Messari: DeFi projects Uniswap, Curve and Balancer capture 90% of the DEX market

Automated-market-maker (AMM) projects Uniswap, Curve, and Balancer account for more than 90% of the decentralized exchange market, according to Messari analysts.

AMMs like Uniswap, Curve, and Balancer currently account for over 90% of total DEX volume.

With AMM volume as a percent of total DEX volume at all-time highs, is it sustainable?

Full analysis: https://t.co/29DMJEnqPp pic.twitter.com/mpHFJgxu6K

— Messari (@MessariCrypto) September 14, 2020

The chart attached to the tweet shows that the share of AMM projects in DEX turnover has reached an all-time high.

Annual revenue to liquidity providers on Uniswap stands at $406 million. SushiSwap is at $228 million, and Balancer at $114 million.

As AMM volumes grow, so too will protocol revenue.

Looking at revenue figures, its evident these protocols are already generating significant annualized revenues:

Uniswap: $406M

SushiSwap: $228M

Balancer: $114M

Swerve: $29M pic.twitter.com/WIgc5oBabr

— Messari (@MessariCrypto) September 14, 2020

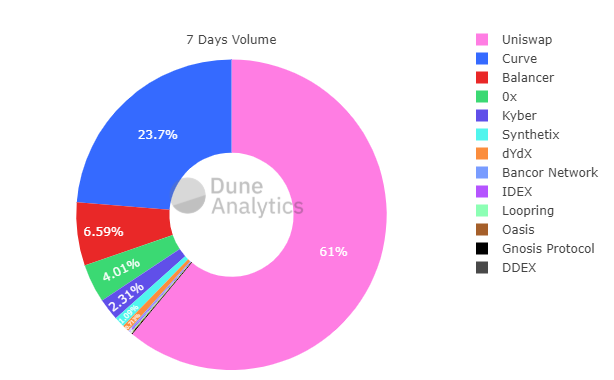

According to Dune Analytics, Uniswap’s share in the DEX segment is 61%, Curve 23.7%, Balancer 6.59%.

Data: Dune Analytics.

Over the past 30 days, trading volume in the segment rose by 156%, reaching $20.25 billion.

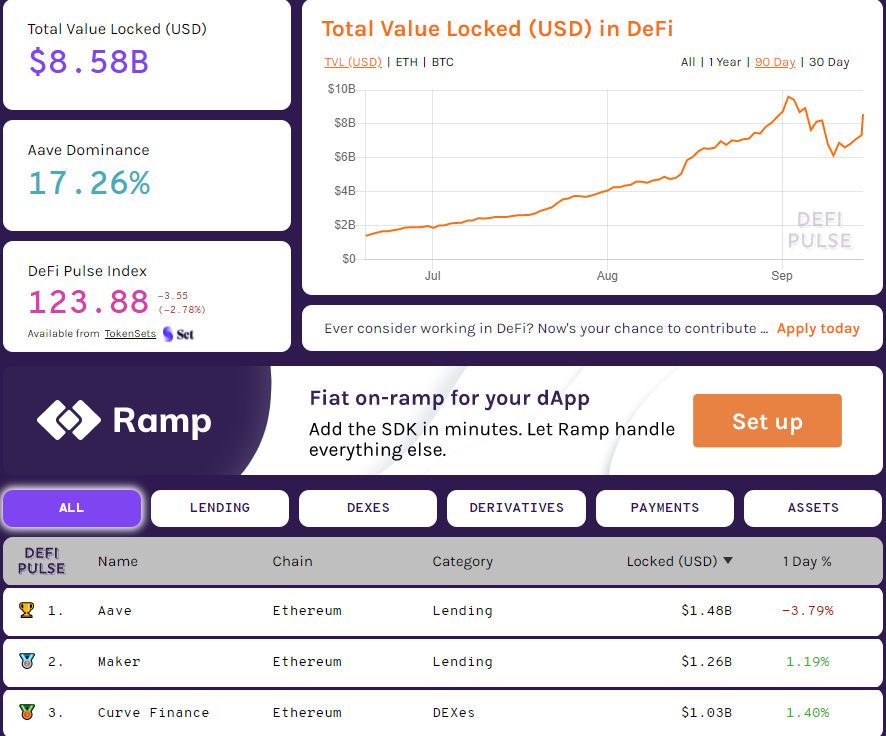

Total value locked in the DeFi segment stands at $8.58 billion.

Data: DeFi Pulse.

Aave leads the ranking, competing with Maker and Curve Finance. Each of these projects has more than $1 billion in total value locked.

Earlier ForkLog published a piece about how SushiSwap managed to attract $1 billion in just two weeks.

Subscribe to ForkLog’s Telegram news: ForkLog FEED — the full feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!