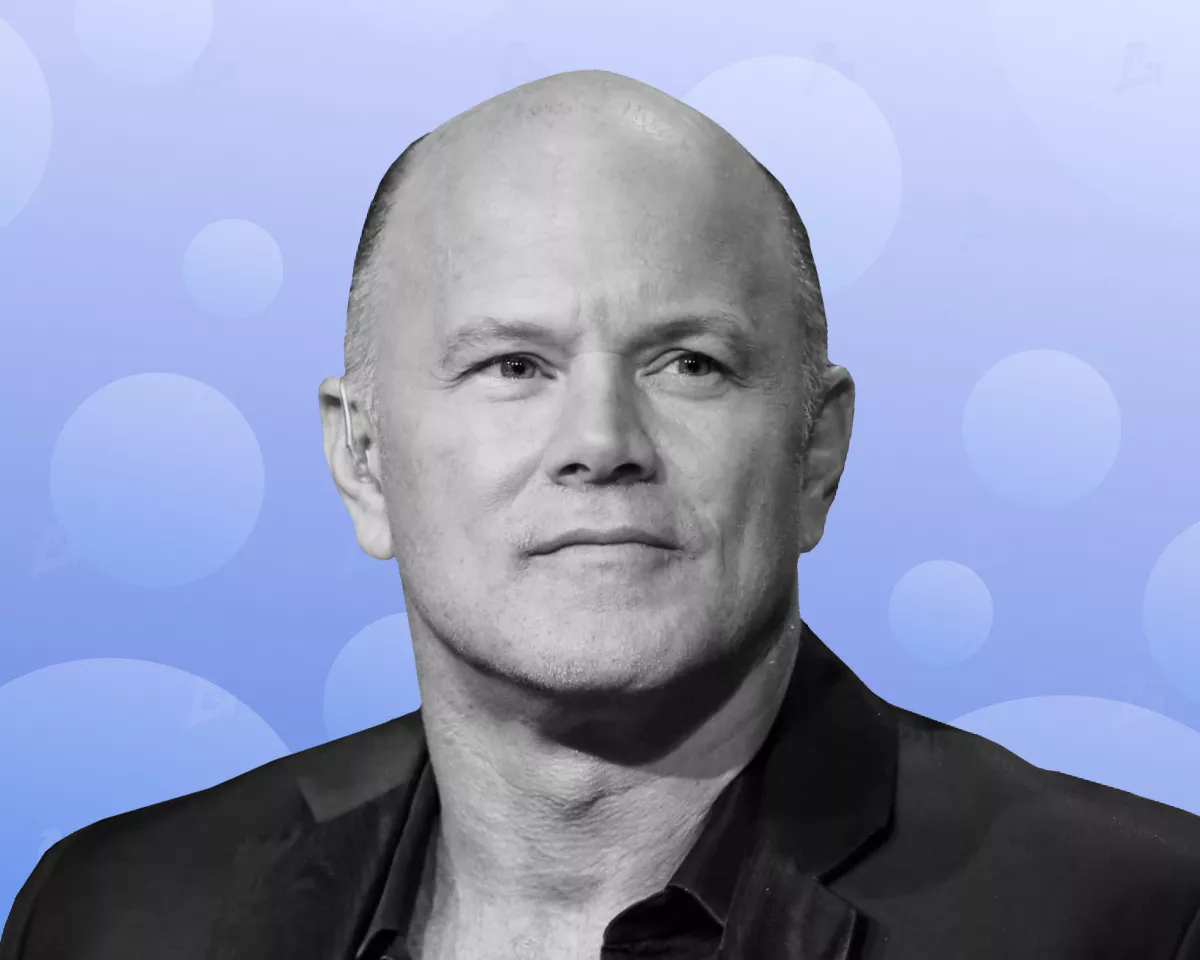

Mike Novogratz Downplays GBTC Sales Impact on Bitcoin’s Future

Most investors liquidating positions in Grayscale’s GBTC will redirect funds into other bitcoin ETFs, neutralizing the current weakness of the leading cryptocurrency, according to Galaxy Digital CEO Mike Novogratz.

I disagree with this. While I think people will sell GBTC, I think most will switch into other ETFs — $BTCO being my favorite !!

Let’s not miss the forest through the trees. It’s now gonna be far easier for boomers to buy corn. And you can get 4×5 times leverage on this… https://t.co/ZJhumt3tzx

— Mike Novogratz (@novogratz) January 21, 2024

The top executive believes that in six months, digital gold will be valued higher than it is now.

“Let’s not miss the forest through the trees. It’s now gonna be far easier for boomers to buy corn. You can get 4×5 times leverage on bitcoin. The current ‘indigestion’ [weakness of the leading cryptocurrency] will end. The price will be higher in six months,” the expert stated.

Novogratz was responding to comments by analyst Chris J. Terry, who warned of bitcoin’s short-term weakness due to investor exits from GBTC. He believes this trend will remain relevant for the next few weeks until the process is fully completed. The specialist noted that the AUM of the product amounts to $25 billion.

J. Terry accused Grayscale’s management of greed for maintaining a 1.5% fee on GBTC. [Most issuers set a zero fee in the early days of trading the product, then raised it to 0.2–0.4%]

Renowned bitcoin maximalist Tuur Demeester shares a similar view to Novogratz.

Huge negative news coverage for bitcoin and yet, it has simply hit some predictable resistance and is now trading in a range. pic.twitter.com/vVdUhoOkri

— Tuur Demeester (@TuurDemeester) January 21, 2024

“Huge negative news coverage for the leading cryptocurrency. Yet, it has simply hit some predictable resistance and is now trading in a range,” the expert explained.

Recent data from Bloomberg analyst Eric Balchunas does not support J. Terry’s view. According to the specialist, investors withdrew $2.8 billion from GBTC, while investing $4 billion into the “nine” other ETFs. The net inflow amounted to $1.2 billion.

Note: the more we think about it and talk to ppl, prob only a small minority of the GBTC outflows are likely going to the Nine right now as much of it was FTX and traders who arb-ed discount. Also the proportionality of the flows to the size of the firm is almost perfect,…

— Eric Balchunas (@EricBalchunas) January 20, 2024

“The more we think about it and talk to people, the more likely it seems that only a small minority of the GBTC outflows are going to the ‘nine’ right now, as much of it was related to FTX and traders who bet on collapsing the discount,” he added.

Critic of the leading cryptocurrency Peter Schiff predicted a further decline in the value of digital gold due to reduced demand for spot bitcoin ETFs.

Earlier, Grayscale CEO Michael Sonnenshein predicted the collapse of most products. In his view, only “two or three exchange-traded funds might achieve some critical mass.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!