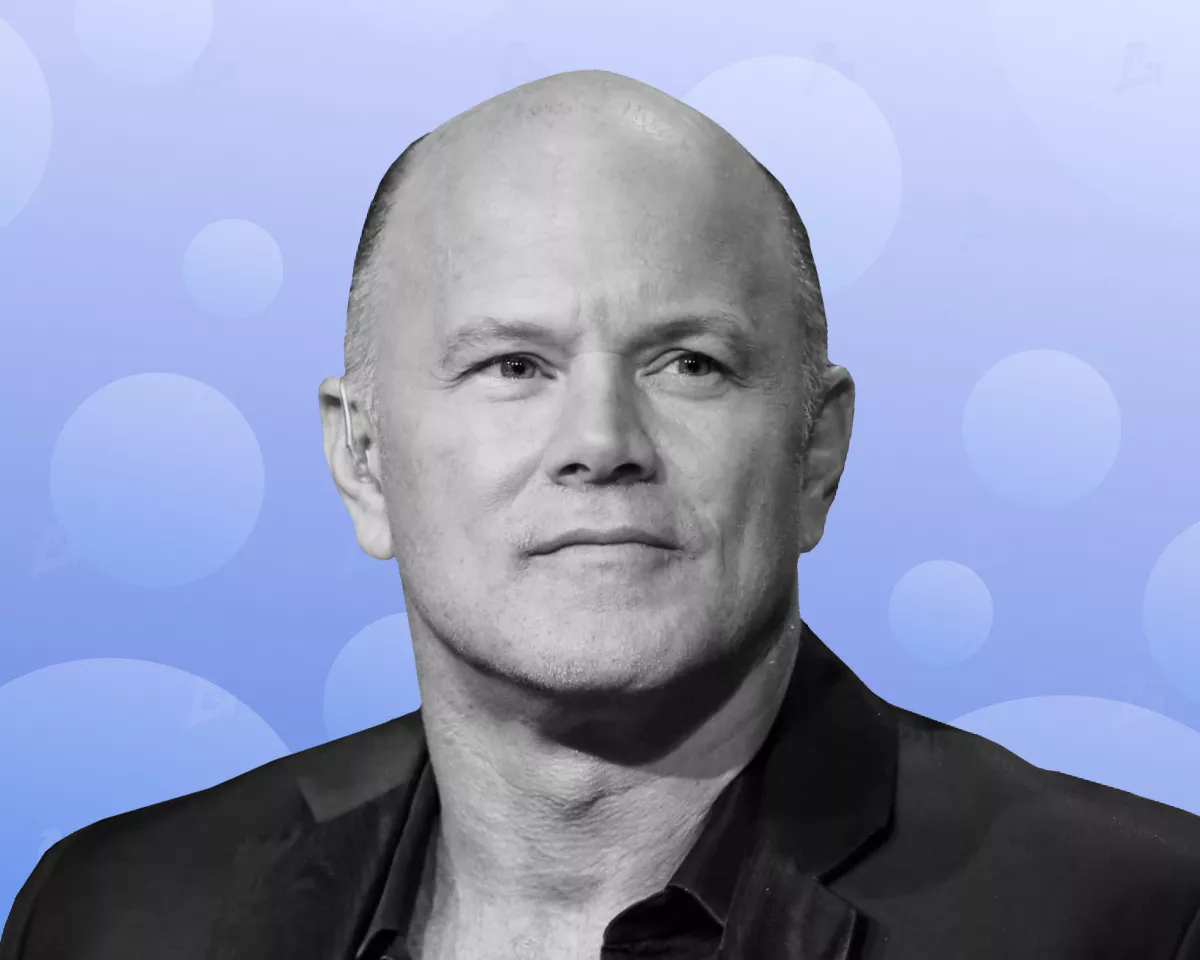

Settlement of claims by the U.S. authorities against Binance and its former CEO Changpeng Zhao — a positive step for the company and the crypto industry as a whole. In an interview Bloomberg said Galaxy Digital CEO Mike Novogratz.

“I think they [platform users] are largely protected from risks. Users were concerned about dealing with Binance. There are far fewer reasons for that now,” he said.

In Novogratz’s view, the key remains a prudent approach. It boils down to collaborating with companies that ‘take their work seriously’. He reminded that the relationships between major financial players and regulators have not always been trouble-free.

“If you look at the list of banks TradFi that have been sanctioned or fined in the last two years, it’s shocking. You shouldn’t anchor your strategy on the absence of mistakes, or else you won’t have anyone to do business with,” he mused.

CEO Galaxy Digital noted that in Binance’s case there were no concerns about the potential closure of the platform or theft of client funds, as it was with FTX.

“They [Binance] had certain fairly serious KYC protocol violations. They fixed them, paid their fine and move on. Overall this is positive for the company and the industry,” he explained.

The top executive also noted high expectations for approval of a spot bitcoin-ETF and the upcoming halving.

According to Novogratz, once the ETF is approved, the sales desks of BlackRock, Fidelity, ARK Invest and Galaxy Digital will actively urge clients to direct capital into the leading cryptocurrency.

“The price will be substantially higher, especially when the Fed is likely to cut rates. Will we reach ATH [for Bitcoin] by this time in 2024? A quite plausible scenario,” he predicted.

The Galaxy Digital CEO also named the upcoming US presidential elections as an additional driver.

“This uncertainty should help Bitcoin. The United States, Europe and Japan are still not able to approach financial accountability. Therefore, people have started investing in digital gold first,” the expert explained.

In November, Novogratz said that approval of the spot bitcoin-ETF was a matter of time.

Earlier this week, the SEC launched a call for comments on the instrument. Along with information about the commission’s meetings with Grayscale and BlackRock this signaled the regulator’s readiness to approve all ETF applications by January 10, 2024.