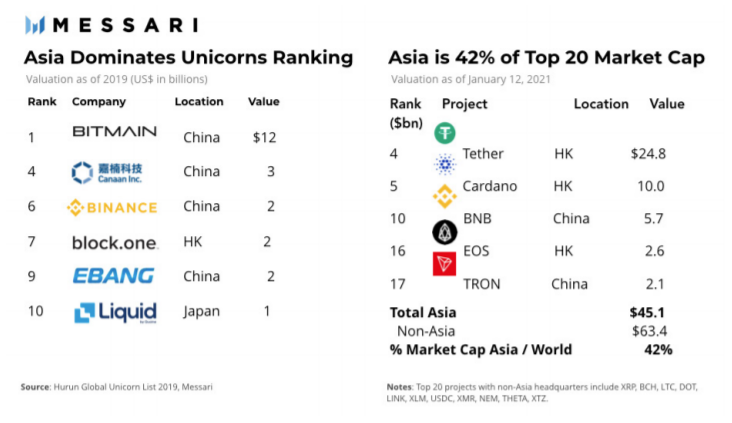

Asia accounts for 43% of global crypto transactions, 70% of Bitcoin hash rate and six of the ten “unicorns.” This is according to Messari’s review.

Asia is the most active #crypto market. We have a history of dictators, currency depreciation, capital controls — all ripe for disruption.

Behold Messari’s Asia Crypto Landscape: Everything you want to know about the major playershttps://t.co/i1xTfDjuuH

— Mira Christanto (@asiahodl) January 20, 2021

Researchers note the interest of infrastructure companies in tapping into the cryptocurrency market, which accounts for 60% of the world’s population. This is not hindered by the Chinese authorities’ ban on Bitcoin exchanges and ICOs.

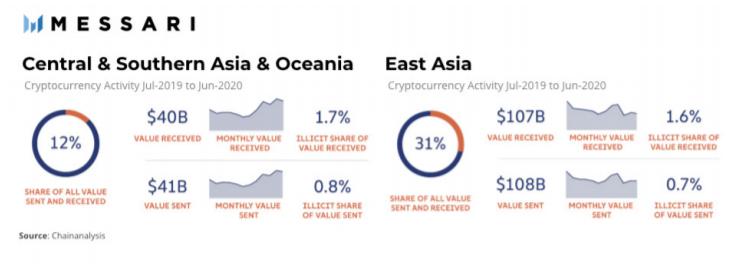

“In East Asia (mainly in China) the size of 90% of transactions exceeds the equivalent of $10,000. The region has more speculative-market participants than North America,” the report says.

Among other factors highlighting Asia on the crypto market, analysts named:

- large stock markets (Japan, China and Hong Kong in the world top-5);

- spread of Wi‑Fi, smartphones and mobile internet;

- popularity of electronic payments;

- high share of young IT professionals and fintech development.

Asia hosts headquarters of the companies behind Tether, Cardano, EOS, Binance Coin and Tron. The projects account for 42% of the total market capitalization of the top-20 cryptocurrencies.

Also in the region are based six of the ten largest companies by value in the industry.

Data: Messari.

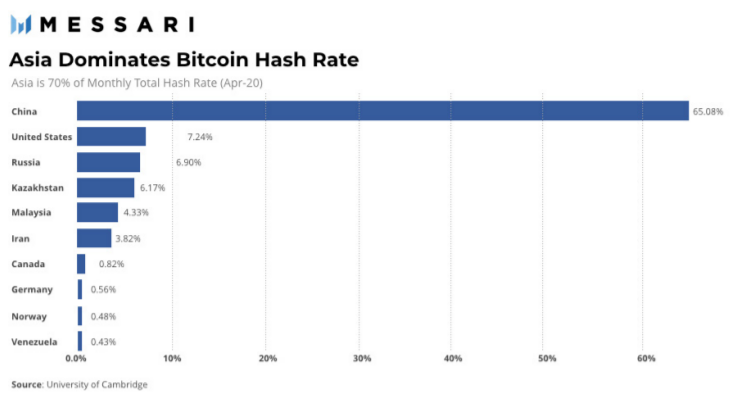

In China, major mining companies Bitmain, Canaan and Ebang operate. There, 65.1% of the world’s total Bitcoin computing power is concentrated.

Another 4.3% goes to Malaysia, which has surpassed Iran (3.8%) and entered the top five for this metric after the United States (7.2%), Russia (6.9%) and Kazakhstan (6.2%).

Data: Messari.

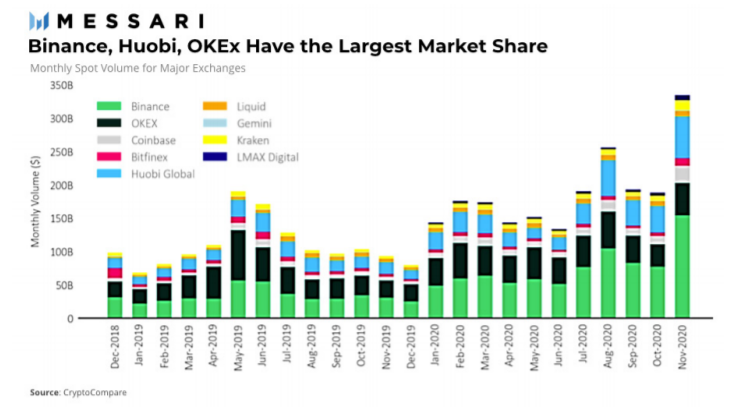

In addition to leading positions in Bitcoin hash rate, China is home to the largest crypto exchanges Binance, Huobi, OKEx and OKCoin. Collectively they hold as many bitcoins as Coinbase.

Data: Messari.

Hong Kong has been chosen as the jurisdiction by the largest crypto-derivative exchanges: FTX, BitMEX, OSL and leading funds. The reason is a broad base of institutional and wealthy private clients, low tax rates, and specialists with investment backgrounds.

According to Chainalysis, as of June 2020 Asia accounted for 43% of the $296 billion in cryptocurrency transactions. The figure equals the combined activity of the United States and Europe.

Data: Messari.

Earlier, the Chinese authorities prohibited citizens from buying foreign currency up to $50,000 per year. Capital controls have boosted the popularity of stablecoins, especially Tether (USDT).

In South Korea, every third investor adds cryptocurrencies to their portfolio. Japanese banks are investing in the industry, promoting the idea of issuing security tokens.

Earlier, Jump Capital analysts named India and Indonesia among the most promising countries for cryptocurrencies.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!