MicroStrategy Increases Bitcoin Holdings by $560 Million

Between December 16 and 22, MicroStrategy acquired 5,262 BTC for approximately $561 million at an average price of about $106,662 per coin.

MicroStrategy has acquired 5,262 BTC for ~$561 million at ~$106,662 per bitcoin and has achieved BTC Yield of 47.4% QTD and 73.7% YTD. As of 12/22/2024, we hodl 444,262 $BTC acquired for ~$27.7 billion at ~$62,257 per bitcoin. $MSTR https://t.co/asDGerBV7q

— Michael Saylor⚡️ (@saylor) December 23, 2024

During the same period, Michael Saylor’s firm sold 1,317,841 shares for approximately $561 million. MicroStrategy still has securities worth around $7.1 billion available for sale.

The company’s bitcoin reserves have reached 444,262 BTC, valued at about $78 billion at the time of writing.

Since August 2020, MicroStrategy has spent approximately $27.7 billion on acquiring the leading cryptocurrency at an average purchase price of around $62,257.

Despite the significant rise in valuations and inclusion in the Nasdaq 100 index, the company increasingly faces criticism for its strategy of creating shareholder value by accumulating bitcoins on its balance sheet, including through debt capital.

Peter Schiff, President of Euro Pacific Capital, predicted MicroStrategy’s bankruptcy in the event of a bitcoin price drop.

Anthony Scaramucci, founder and managing partner of SkyBridge Capital, refuted such concerns in an interview with Bloomberg. He believes that only a “systemic collapse” of the leading cryptocurrency, lasting six to seven years, would pose serious problems for Saylor’s strategy. The company’s favor is also supported by the structure of its corporate debt, which predominantly consists of long-term loans, according to the expert.

MicroStrategy’s shares are the third most valuable position in the portfolio of the First Trust SkyBridge Crypto Industry and Digital Economy ETF managed by SkyBridge.

In December, Saylor stated that the company would continue purchasing bitcoins regardless of the price. The cryptocurrency from the latest batch cost MicroStrategy at a rate close to recent historical highs around $108,000.

Following MicroStrategy’s bitcoin strategy, Japanese public company Metaplanet announced on December 23 the purchase of an additional 619.7 BTC at an average of $97,546.

*Metaplanet purchases additional 619.70 BTC* pic.twitter.com/5npflMJ3kW

— Metaplanet Inc. (@Metaplanet_JP) December 23, 2024

The total transaction amounted to approximately $61 million. In November, the firm issued rights to purchase its shares for roughly the same amount to raise funds.

Metaplanet’s cryptocurrency holdings have reached 1,762 BTC, purchased at an average of about $75,380.

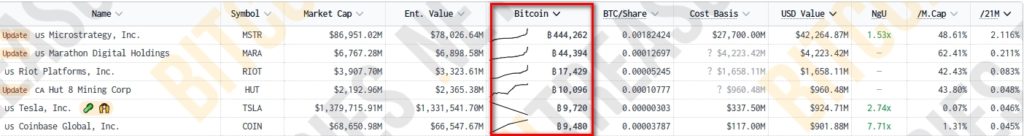

According to BitcoinTreasures, MicroStrategy confidently leads among corporations in terms of bitcoin reserves.

In second place is MARA Holdings (formerly Marathon Digital) with 44,384 BTC. They are followed by two more mining companies — Riot Platforms and Hut 8 Corp.

Earlier in the year, public miners of the leading cryptocurrency increasingly adopted MicroStrategy’s strategy of accumulating digital gold, analysts at JPMorgan noted.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!