Michael Saylor: Spot Bitcoin ETFs to Surpass Gold-Based Funds

- This summer, Bitcoin ETFs will surpass gold-based funds in asset volume.

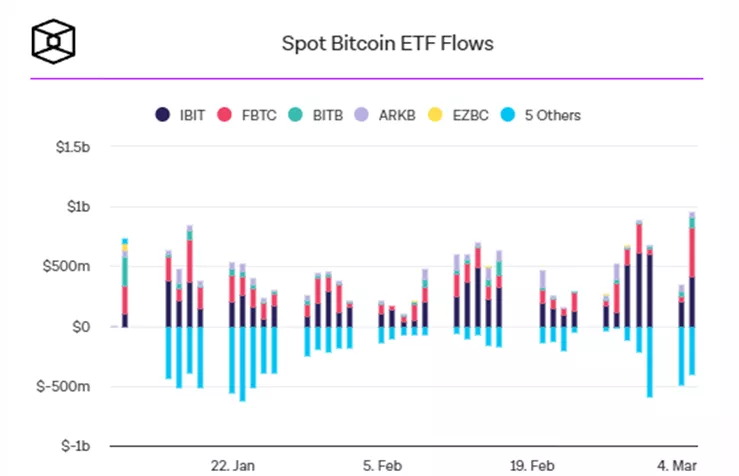

- BlackRock’s IBIT set a new record for daily inflow and trading volume.

- The combined turnover of the products exceeded that of Microsoft shares.

Gold ETFs remain the largest in the exchange-traded commodities category but will soon be overtaken by their counterparts based on the first cryptocurrency, according to MicroStrategy founder Michael Saylor.

Michael Saylor: #Bitcoin ‘Gold Rush’ 2024-2034: The era of mass adoption is here.

I had the chance to sit down with @Saylor to discuss the success of the spot Bitcoin ETFs, why our money is toxic, the ideal form of government, building companies on the network and why Bitcoin is… pic.twitter.com/6FPt95hhsG

— Natalie Brunell ⚡️ (@natbrunell) March 6, 2024

According to the Bitcoin maximalist, digital gold-based products are beginning to compete with the largest exchange-traded funds. The MicroStrategy founder acknowledged that ETFs have exceeded his expectations in terms of inflows and trading volumes.

“We thought the first cryptocurrency was a competitor to gold. In reality, it has risen in the rankings and is nipping at the heels of the S&P 500 index-based instrument,” he shared.

According to BitMEX, since the launch on January 11, net inflow into spot Bitcoin ETFs has reached $8.9 billion. BlackRock’s IBIT and Fidelity’s FBTC have entered the top 20 most actively traded exchange-traded funds.

[3/4] Total net flow since 11th Jan 2024 is now $8,895.6 million. pic.twitter.com/61VmMD9vqc

— BitMEX Research (@BitMEXResearch) March 7, 2024

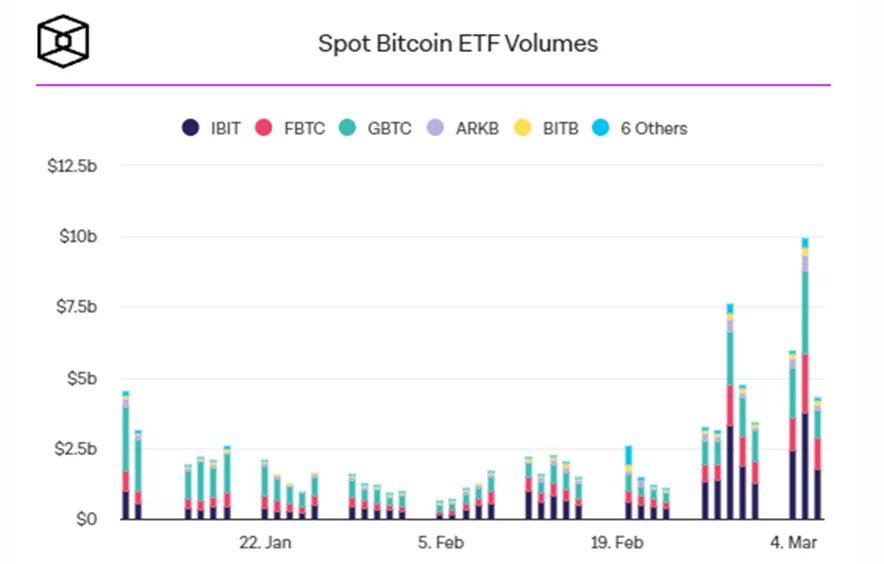

According to SoSovalue, on March 5, the total trading volume of the instruments exceeded $10.4 billion. For comparison, the figure for Microsoft shares was $8.9 billion. According to the latest data, the AUM of the funds reached $53.11 billion.

IBIT Records

On March 5, net inflow into IBIT set a new record of $788.3 million. This was made possible by Bitcoin reaching a new all-time high. The previous record was $603.9 million.

In terms of trading volume, IBIT also recorded a record $3.76 billion. The figures for Grayscale’s GBTC and Fidelity’s FBTC were $2.85 billion and $2.05 billion, respectively.

When Will Saylor’s Prediction Come True?

According to Bloomberg analyst Eric Balchunas, Saylor’s prediction could come true this summer. This will happen if the current monthly inflow rate of $10 billion is maintained.

If they keep up this pace and add $10b a month (which is pretty insane but very poss if btc price complies) they will pass gold ETFs this summer

— Eric Balchunas (@EricBalchunas) March 5, 2024

“It’s a bit crazy, but quite possible given Bitcoin’s dynamics,” the specialist explained.

ETFs as a Universal API

Saylor described ETFs as a “universal API” that allows investors to access the first cryptocurrency through easy entry and exit from various funds.

“It is also a global protocol for trading volatility or obtaining loans,” he noted.

According to the expert, before the advent of ETFs, obtaining a loan secured by Bitcoin required time and involved a much higher interest rate. Now there is an opportunity to use exchange-traded fund shares as a down payment on a mortgage.

“ETFs have opened up a whole financial world of awareness, opportunities, and functionality for 99% of mainstream investors. You cannot underestimate how important this is for the entire network,” he explained.

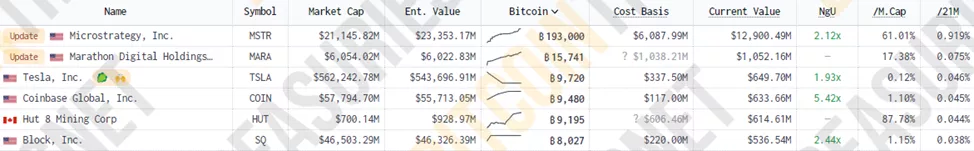

According to BitcoinTreasuries, MicroStrategy holds 193,000 BTC worth $12.9 billion. Unrealized profit has reached $6.8 billion.

On February 26, the company increased its holdings by 3,000 BTC. In the same month, the firm reported a January purchase of 850 BTC for $37.2 million.

Earlier, its founder Michael Saylor stated that in the near and long term, MicroStrategy does not intend to sell its digital gold reserves.

The firm intends to refocus as a “Bitcoin and Bitcoin-based product development company.” Since its inception, it has focused on creating and supporting analytical software.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!