Messari Labels Meme Coins as the Most Extractive Crypto Phenomenon

Meme tokens have been dubbed the “most extractive crypto phenomenon” in terms of value destruction since the ICO boom. This view was expressed by Messari data engineer Mike Kremer in a newsletter, reports Cointelegraph.

The expert noted that speculative assets and bubbles have historically been part of the ecosystem, but the hype around the latest trendy fad always “left behind some residual value.”

“During the ‘DeFi summer,’ projects like Uniswap Labs launched protocols that brought real benefits to the crypto economy. When the speculation boom subsided, these tokens still had underlying value because they were tied to functioning, value-generating services,” Kremer believes.

According to him, meme coins exhibit “a much more destructive dynamic.”

“Here, insiders or cartels create tokens like supercumrocket69, hype them up, and lure retail investors into betting on these ‘revolutionary’ new assets,” Kremer wrote.

He added that after the price surge, developers “dump” their tokens, leaving users with devalued, worthless coins.

“The entire process is a zero-sum game where value is not just redistributed but destroyed,” Kremer concluded.

Investor Disappointment Grows as Volumes Decline

The COO of the NFT project Unfungible, known as Kermit, provided statistics showing that 60% of meme coin investors lost their money.

Here’s a pie chart of pump fun traders:

• 60% lost money.

• 4.7% made no money.

• 24% made less than $100.

• 11.2% made more than $100.

• 3% made more than $1,000.

• 0.5% made more than $10,000.

• People who have made more than $10K can barely even be seen on this… https://t.co/NETZsiDFGv pic.twitter.com/jUVSG0ZWnL

— Kermit ? (@crypto__kermit) August 18, 2024

The share of users earning up to 100% from trading was 24%. Only 0.5% made a profit of more than $10,000.

Earlier data showed that only ~1.4% of meme coins launched on the popular Solana-based platform Pump.fun reach a profitable level. In this scenario, the chances of finding a profitable asset were lower than winning at roulette with the riskiest bet on a number.

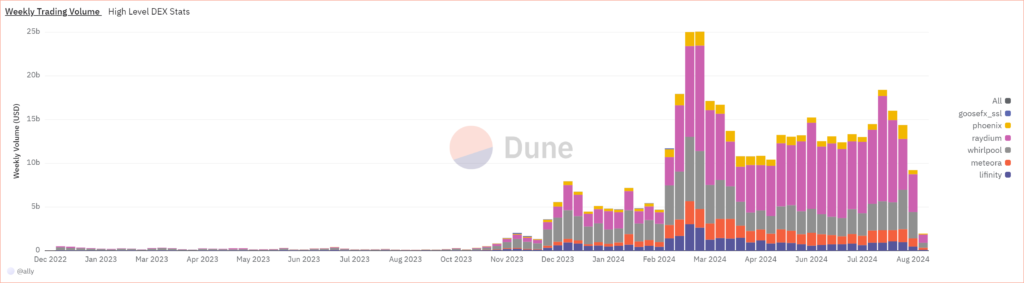

Amid disappointment, investors began leaving the market. According to a dashboard on Dune, trading volumes in the segment have fallen by 80% over the past two weeks.

Back in April, Pump.fun abolished the fee for creating meme tokens and introduced a reward of 0.5 SOL for completing the “bonding curve” — attracting minimum liquidity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!