Mike Novogratz declares ‘Solana season’

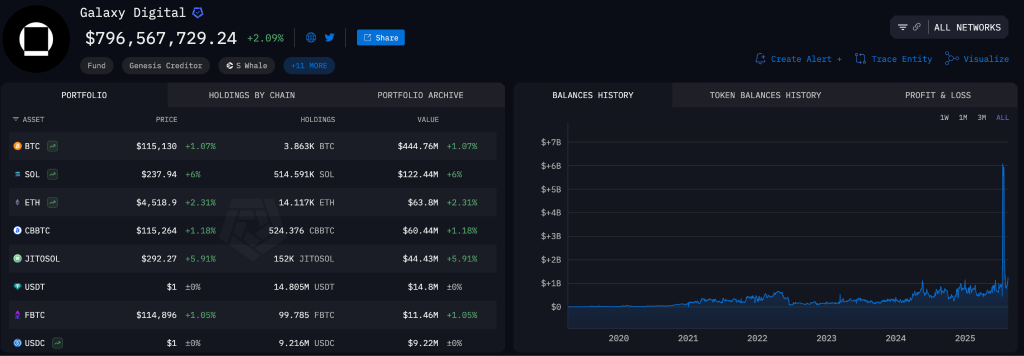

Following his comments, Galaxy added 2.31 million SOL

- Galaxy Digital’s CEO voiced confidence in Solana’s ascent as his firm added 2.31 million SOL.

- Bitwise’s Matt Hougan predicted an “impressive rally” for the cryptocurrency by year-end.

- FTX and Alameda unstaked 8.98 million SOL.

Buoyed by market momentum and friendlier regulatory signals, crypto has entered “Solana season”, said Galaxy Digital chief executive Mike Novogratz in an interview with CNBC.

A key catalyst, he said, was the launch of the largest SOL treasury, at $1.6bn, by Forward Industries with backing from Galaxy, Jump Crypto and Multicoin Capital. He noted that “firms focused on altcoins are bringing new energy and money into the industry”.

Novogratz also pointed to a shifting regulatory landscape. SEC head Paul Atkins recently said the agency is working to modernise rules to bring traditional markets onto blockchains. He affirmed that “most crypto tokens are not securities” and fall outside the regulator’s remit.

The Galaxy CEO called this a “radical departure” from prior policy and a sign of quickening institutional adoption of digital assets.

Meanwhile Nasdaq filed with the SEC for permission to trade tokenised stocks and ETFs. If approved, blockchain settlement could go live by the third quarter of 2026. Novogratz stressed that Solana is well suited to financial markets, citing the network’s speed and throughput.

“We are seeing a key turn: from talk to real infrastructure. It is this shift that will draw significant capital into the industry,” he added.

Following his remarks, Galaxy bought an additional 2.31 million SOL worth $536m, according to Arkham.

Another Solana bull

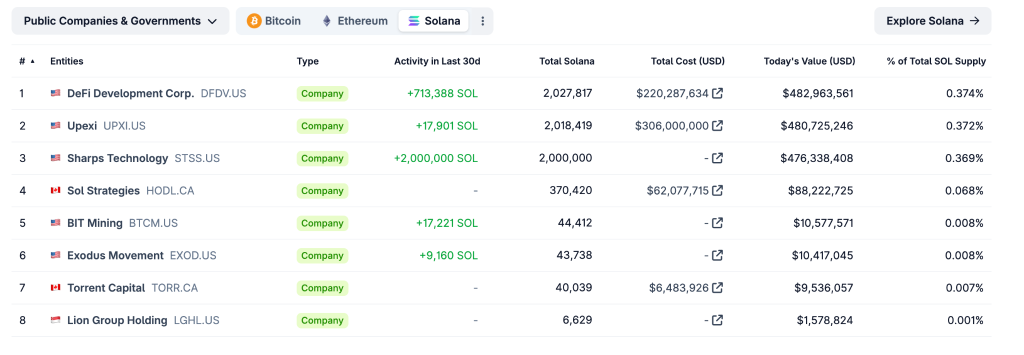

On September 9th, Bitwise CIO Matt Hougan spoke of “Solana season”. He forecast an “impressive rally” by year-end. Drivers include inflows via exchange-traded products and SOL accumulation by corporate treasuries.

He noted that in a similar scenario bitcoin previously rose from $40,000 to $125,000, coinciding with the approval of spot ETFs on the first cryptocurrency.

“It is no surprise the recipe works. It is a classic. When demand exceeds supply, prices usually rise,” Hougan noted.

He believes the same setup is forming for Solana. Several companies have filed for exchange-traded funds on the altcoin. A decision from the SEC is expected on October 10th — which could clear the way for launches as early as the fourth quarter.

In July REX‑Osprey already launched a Solana ETF with staking. So far, the fund has attracted only $195m.

FTX withdrew another tranche of SOL from staking

According to EmberCN, on September 12th addresses linked to FTX and Alameda Research withdrew about 192,000 SOL from staking, worth roughly $44.9m. The funds were sent to Coinbase and Binance.

又到 FTX/Alameda 每月十来号的 SOL 固定转出时间了。

他们在 7 小时前从质押里赎回了 19.2 万枚 $SOL ($4356 万),应该会和以前一样在今天晚些时间分发转移给多个地址。然后这些收到 SOL 的多数地址后续会把 SOL 转进 Coinbase 或 Binance。

FTX/Alameda 质押地址从 2023 年 11… pic.twitter.com/TjALHssMsA

— 余烬 (@EmberCN) September 12, 2025

In total since November 2023 the firms have withdrawn 8.98 million SOL, about $1.2bn at an average price of $134 per token. A substantial portion remains locked. According to Solscan, 4.18 million SOL worth $977m are still staked.

Over the past 24 hours Solana’s price has risen by 5.8%. At the time of writing the asset trades at $238.

Earlier, market participants predicted Solana would rise to $300.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!