MicroStrategy to Issue $500 Million in Bonds for Bitcoin Acquisition

MicroStrategy plans to raise $500 million through the issuance of convertible bonds maturing in 2030 for qualified investors. The funds will be used for “acquiring additional bitcoins and general corporate purposes.”

The company intends to offer buyers an option to purchase additional securities worth up to $75 million.

The issuance will depend on “market and other conditions.”

The unsecured senior bonds will mature in 2031. MicroStrategy may convert the securities into shares, cash, or a combination thereof until September 15, 2030, only upon certain events, and at any time after that date until two days before maturity. On September 15, 2028, holders will have the right to demand redemption.

This initiative follows MicroStrategy’s issuance of $800 million in convertible bonds including an option. The corporation used the funds to purchase 12,000 BTC.

On March 13, Coinbase announced its interest in raising $1 billion through a private placement of convertible debt. The cryptocurrency exchange will use the proceeds for bond repayment, general corporate purposes, and potential acquisitions.

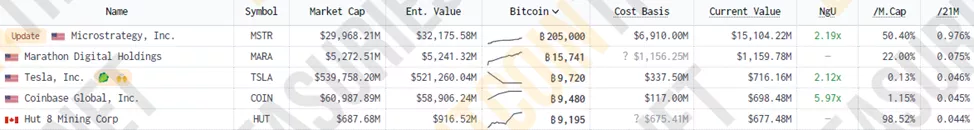

Amid Bitcoin’s rally to $72,000, MicroStrategy’s market capitalization reached a record $29.97 billion. Its shares surged by 10.85% in a day, reaching $1766.

According to BitcoinTreasuries, the company holds 205,000 BTC valued at $15.06 billion. Unrealized profits have reached $8.15 billion.

On February 26, MicroStrategy increased its holdings by 3,000 BTC. In the same month, the firm reported purchasing 850 BTC for $37.2 million in January.

In October 2023, the company acquired 155 BTC for $5.3 million. In November, it bought an additional 16,130 BTC for $593.3 million, and in December, another 14,620 BTC for $615.7 million.

Previously, its founder Michael Saylor stated that in the near and long term, the firm does not intend to sell its holdings of the leading cryptocurrency.

Earlier, MicroStrategy announced plans to refocus as a “developer of Bitcoin and related products.” Since its inception, it has concentrated on creating and supporting analytical software.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!