Michael Saylor Reveals His Bitcoin Investment Strategy

Michael Saylor, founder of MicroStrategy, shared his approach to effective investment in digital gold during an interview with Yahoo Finance, noting that the essence of the strategy is quite simple.

“Every day for the past four years, I’ve been saying: buy bitcoin, don’t sell bitcoin. I will buy more coins. I will always buy the first cryptocurrency at peak levels,” the entrepreneur stated.

Saylor advised market participants to “simply continue acquiring bitcoin with their free capital,” as the asset “will always appreciate against the dollar.”

He suggested thinking of the first cryptocurrency as a long-term capital asset.

“So, if you have money that you won’t need for four years, or even better, for ten years, you put it in a portfolio… Say, dollar-cost averaging into bitcoin every quarter. Invest a portion of long-term savings in the first cryptocurrency. Expect it to hold its value over a decade or longer, and don’t worry too much about short-term volatility,” he advised.

Michael Saylor noted that even without fully understanding bitcoin’s applications, use cases exist. He emphasized that MicroStrategy successfully profits by holding the digital asset, creating significant value for shareholders. According to him, investors don’t need to understand the details of the company’s strategy—it’s enough to simply own bitcoin and let the market increase its price.

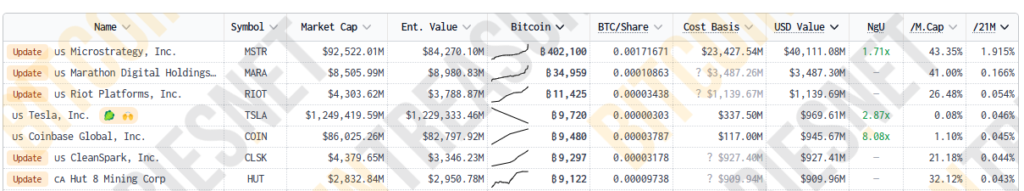

Currently, MicroStrategy holds 402,100 BTC (1.915% of the total digital gold supply). The value of the coins has surpassed $40 billion.

In early November, the company acquired an additional 15,400 BTC for $1.5 billion. The average purchase price was $95,976.

The funds for replenishing the “digital reserves” were raised by selling 3.7 million company shares on the stock market.

MSTR shares are trading at $395, with the company’s market capitalization at $92.52 billion.

Throughout 2024, MicroStrategy’s securities showed a fivefold increase in market value compared to bitcoin—650.2% versus 123.1%. The company’s growth rate surpassed even the S&P 500 index and Nvidia.

Earlier, during a presentation for Microsoft’s board of directors, Saylor introduced a crypto strategy expected to add $5 trillion to the company’s capitalization.

Previously, the entrepreneur doubted the likelihood of an 80% drop in the first cryptocurrency’s price. In his observations, the market structure has significantly changed compared to previous cycles.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!